South Dakota Articles of Association of Unincorporated Charitable Association

Description

How to fill out Articles Of Association Of Unincorporated Charitable Association?

If you need to gather, acquire, or produce legal document templates, utilize US Legal Forms, the premier collection of legal documents available online.

Utilize the website's straightforward and user-friendly search feature to locate the documents you require.

Various templates for business and personal use are organized by categories and titles, or keywords.

Step 4. Once you have located the form you need, click the Buy now button. Choose the payment plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Utilize US Legal Forms to access the South Dakota Articles of Association of Unincorporated Charitable Association in just a few clicks.

- If you are currently a US Legal Forms customer, sign in to your account and click the Download button to retrieve the South Dakota Articles of Association of Unincorporated Charitable Association.

- You can also access documents you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Confirm that you have selected the form for the correct state/country.

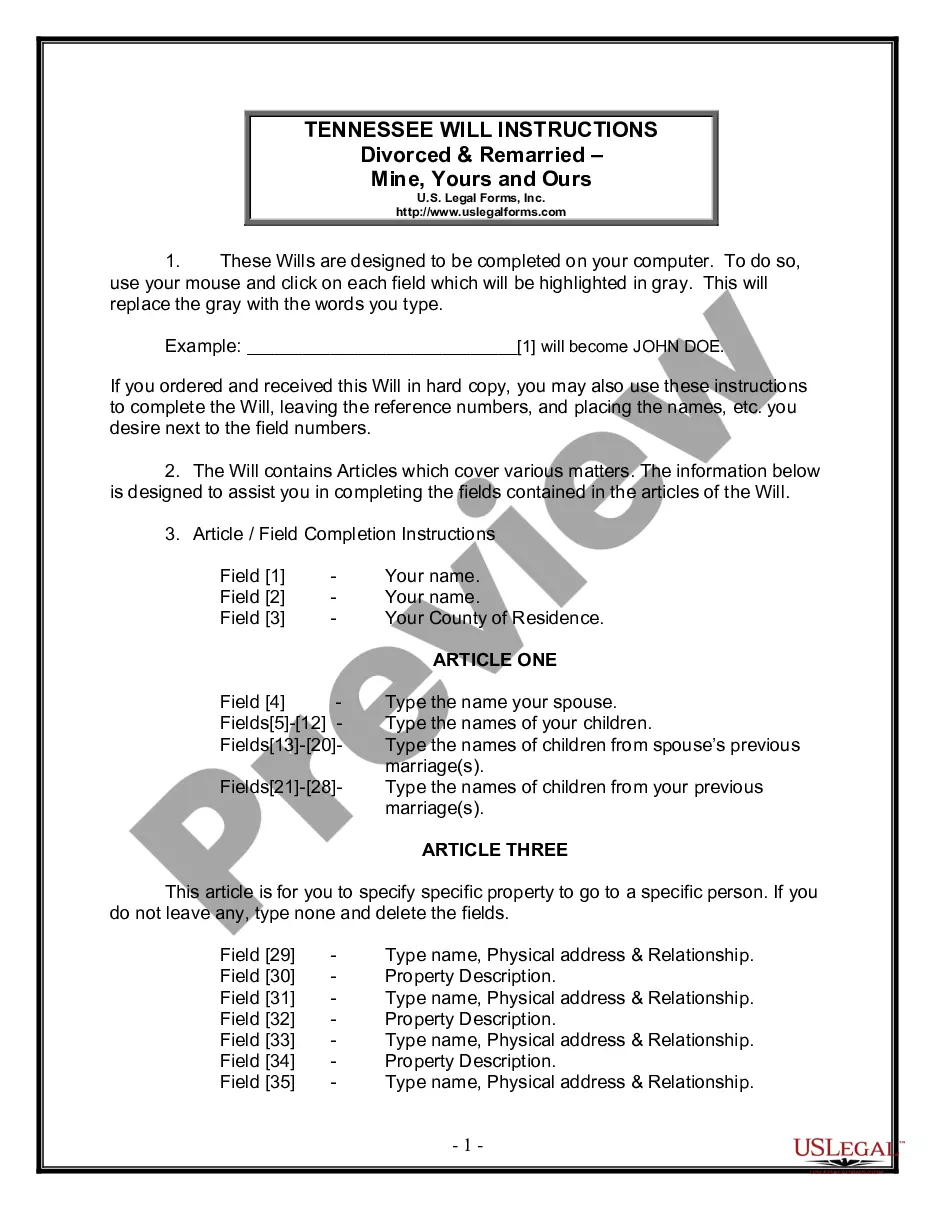

- Step 2. Use the Preview option to review the content of the form. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search section at the top of the screen to find other templates in the legal form category.

Form popularity

FAQ

No, an unincorporated association is not the same as a nonprofit. An unincorporated association does not have a formal legal status but can pursue charitable activities. The South Dakota Articles of Association of Unincorporated Charitable Association provide a framework for how such groups can organize and operate without federal nonprofit status.

"Unincorporated" indicates that the association is not a legal person. If, say, the group of people wants to enter into a contract to hire a football pitch, then they cannot do this themselves but must appoint someone (usually one or more of the members) to act on their behalf.

To form a 501(c)(3) nonprofit organization, follow these steps:Step 1: Name Your South Dakota Nonprofit.Step 2: Choose Your Registered Agent.Step 3: Select Your Board Members & Officers.Step 4: Adopt Bylaws & Conflict of Interest Policy.Step 5: File the Articles of Incorporation.Step 6: Get an EIN.More items...?

An organization that normally has $50,000 or more in gross receipts and that is required to file an exempt organization information return must file either Form 990PDF, Return of Organization Exempt from Income Tax, or Form 990-EZPDF, Short Form Return of Organization Exempt from Income Tax.

One way of starting a nonprofit without money is by using a fiscal sponsorship. A fiscal sponsor is an already existing 501(c)(3) corporation that will take a new organization under its wing" while the new company starts up. The sponsored organization (you) does not need to be a formal corporation.

If an unincorporated association does not apply for tax-exempt status, it files Form 100, California Corporation Franchise or Income Tax Return, with us and computes its tax using the general corporation tax rate. It does not pay the minimum franchise tax.

How to Start a Nonprofit in South DakotaName Your Organization.Recruit Incorporators and Initial Directors.Appoint a Registered Agent.Prepare and File Articles of Incorporation.File Initial Report.Obtain an Employer Identification Number (EIN)Store Nonprofit Records.Establish Initial Governing Documents and Policies.More items...

Section 501(c)(3) is one of the tax law provisions granting exemption from the federal income tax to nonprofit organizations that exist for religious, charitable, scientific, literary, or educational purposes, among others. See the IRS's website for more information on the designation of charitable organizations.

An unincorporated association can operate as a tax-exempt nonprofit as long as the purpose of its activity is of public benefit, and annual revenues are less than $5,000. If the association remains small with limited income, the unincorporated association does not need to apply to the IRS for 501(c)(3) status.

No one person or group of people can own a nonprofit organization. Ownership is the major difference between a for-profit business and a nonprofit organization. For-profit businesses can be privately owned and can distribute earnings to employees or shareholders.