South Dakota Loan Agreement for Employees

Description

How to fill out Loan Agreement For Employees?

Are you within a placement where you will need papers for possibly company or individual uses nearly every time? There are a lot of legal record themes available on the net, but discovering versions you can rely on is not effortless. US Legal Forms delivers a huge number of type themes, just like the South Dakota Loan Agreement for Employees, that are composed to satisfy federal and state specifications.

When you are presently informed about US Legal Forms web site and get a merchant account, just log in. Following that, you can download the South Dakota Loan Agreement for Employees web template.

Unless you have an profile and need to start using US Legal Forms, follow these steps:

- Find the type you require and make sure it is for that right town/county.

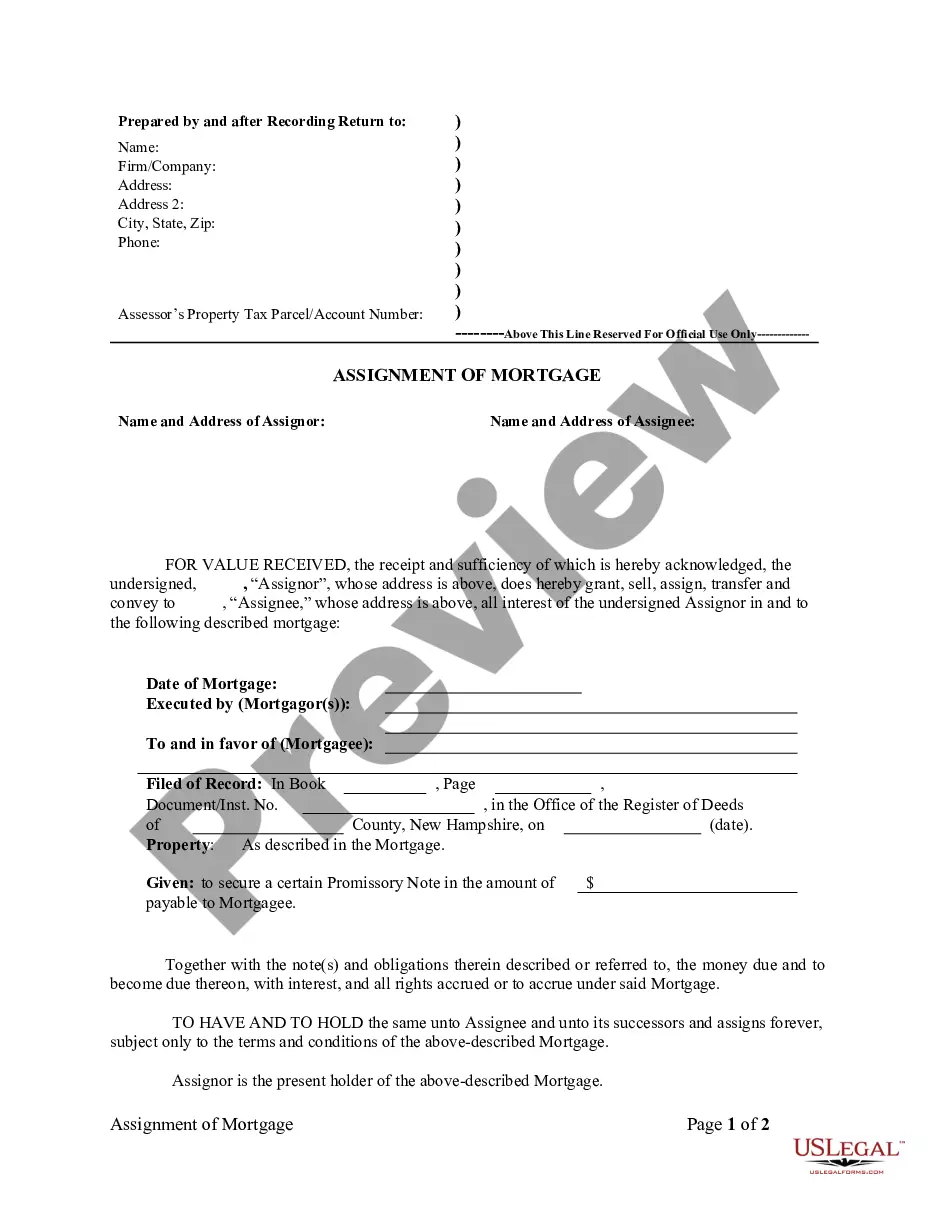

- Take advantage of the Preview button to check the form.

- See the outline to actually have chosen the proper type.

- When the type is not what you`re trying to find, make use of the Search area to get the type that meets your needs and specifications.

- When you obtain the right type, click Acquire now.

- Choose the rates plan you want, fill out the desired information and facts to produce your account, and pay for your order with your PayPal or credit card.

- Pick a handy paper file format and download your copy.

Locate all the record themes you might have bought in the My Forms food list. You may get a further copy of South Dakota Loan Agreement for Employees whenever, if possible. Just select the required type to download or printing the record web template.

Use US Legal Forms, probably the most considerable assortment of legal types, to conserve time and stay away from errors. The service delivers appropriately produced legal record themes which can be used for a range of uses. Produce a merchant account on US Legal Forms and begin creating your way of life easier.

Form popularity

FAQ

A credit agreement is a legally binding contract documenting the terms of a loan, made between a borrower and a lender. A credit agreement is used with many types of credit, including home mortgages, credit cards, and auto loans. Credit agreements can sometimes be renegotiated under certain circumstances.

Loan Party means each of the Borrower and each other Person who guarantees all or a portion of the Obligations and/or who pledges any collateral security to secure all or a portion of the Obligations.

A loan agreement is made between the creditor (the lender) and the borrower (the debtor), although it is generally prepared by the lender's legal counsel in order to ensure the legal enforceability of the contract.

A loan agreement is made between the creditor (the lender) and the borrower (the debtor), although it is generally prepared by the lender's legal counsel in order to ensure the legal enforceability of the contract.

A term used in bank loan facilities to refer collectively to the borrower and all other parties that guarantee the borrower's loan agreement obligations or provide some other form of credit support, such as granting a lien on their assets to secure the borrower's loan.