Many so-called nonprofits are simply groups of people who come together to perform some social good. These informal groups are called unincorporated nonprofit associations. An unincorporated nonprofit association may be subject to certain legal requirements, even though it hasn't filed for incorporation under its state's incorporation laws. For example, an unincorporated association will generally need to file tax returns, whether as a taxable or tax-exempt entity. Additionally, there may be state registration requirements.

South Dakota Articles of Association of Unincorporated Church Association

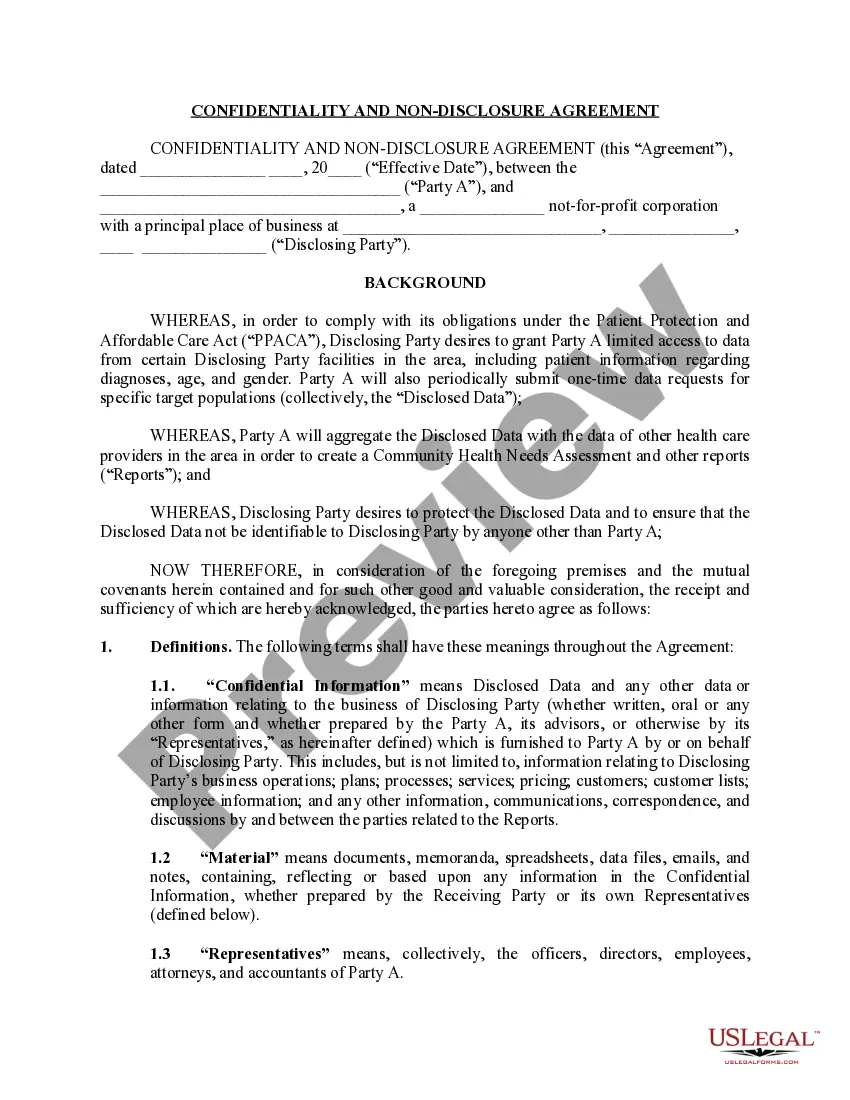

Description

How to fill out Articles Of Association Of Unincorporated Church Association?

If you require to total, obtain, or print sanctioned document formats, utilize US Legal Forms, the premier collection of legal templates, available online.

Take advantage of the website's straightforward and user-friendly search feature to locate the documents you need.

Numerous templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to find the South Dakota Articles of Association of Unincorporated Church Association in just a few clicks.

Every legal document template you purchase is yours permanently. You have access to all forms you downloaded within your account. Select the My documents section and choose a form to print or download again.

Complete and download, and print the South Dakota Articles of Association of Unincorporated Church Association with US Legal Forms. There are thousands of specialized and state-specific forms you may use for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the South Dakota Articles of Association of Unincorporated Church Association.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have chosen the correct form for the specific city/state.

- Step 2. Use the Preview option to view the form's details. Be sure to read through the description.

- Step 3. If you are not satisfied with the document, utilize the Search field at the top of the screen to find alternative versions of the legal document template.

- Step 4. Once you have located the form you need, click the Purchase now button. Select the payment plan you prefer and enter your details to register for an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Choose the format of the legal document and download it to your device.

- Step 7. Fill out, edit, and print or sign the South Dakota Articles of Association of Unincorporated Church Association.

Form popularity

FAQ

An unincorporated association is not the same as a nonprofit, although they can overlap. An unincorporated association functions without formal incorporation and may operate under the South Dakota Articles of Association of Unincorporated Church Association framework. In contrast, a nonprofit is formally registered and recognized by government entities, providing specific legal protections and tax exemptions. Knowing these differences can help you decide the best route for establishing your organization.

The main difference lies in their structure and purpose. A nonprofit organization focuses on a mission that benefits the public or a specific community without profit motives, while an association, such as a South Dakota Articles of Association of Unincorporated Church Association, is typically a group formed for mutual aid or to pursue shared interests. While every nonprofit is an association, not every association qualifies as a nonprofit under IRS regulations. Thus, understanding these distinctions is important when establishing your organization.

An unincorporated association may need an Employer Identification Number (EIN), especially if it plans to open a bank account, hire employees, or apply for tax-exempt status. For example, if your organization is classified as a South Dakota Articles of Association of Unincorporated Church Association and intends to establish financial operations, obtaining an EIN becomes crucial. Furthermore, even if you don’t have employees, having an EIN can simplify business transactions and keep your personal and organizational finances separate.

The governing document of an organization typically refers to the foundational papers that define its structure and operational rules. For unincorporated associations, this often includes bylaws or articles of association. Following the South Dakota Articles of Association of Unincorporated Church Association ensures your organization functions effectively and within legal parameters.

Organizing documents serve as essential guidelines for an unincorporated association, detailing its mission and operational structure. These might include the articles of association or by-laws, establishing how the organization functions. Always consult the South Dakota Articles of Association of Unincorporated Church Association for a standardized format.

While an unincorporated association often does not have to file a tax return, circumstances can change based on income levels and other factors. If the association's activities generate taxable income, filing may be necessary. Referencing the South Dakota Articles of Association of Unincorporated Church Association can provide insight into specific filing requirements.

The organizing document for an unincorporated association usually includes its bylaws or articles of association. These documents outline the purpose, structure, and membership rules. It's critical to adhere to the South Dakota Articles of Association of Unincorporated Church Association when drafting these documents to ensure compliance.

Unincorporated associations can receive a 1099 form if they earn income through sources like services provided. This form reports various income types to the IRS. Always consider the South Dakota Articles of Association of Unincorporated Church Association for clarity on your association’s financial reporting.

An unincorporated association generally does not need to file a tax return if it does not generate significant income. However, if it earns over a specific threshold, it may be required to file. It's essential to review the South Dakota Articles of Association of Unincorporated Church Association for specific guidance on tax obligations.

An unincorporated association is not the same as a non-profit organization, though they may share similar goals. Unincorporated associations lack the formal legal structure and protections that come with non-profit status. Understanding this distinction is essential when drafting the South Dakota Articles of Association of Unincorporated Church Association, to ensure your organization is set up for success.