This form is used as formal notice to the state of a change in resident agent.

South Dakota Change of Resident Agent of Non-Profit Church Corporation

Description

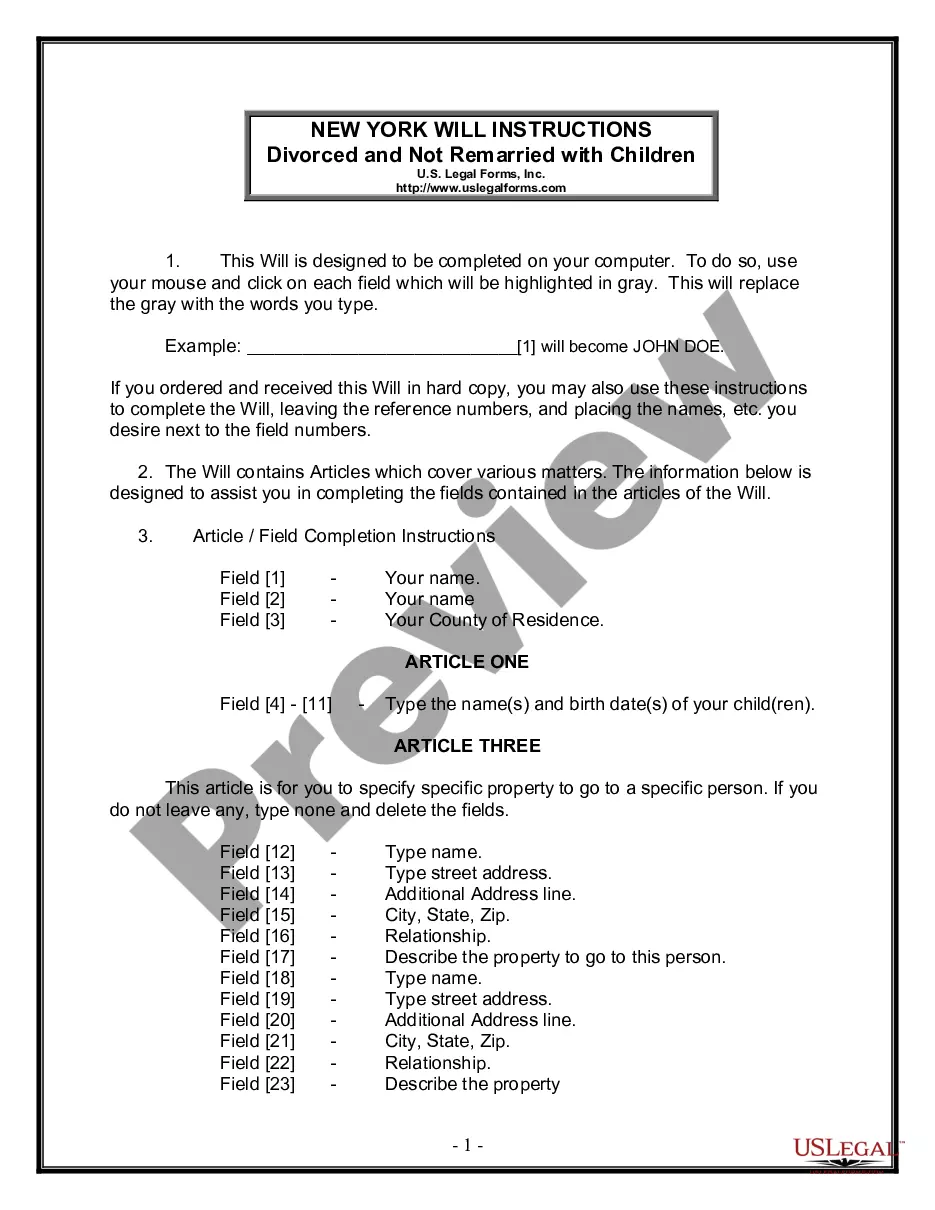

How to fill out Change Of Resident Agent Of Non-Profit Church Corporation?

Finding the correct legal document format can be a challenge.

It's clear that there are many templates accessible online, but how can you acquire the legal document you require.

Utilize the US Legal Forms website. This service offers a vast array of templates, including the South Dakota Change of Resident Agent of Non-Profit Church Corporation, suitable for both business and personal use.

If the form doesn’t meet your requirements, use the Search box to locate the correct form. Once you are sure the form is appropriate, click the Acquire now button to obtain the form. Choose your desired pricing plan and input the necessary information. Create your account and complete the payment via your PayPal account or credit card. Select the file format and download the legal document to your device. Finally, complete, modify, print, and sign the obtained South Dakota Change of Resident Agent of Non-Profit Church Corporation. US Legal Forms is the largest collection of legal documents where you can find a variety of file templates. Utilize this service to download accurately crafted documents that conform to state requirements.

- All templates are verified by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click on the Download button to obtain the South Dakota Change of Resident Agent of Non-Profit Church Corporation.

- Use your account to review the legal documents you have previously ordered.

- Navigate to the My documents section of your account to get another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps to follow.

- First, ensure you have selected the correct form for your city/state. You can review the form using the Review button and read the form outline to confirm it's what you need.

Form popularity

FAQ

Any corporation may for legitimate corporate purpose or purposes amend its articles of incorporation by a majority vote of its board of directors or trustees and the vote or written assent of two-thirds of its members if it be a non-stock corporation, or if it be a stock corporation, by the vote or written assent of

To make amendments to the organization of your limited liability company in South Dakota, you submit the completed Application for Amended Articles of Organization form to the Secretary of State by mail or in person, in duplicate and with the filing fee.

Nonprofit name changeYou may be required to notify a variety of agencies, like the Franchise Tax Board.You need to report the change when submitting your next annual IRS return; in many cases, this is in the form of Form 990 or 990-EZ.More items...

There are two options for transferring LLC ownership for a South Dakota LLC: (1) a partial transfer and (2) a full transfer.Partial Transfer in South Dakota: The Buyout Provision.Full Transfer: Selling Your South Dakota LLC.Death of a Member.Dissolution/Reformation.More items...

If the nonprofit's mission is stated on its Articles of Incorporation and/or Bylaws, and the new mission statement is substantively different from the existing one, board action must be taken to amend those documents and, in the case of the Articles, the amendment must be filed with the Secretary of State.

Changing articles of incorporation often means changing things like agent names, the businesses operating name, addresses, and stock information. The most common reason that businesses change the articles of incorporation is to change members' information.

S.D. Codified Laws § 10-45-14. Nonprofits that devote resources exclusively to the relief of the poor, distressed or underprivileged and is recognized under the Internal Revenue Code as tax-exempt is exempt from sales tax. S.D.

As long as the organization still meets the criteria for continuing on as a nonprofit organization, the board should vote to approve the new mission statement. The next step would be to make any necessary amendments to the bylaws and the Articles of Incorporation.

Contact Your Secretary of State If you have any questions, call the secretary of state's office for guidance. In many cases, you can makes changes to your nonprofit, such as updating your address or board members, online.

You amend the articles of your South Dakota Corporation by submitting the completed Amendment to Articles of Incorporation form in duplicate by mail or in person, along with the filing fee to the South Dakota Secretary of State.