South Dakota Document Organizer and Retention

Description

How to fill out Document Organizer And Retention?

You have the capability to spend hours online searching for the legal document template that satisfies the federal and state criteria you require.

US Legal Forms offers thousands of legal forms that can be evaluated by professionals.

You can easily download or print the South Dakota Document Organizer and Retention from the services available.

If you wish to acquire another version of the form, use the Lookup field to find the template that suits your needs and specifications.

- If you possess a US Legal Forms account, you can Log In and press the Obtain button.

- Then, you can complete, edit, print, or sign the South Dakota Document Organizer and Retention.

- Every legal document template purchased is yours permanently.

- To get another copy of any acquired form, navigate to the My documents section and click on the relevant button.

- If you're using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the region/area of your choice.

- Review the form description to ensure you have chosen the appropriate form.

- If available, use the Preview button to examine the document template as well.

Form popularity

FAQ

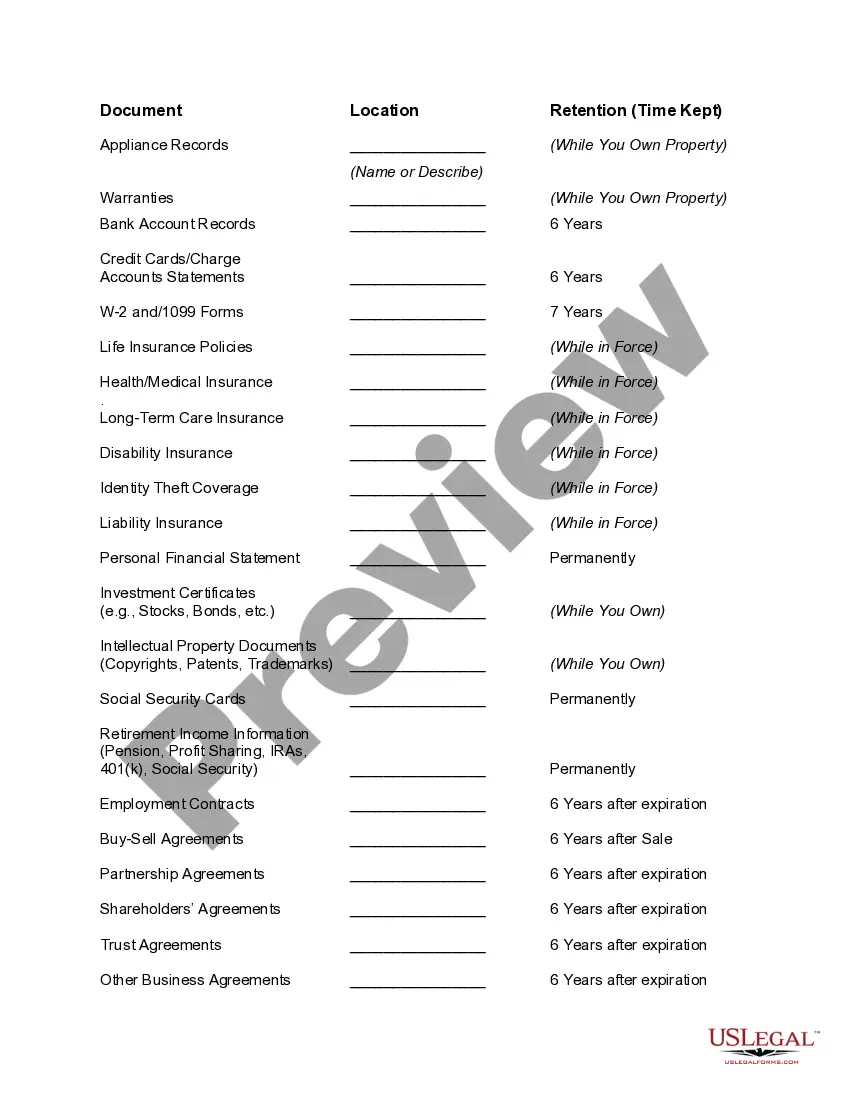

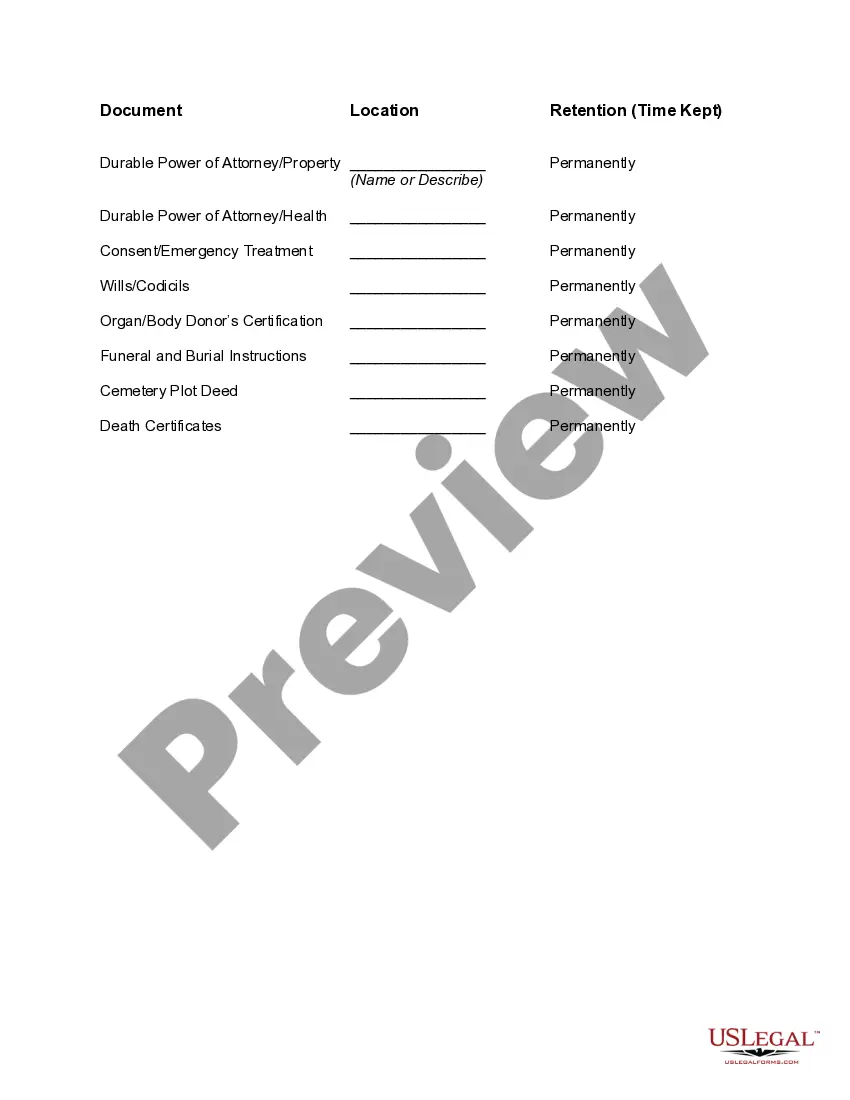

Benefits of a Document Retention PolicyServe as a safety measure in audits or litigation. Improve the organization of documents. Destroy sensitive data that is no longer needed. Eliminate clutter by destroying or archiving unused documents.

A document retention schedule is a policy that clearly defines what documents need to be maintained and for how long. A retention policy will include all types of documents and records that are created on behalf of the company as part of its business.

Document retention guidelines typically require businesses to store records for one, three or seven years. In some cases, you will need to keep the records forever. If you're unsure what to keep and what to shred, your accountant, lawyer and state record-keeping agency may provide guidance.

A retention period (associated with a retention schedule or retention program) is an aspect of records and information management (RIM) and the records life cycle that identifies the duration of time for which the information should be maintained or "retained," irrespective of format (paper, electronic, or other).

6.2 Retention times for specific records are defined in Table 1, unless otherwise specified quality records shall be retained for 10 years. In no case shall the retention time be less than seven years after final payment on the associated contract.

As a general rule of thumb, tax returns, financial statements and accounting records should be retained for a minimum of six years.

A DRP will identify documents that need to be maintained, contain guidelines for how long certain documents should be kept, and save your company valuable computer and physical storage space.

According to the U.S. Department of Labor, the Fair Labor Standards Act (FLSA) requires employers to maintain records for a period of at least three years. Records to compute pay, which include time cards, work and time schedules and records of additions to or reductions from wages, must be kept for two years.

(also disposition standard), n. The length of time records should be kept in a certain location or form for administrative, legal, fiscal, historical, or other purposes.

A document retention policy (also known as a records and information management policy, recordkeeping policy, or a records maintenance policy) establishes and describes how a company expects its employees to manage company data from creation through destruction.