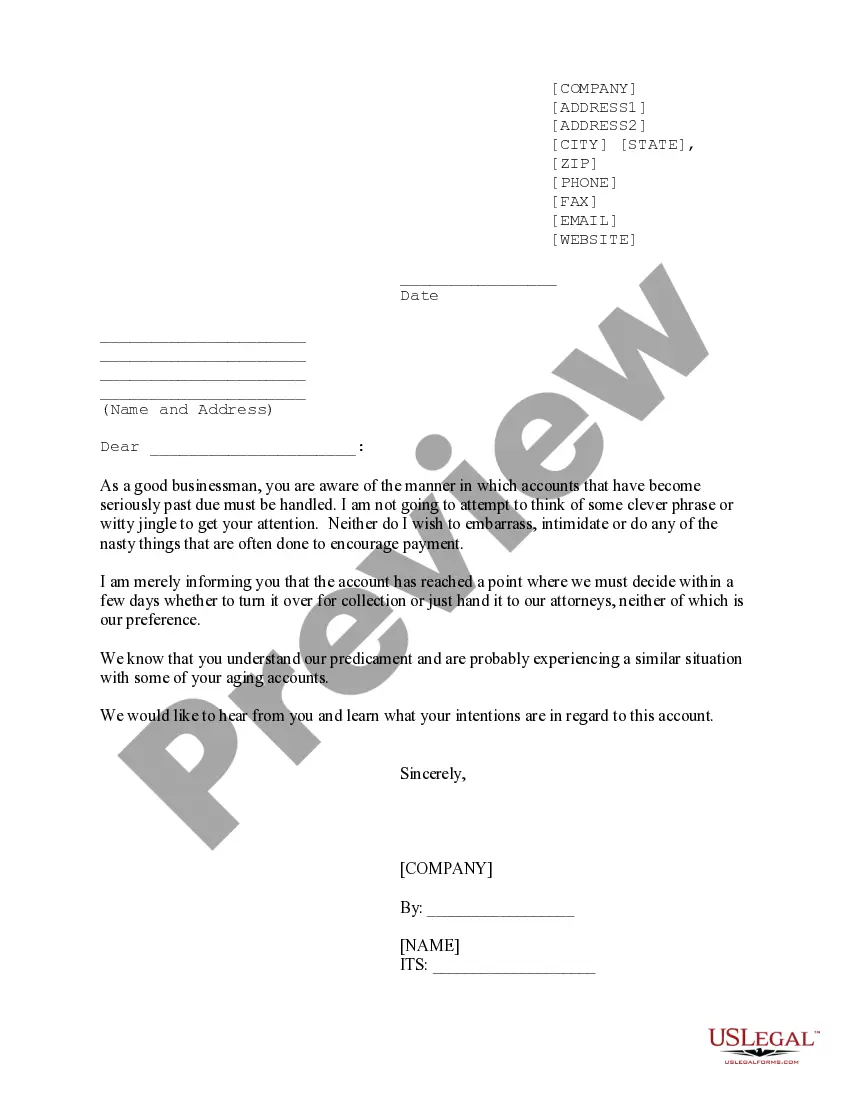

South Dakota Sample of a Collection Letter to Small Business in Advance

Description

How to fill out Sample Of A Collection Letter To Small Business In Advance?

If you wish to obtain thorough, download, or print legal documents templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Benefit from the site's user-friendly and efficient search to find the documents you require.

A range of templates for business and personal uses are categorized by groups and states, or keywords.

Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

Step 6. Choose the file format of the legal form and download it to your device. Step 7. Complete, edit, and print or sign the South Dakota Sample of a Collection Letter to Small Business in Advance.

- Utilize US Legal Forms to find the South Dakota Sample of a Collection Letter to Small Business in Advance with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click on the Acquire button to obtain the South Dakota Sample of a Collection Letter to Small Business in Advance.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for your specific city/state.

- Step 2. Use the Preview feature to review the form's content. Remember to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find different versions of the legal form template.

- Step 4. Once you have located the form you need, click the Purchase now button. Choose the pricing plan you prefer and input your details to register for the account.

Form popularity

FAQ

Writing a debt collection letter involves clarity and professionalism. Start by addressing the debtor by name, stating the amount due, and outlining payment methods. The South Dakota Sample of a Collection Letter to Small Business in Advance provides insight into the structure and tone necessary for an effective communication strategy.

A good debt settlement letter should clearly state your offer to settle the debt for a lesser amount. Include your payment proposal, a brief explanation for the request, and express your intent to resolve the matter amicably. Enhance your strategy by utilizing the South Dakota Sample of a Collection Letter to Small Business in Advance as a model for clarity.

To create a collection letter, start with a clear format and a professional tone. Outline the details such as the amount owed, due date, and payment options. You can find a structured approach in the South Dakota Sample of a Collection Letter to Small Business in Advance, which can serve as a valuable reference.

A debt collection letter should include essential details such as the debtor's name, the amount owed, payment terms, and the consequences of non-payment. Additionally, ensure to specify how the debtor can contact you for questions. For an effective layout and wording strategy, check the South Dakota Sample of a Collection Letter to Small Business in Advance.

A debt collector validation letter confirms the amount owed and validates the debt. It typically includes your personal information, details about the debt, and a request for additional documentation if needed. This letter's format can be influenced by the South Dakota Sample of a Collection Letter to Small Business in Advance, ensuring it meets required standards.

A collection letter typically follows a clear structure to enhance understanding. Begin with a professional greeting, state the purpose of the letter, outline the outstanding amount, and include payment options. For best practices, refer to the South Dakota Sample of a Collection Letter to Small Business in Advance, which demonstrates how to effectively organize your letter.

To write a collection statement, start by clearly stating the amount owed, the due date, and any relevant account information. Include a brief summary of the services or products provided, along with any payment terms agreed upon. For additional guidance, consider the South Dakota Sample of a Collection Letter to Small Business in Advance, which offers a structured format for effective communication.

To write an effective collection letter, first, address the recipient by name to establish a personal connection. Clearly state the outstanding amount and payment terms, and invite them to discuss any concerns. You can use a South Dakota Sample of a Collection Letter to Small Business in Advance as a basis for your letter, ensuring clarity and professionalism throughout your communication.

When drafting an effective collection letter, start with a polite tone while firmly stating the facts. Ensure you outline the payment details and the next steps explicitly, making it easy for the reader to understand their obligations. Using a South Dakota Sample of a Collection Letter to Small Business in Advance can help you follow these guidelines and create a well-structured letter that prompts action.

A properly written collection letter must contain clear communication of the debt owed, including the amount and due date. Additionally, it should provide specific contact information, allowing the recipient to reach out easily for questions or payment arrangements. For a practical approach, you can refer to a South Dakota Sample of a Collection Letter to Small Business in Advance to ensure your letter meets these essential requirements.