South Dakota Contract with Independent Contractor - Contractor has Employees

Description

How to fill out Contract With Independent Contractor - Contractor Has Employees?

If you require to summarize, acquire, or generate legal document templates, utilize US Legal Forms, the premier assortment of legal forms, which can be accessed online.

Leverage the website's simple and user-friendly search feature to locate the documents you need.

Various templates for commercial and personal purposes are organized by categories and claims, or keywords.

Step 4. Once you have found the form you need, select the Get now button. Choose the pricing plan you prefer and enter your credentials to register for an account.

Step 5. Process the transaction. You can use your Visa or MasterCard or PayPal account to complete the payment. Step 6. Choose the format of the legal form and download it to your device. Step 7. Complete, edit, and print or sign the South Dakota Contract with Independent Contractor - Contractor has Employees.

- Use US Legal Forms to obtain the South Dakota Contract with Independent Contractor - Contractor has Employees with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to retrieve the South Dakota Contract with Independent Contractor - Contractor has Employees.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

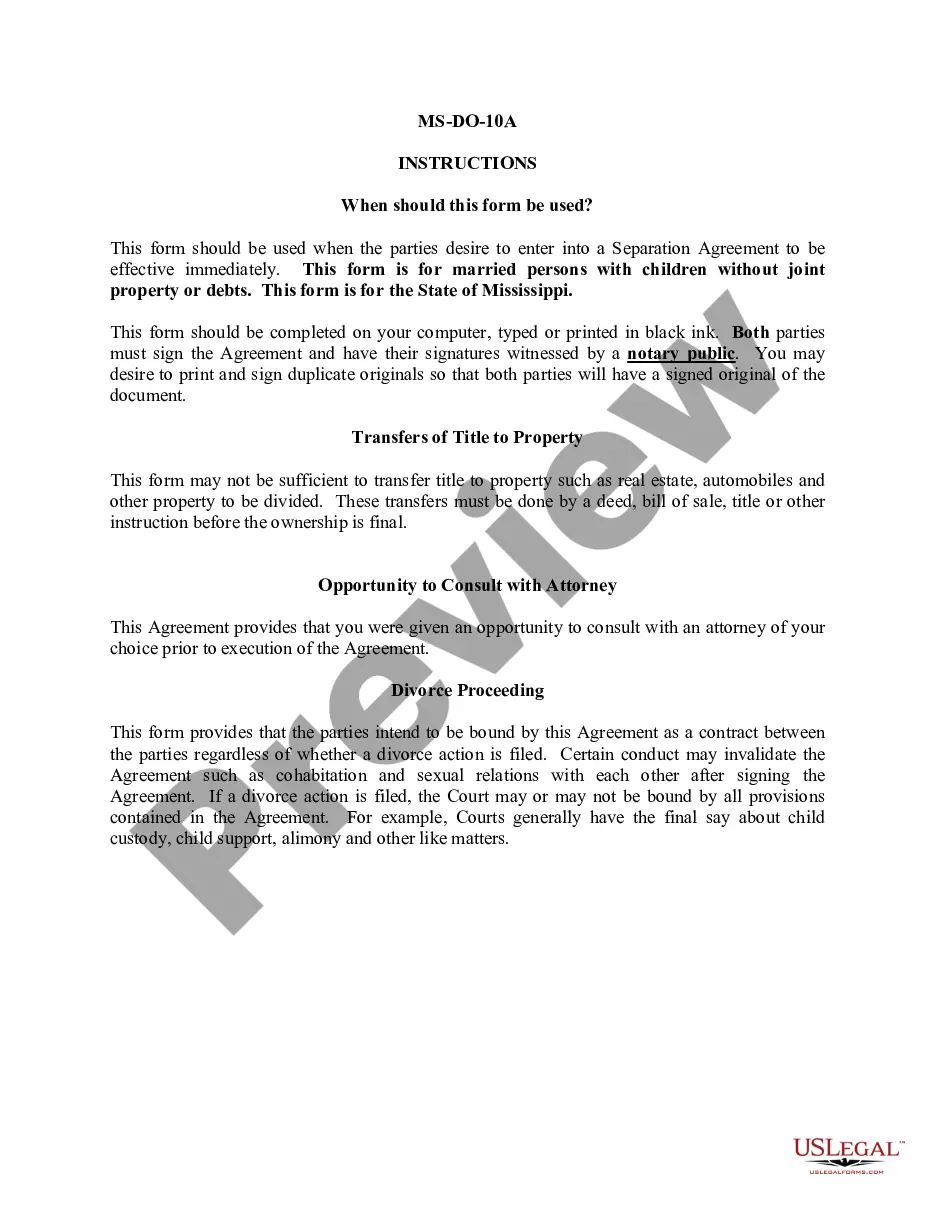

- Step 2. Use the Review option to examine the form's details. Don't forget to read the information.

- Step 3. If you are not satisfied with the template, use the Search field at the top of the screen to find different versions of the legal form template.

Form popularity

FAQ

Independent contractors are not employees, nor are they eligible for employee benefits. They do not have taxes withheld from their paychecks but instead must pay estimated income taxes in advance through quarterly payments.

Using our template will ensure you complete the necessary steps:State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Independent contractors provide goods or services according to the terms of a contract they have negotiated with an employer. Independent contractors are not employees, and therefore they are not covered under most federal employment statutes.

A contractor also called a contract worker, independent contractor or freelancer is a self-employed worker who operates independently on a contract basis.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

A contract worker, also known as an independent contractor or 1099 employee (based on the 1099 tax form they receive), is an individual who enters into a contractual agreement with a business in order to provide a service in exchange for a fee.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.