South Dakota Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions

Description

How to fill out Shareholders Buy Sell Agreement Of Stock In A Close Corporation With Noncompetition Provisions?

Are you in a circumstance where you require documents for both business and personal reasons nearly every workday.

There is a multitude of legal document templates accessible online, but finding trustworthy ones isn’t simple.

US Legal Forms offers a vast selection of form templates, such as the South Dakota Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions, which are designed to meet both federal and state regulations.

Once you acquire the correct template, click Purchase now.

Choose the pricing plan you prefer, input the required information to create your account, and complete your order using PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Afterward, you can download the South Dakota Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions template.

- If you don’t have an account and wish to start utilizing US Legal Forms, follow these steps.

- Select the template you need and ensure it’s for your specific area/county.

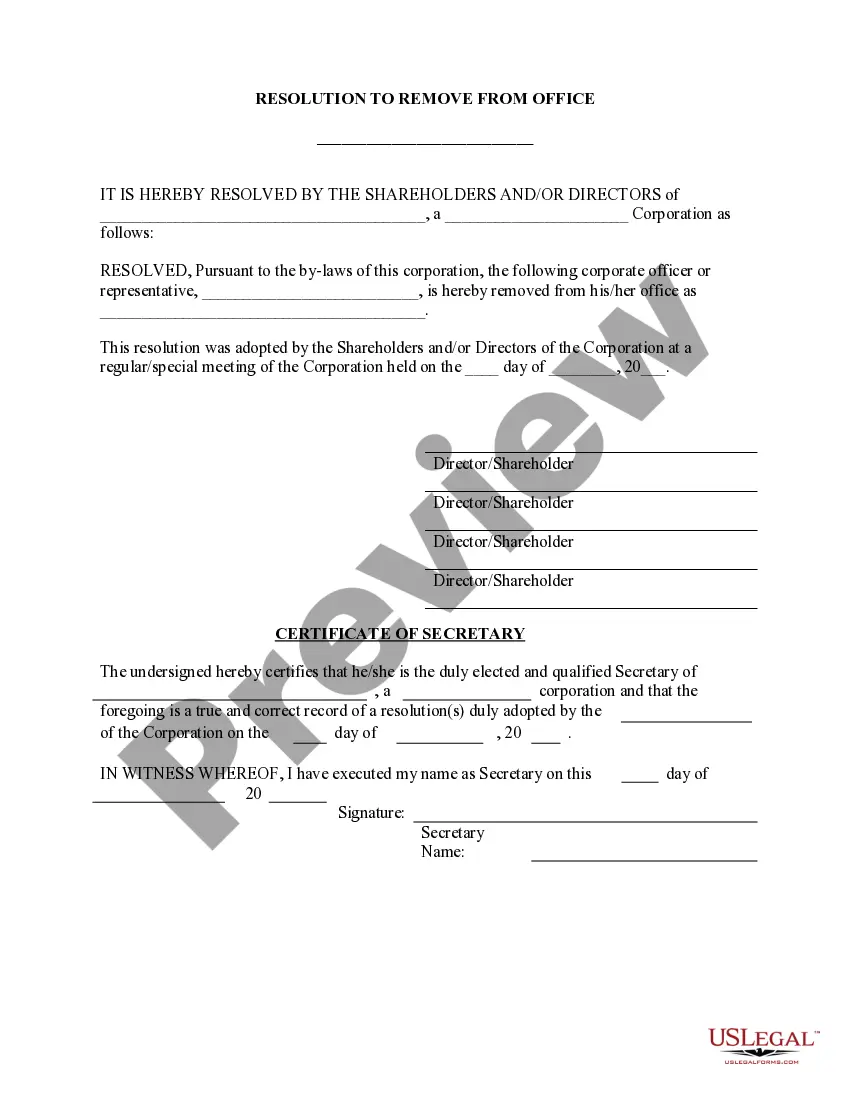

- Use the Review button to examine the document.

- Read the description to confirm that you have chosen the correct template.

- If the template isn’t what you’re looking for, utilize the Search field to find the template that matches your needs.

Form popularity

FAQ

One key disadvantage of a buy-sell agreement is the potential illiquidity it can create, which may burden shareholders if they need to sell shares quickly. Additionally, if not properly structured, it can lead to disputes among shareholders when triggering events occur. That's why a comprehensive South Dakota Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions is vital to address these concerns upfront.

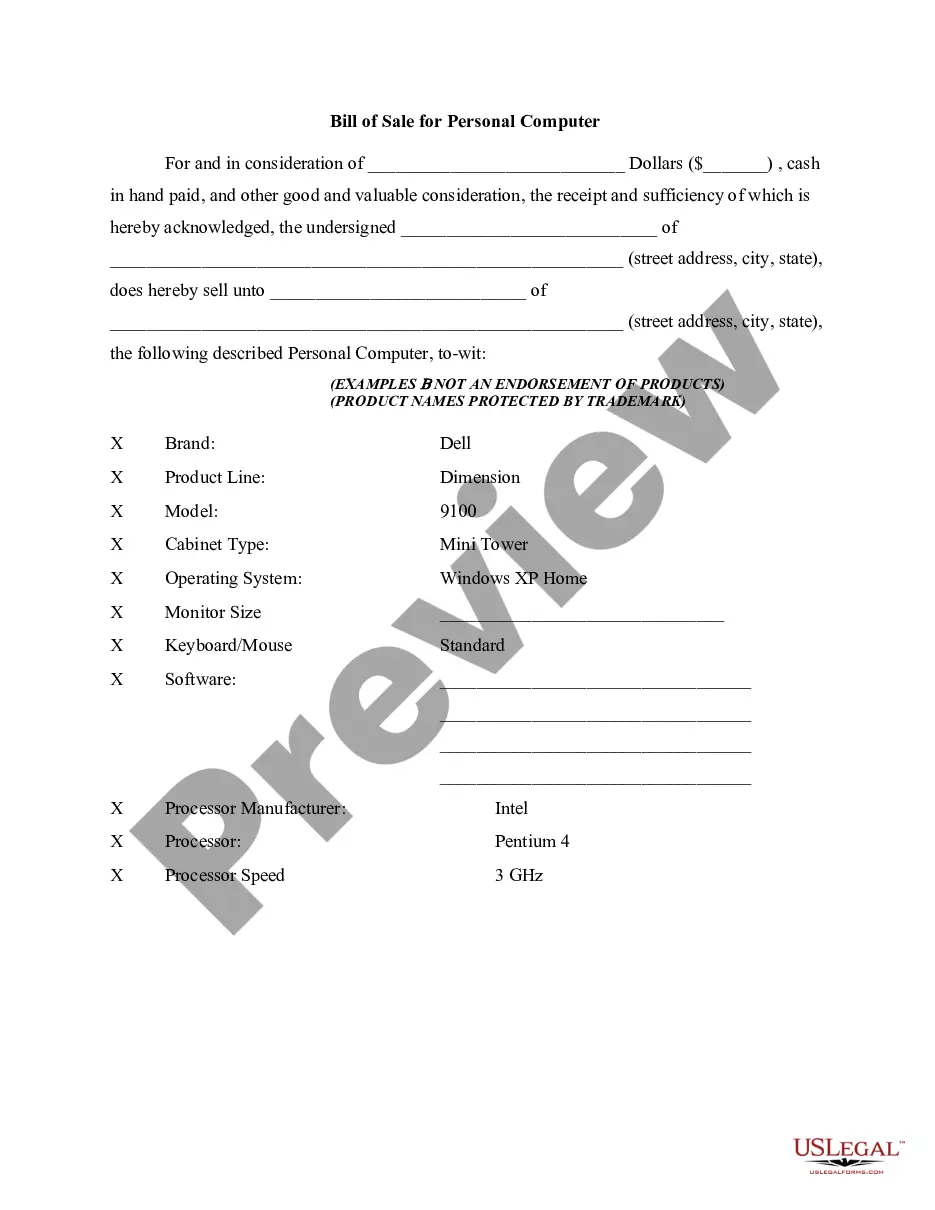

The key elements of a buy-sell agreement include:Element 1. Identify the parties.Element 2. Triggered buyout event.Element 3. Buy-sell structure.Element 4. Company valuation.Element 5. Funding resources.Element 6. Taxation considerations.

A buy and sell agreement is a legally binding contract that stipulates how a partner's share of a business may be reassigned if that partner dies or otherwise leaves the business. Most often, the buy and sell agreement stipulates that the available share be sold to the remaining partners or to the partnership.

What is a Buy-Sell Agreement? Buy-sell agreements, also called buyout agreements and shareholder agreements, are legally binding documents between two business partners that govern how business interests are treated if one partner leaves unexpectedly.

The creation of buy-sell agreements involves a certain amount of future-thinking. The parties must think about what could, might, or will happen and write an agreement that will work for all sides in the event an agreement is triggered at some unknown time in the future.

Definition. 1. A buy-sell agreement is an agreement among the owners of the business and the entity. 2. The buy-sell agreement usually provides for the purchase and sale of ownership interests in the business at a price determined in accordance with the agreement, upon the occurrence of certain (usually future) events.

Company purchase agreements are essential for transferring the ownership of a business upon a trigger event, such as death or disability. They generally contain the terms and conditions of the sale, including obligations, warranties, and liabilities.

sell clause outlines a process and pricing mechanism for the sale of the shares of a departing shareholder (e.g. upon death, disability, retirement, etc.) that necessitates a change in the ownership of a closelyheld private company.

The four types of buy sell agreements are:Cross-purchase agreement.Entity purchase agreement.Wait-and-See.Business-continuation general partnership.

Some of the common triggers include death, disability, retirement or other termination of employment, the desire to sell an interest to a non-owner, dissolution of marriage or domestic partnership, bankruptcy or insolvency, disputes among owners, and the decision by some owners to expel another owner.