South Dakota Notice of Assignment of Security Interest

Description

How to fill out Notice Of Assignment Of Security Interest?

Are you currently in a location where you require documents for either business or personal purposes on a regular basis? There is a multitude of valid document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of document templates, including the South Dakota Notice of Assignment of Security Interest, which are crafted to comply with state and federal regulations.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. Afterwards, you can download the South Dakota Notice of Assignment of Security Interest template.

- Locate the document you need and ensure it is for the correct state/region.

- Use the Review button to examine the form.

- Read the description to confirm you have selected the right form.

- If the form is not what you seek, utilize the Search field to find the document that meets your needs and criteria.

- Once you find the correct document, click Buy now.

- Choose the payment plan you desire, fill in the required details to create your account, and complete the purchase using your PayPal or Visa or Mastercard.

- Select a convenient file format and download your copy.

Form popularity

FAQ

Yes, South Dakota does have a stand your ground law. This law allows individuals to use reasonable force, including deadly force, to protect themselves without a duty to retreat. It's important to understand the nuances of this law, especially if you are dealing with a South Dakota Notice of Assignment of Security Interest, where legal protection can be vital in property disputes.

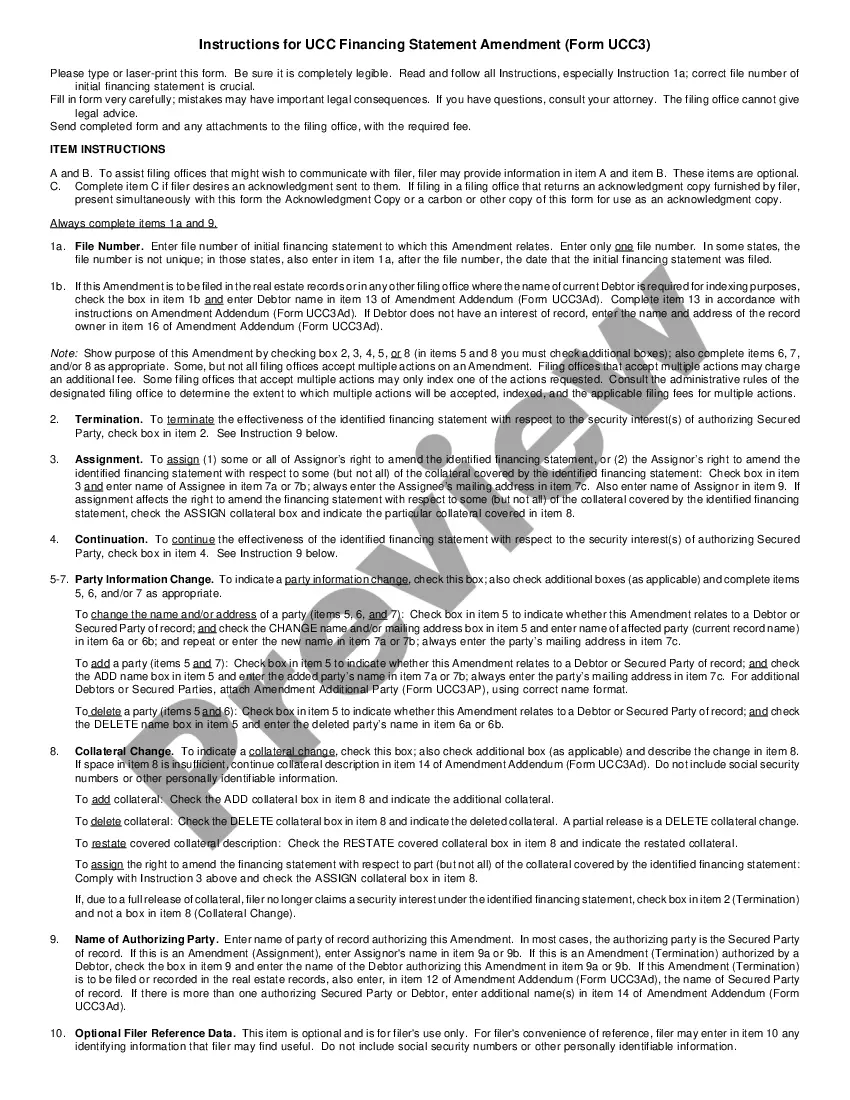

To assign (1) some or all of Assignor's right to amend the identified financing statement, or (2) the Assignor's right to amend the identified financing statement with respect to some (but not all) of the collateral covered by the identified financing statement: Check box in item 3 and enter name of Assignee in item 7a

Security interest is an enforceable legal claim or lien on collateral that has been pledged, usually to obtain a loan. The borrower provides the lender with a security interest in certain assets, which gives the lender the right to repossess all or part of the property if the borrower stops making loan payments.

If at any time any Grantor shall take a security interest in any property of an Account Debtor or any other Person to secure payment and performance of an Account, such Grantor shall be deemed to have assigned such security interest to the Collateral Agent.

The three requirements of: giving value, debtor rights in the collateral, and an authenticated security agreement apply to the most common types of collateral, such as equipment, inventory and even payments due under a contract.

The term 'assignment by way of charge only' is also often used. This just means that the security interest constitutes a charge, ie an encumbrance over the asset, rather than an assignment, ie a transfer of title to the chose in action (whether legal or beneficial) to the secured party.

It is recommended that the security agreement include a provision giving the creditor a right to enter on the debtor's premises and retake the collateral in the event of default. Second, the creditor can file a claim & delivery lawsuit and have a court order the property be turned over to the creditor.

In order for a security interest to be enforceable against the debtor and third parties, UCC Article 9 sets forth three requirements: Value must be provided in exchange for the collateral; the debtor must have rights in the collateral or the ability to convey rights in the collateral to a secured party; and either the

The secured party (assignor) may assign all of its rights to another party (assignee). (This is considered a full assignment.) The secured party may assign the rights to some portion or percentage of all the collateral covered by the initial UCC financing statement to another party.

For a security interest to attach, the following events must have occurred: (A) value must have been given by the Secured Party; (B) the Debtor must have rights in the collateral; and (C) the Secured Party must have been granted a security interest in the collateral.