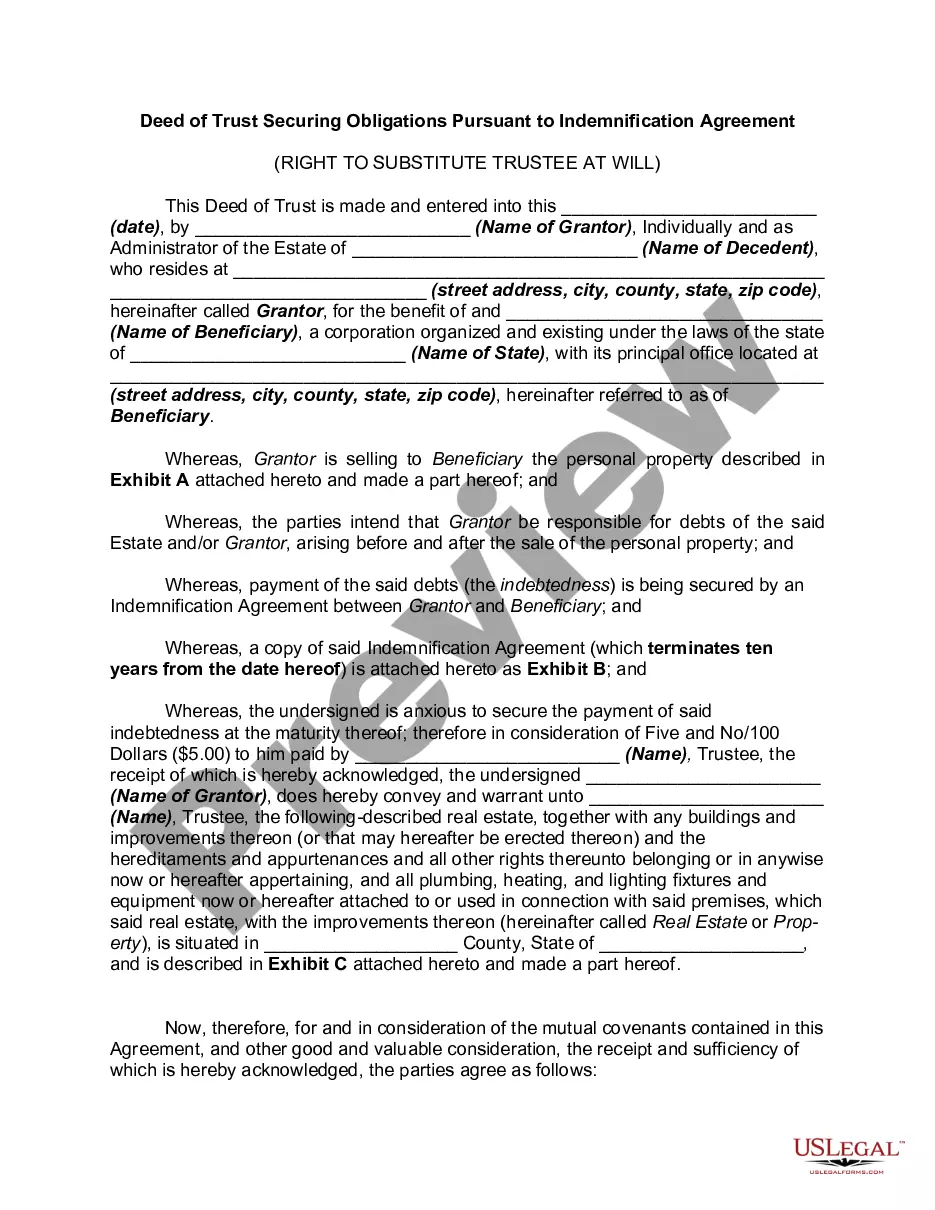

South Dakota Indemnification Agreement for a Trust

Description

How to fill out Indemnification Agreement For A Trust?

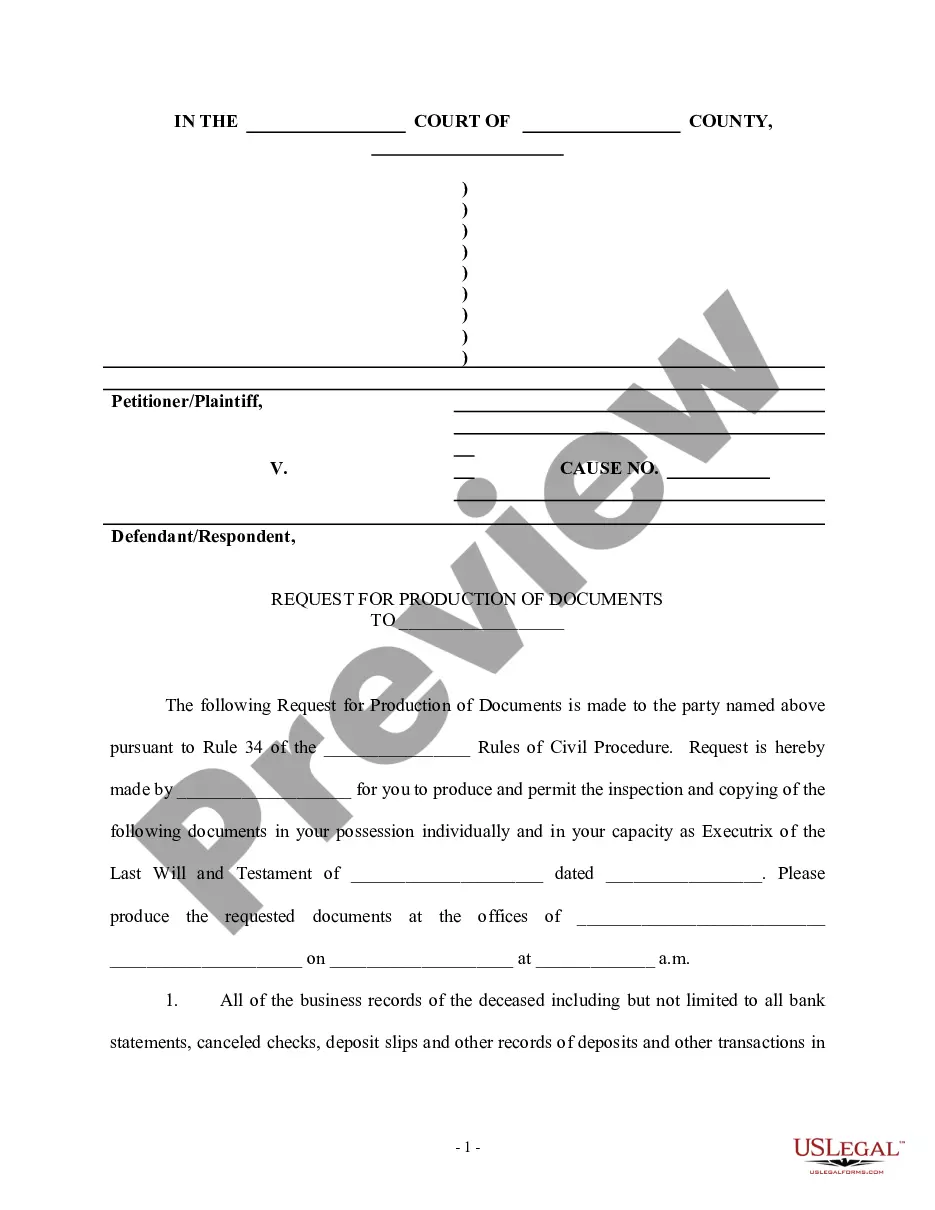

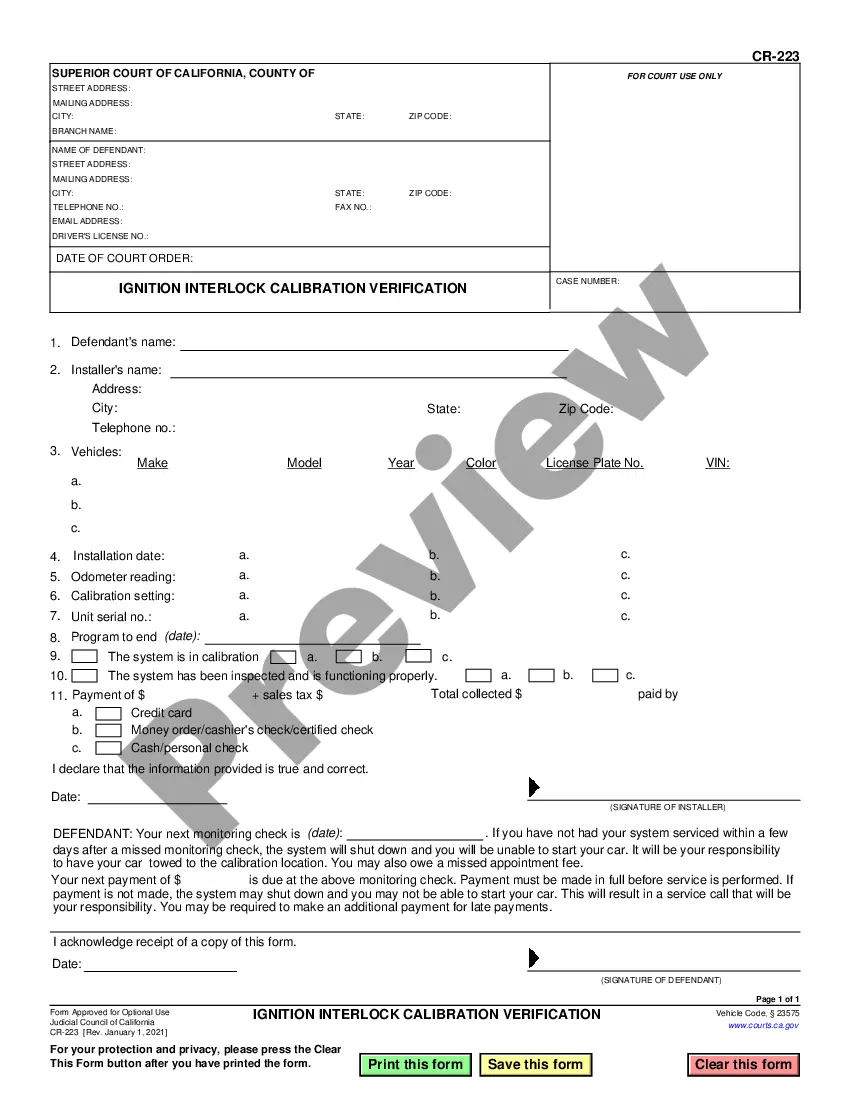

You can spend hours online trying to locate the authentic document template that satisfies the state and federal regulations you require.

US Legal Forms offers thousands of legal forms that have been reviewed by professionals.

You can easily download or print the South Dakota Indemnification Agreement for a Trust from their service.

If available, utilize the Preview button to browse through the document format as well.

- If you already have a US Legal Forms account, you can Log In and click on the Obtain button.

- Next, you can complete, modify, print, or sign the South Dakota Indemnification Agreement for a Trust.

- Every legal document template you purchase is yours forever.

- To obtain an additional copy of a purchased form, visit the My documents tab and click on the respective button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for the state/city of your choice.

- Read the form details to verify that you have selected the appropriate document.

Form popularity

FAQ

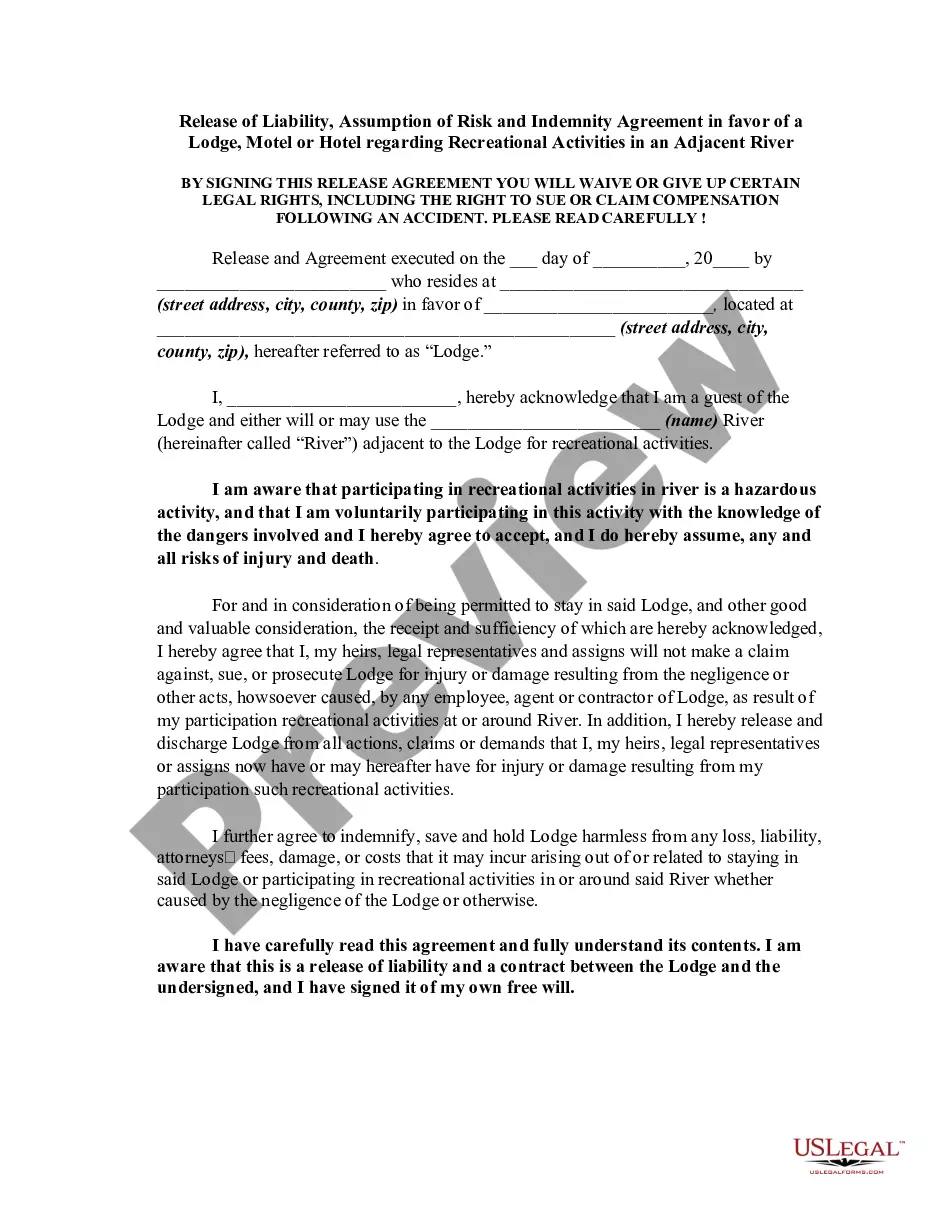

An indemnity agreement is a contract that protect one party of a transaction from the risks or liabilities created by the other party of the transaction. Hold harmless agreement, no-fault agreement, release of liability, or waiver of liability are other terms for an indemnity agreement.200c

It helps to remember that a Trust is a separate legal entity. The Trustees and beneficiaries are not personally liable for debts owed by the Trust. The Trustee is acting in a fiduciary capacity.

What are the Disadvantages of a Trust?Costs. When a decedent passes with only a will in place, the decedent's estate is subject to probate.Record Keeping. It is essential to maintain detailed records of property transferred into and out of a trust.No Protection from Creditors.

Indemnity/indemnification:A trustee is entitled to reasonable compensation for her services. The amount payable can either come from the trust agreement itself or be fixed by the court (taking into account the trustee's skill level and actual duties performed) or state statute.

Indemnification provisions are generally enforceable. There are certain exceptions however. Indemnifications that require a party to indemnify another party for any claim irrespective of fault ('broad form' or 'no fault' indemnities) generally have been found to violate public policy.

At their core, indemnification provisions transfer liabilities related to a claim from one party to another party, generally in the event of a breach of contract or a party's negligence or misconduct in the performance of the agreement.

An indemnity agreement is a contract that 'holds a business or company harmless' for any burden, loss, or damage. An indemnity agreement also ensures proper compensation is available for such loss or damage.

Tips for Enforcing Indemnification ProvisionsIdentify Time Periods for Asserting Indemnification Rights.Provide Notice in a Timely Fashion.Notify All Concerned Parties.Understand Limitations on Recovery.Exclusive Remedy.Scope of Damages.Claims Process/Dispute Resolution.

An indemnity agreement is a contract that protect one party of a transaction from the risks or liabilities created by the other party of the transaction. Hold harmless agreement, no-fault agreement, release of liability, or waiver of liability are other terms for an indemnity agreement.200c

Some of the most common reasons trusts are invalid include: Legal formalities were not followed when executing the trust instrument. The trust was created or modified through forgery or another type of fraud. The trust maker was not mentally competent when they created or modified the trust.