South Dakota Debt Adjustment Agreement with Creditor

Description

How to fill out Debt Adjustment Agreement With Creditor?

If you intend to compile, acquire, or create authentic document templates, utilize US Legal Forms, the most extensive collection of authentic forms available online.

Utilize the website's straightforward and convenient search feature to find the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Process the transaction. You can use your Visa or Mastercard or PayPal account to complete the transaction.

- Utilize US Legal Forms to locate the South Dakota Debt Adjustment Agreement with Creditor in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to acquire the South Dakota Debt Adjustment Agreement with Creditor.

- You can also access forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct area/state.

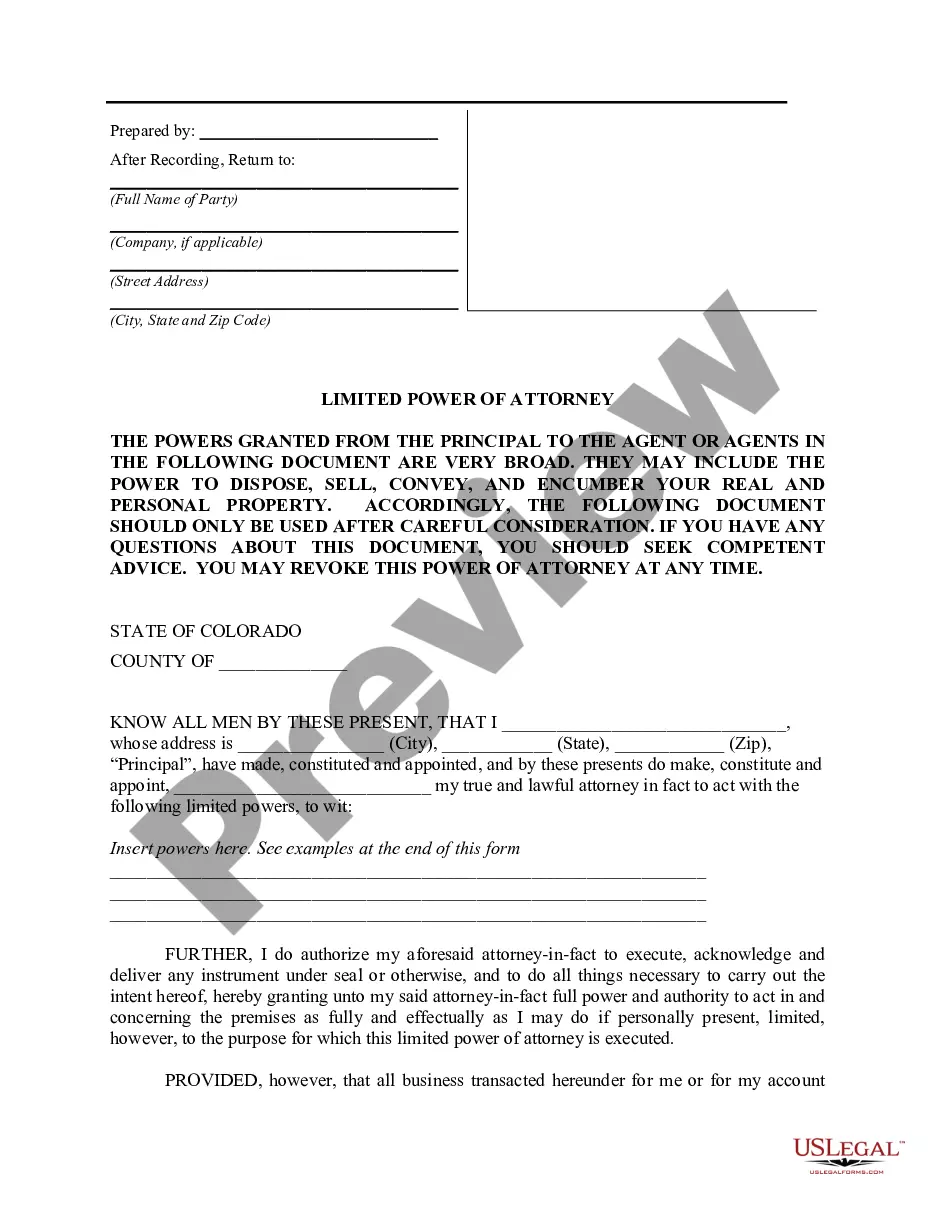

- Step 2. Use the Preview option to review the form's details. Remember to read the information.

- Step 3. If you are unhappy with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.

Offer a Lump-Sum Settlement Some want 75%80% of what you owe. Others will take 50%, while others might settle for one-third or less. Proposing a lump-sum settlement is generally the best optionand the one most collectors will readily agree toif you can afford it.

So, you can get out of debt for a lower percentage of what you owe as the clock runs out. In some cases, you may be able to settle for much less than that 48% average. Collectors holding old debts may be willing to settle for 20% or even less.

Once you've done your research and put aside some cash, it's time to determine what your settlement offer will be. Typically, a creditor will agree to accept 40% to 50% of the debt you owe, although it could be as much as 80%, depending on whether you're dealing with a debt collector or the original creditor.

When you're negotiating with a creditor, try to settle your debt for 50% or less, which is a realistic goal based on creditors' history with debt settlement. If you owe $3,000, shoot for a settlement of up to $1,500.

You can pay less than the full amount owed if you negotiate with a lender to settle the debt. Debt settlement companies offer the option to settle debt on your behalf for a fee, but there are many drawbacks to this process, including shattered credit and high fees.

Most debt settlement agreements allow borrowers to pay 40%-60% of what they originally owed. Once the creditor agrees to a debt settlement amount, they'll forgive the remainder of the debt.

Debt settlement is an agreement made between a creditor and a consumer in which the total debt balance owed is reduced and/or fees are waived, and the reduced debt amount is paid in a lump sum instead of revolving monthly.

In South Dakota, the statute of limitations is six years. If a debt collector attempts to collect a debt that is older than what is permitted under state law, you may be able to sue them.

You can pay less than the full amount owed if you negotiate with a lender to settle the debt. Debt settlement companies offer the option to settle debt on your behalf for a fee, but there are many drawbacks to this process, including shattered credit and high fees.