South Dakota Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption

Description

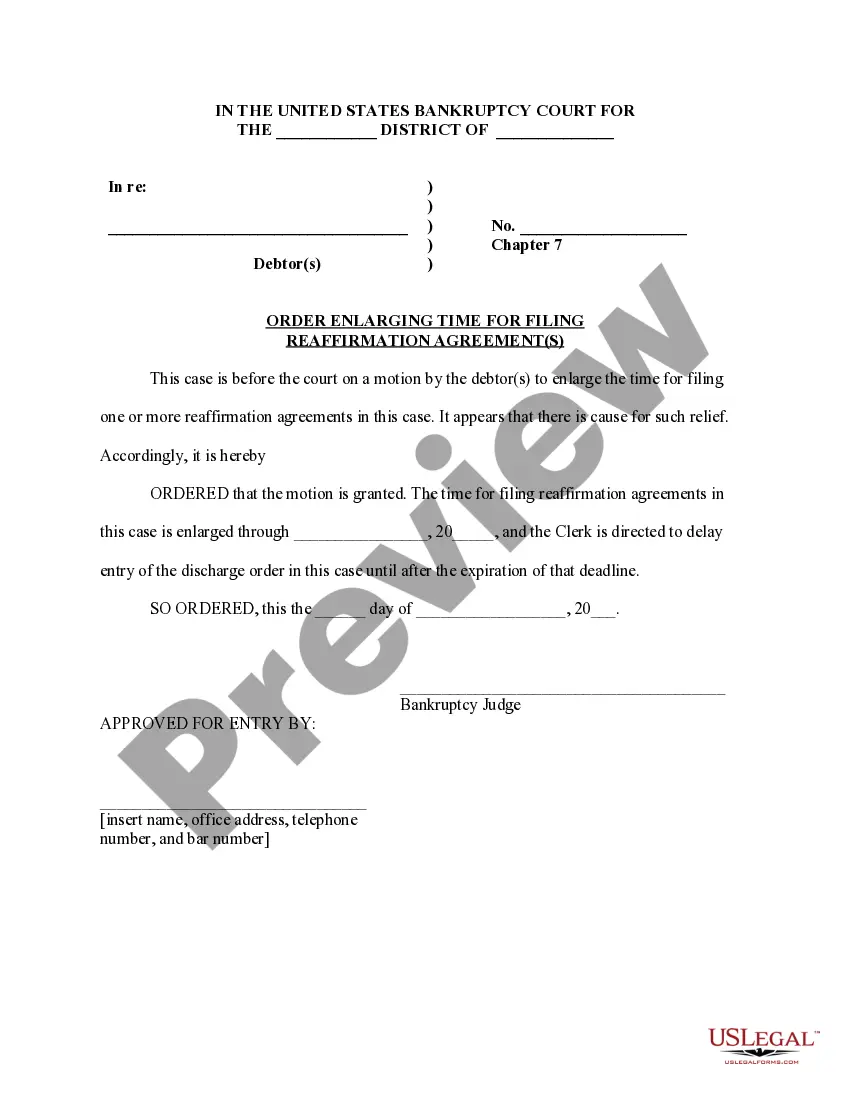

How to fill out Certification Of No Information Reporting On Sale Or Exchange Of Principal Residence - Tax Exemption?

Locating the appropriate legal documents web template can be challenging. It goes without saying that there are numerous themes accessible online, but how can you acquire the legal form you need? Turn to the US Legal Forms website.

The service provides thousands of templates, including the South Dakota Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption, which you can utilize for business and personal purposes. All the forms are verified by specialists and comply with federal and state regulations.

If you are already registered, Log In to your account and click on the Obtain button to access the South Dakota Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption. Use your account to view the legal forms you have previously purchased. Navigate to the My documents section of your account to download an additional copy of the forms you need.

Complete, modify, print, and sign the acquired South Dakota Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption. US Legal Forms is the largest repository of legal forms where you can find various document templates. Use the service to download professionally crafted documents that adhere to state requirements.

- If you are an inexperienced user of US Legal Forms, here are straightforward steps you can follow.

- First, ensure you have chosen the correct form for your region/location. You can review the form using the Review option and read the form outline to confirm it is suitable for you.

- If the form doesn’t meet your requirements, use the Search field to find the appropriate form.

- Once you are confident that the form is appropriate, click the Acquire now button to obtain the form.

- Select the desired pricing plan and input the necessary information. Create your account and pay for your order using your PayPal account or credit card.

- Choose the file format and download the legal documents web template to your device.

Form popularity

FAQ

Non-qualified use of a principal residence refers to the periods when a homeowner rents out their home or uses it for business purposes, which can affect tax exemptions. In South Dakota, such usage may lead to changes in tax obligations and could impact eligibility for the South Dakota Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption. It is crucial to keep accurate records of any non-qualified use to avoid future tax complications.

To report the sale of a timeshare, you will need to include the transaction details on Schedule D of your tax return. If you qualify for the South Dakota Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption, the reporting process becomes easier, as it may relieve you from having to report the sale altogether. Consider consulting a tax specialist to maximize your tax reporting strategy.

PIERRE, S.D. (KELO) Democrats in South Dakota's Legislature have found some Republican allies in their decades-long push to remove the state sales tax from food. The state House voted 47-22 Monday to lift the 4.5% tax on food purchases.

In the state of South Dakota, sales tax is legally required to be collected from all tangible, physical products being sold to a consumer. Several examples of of items that exempt from South Dakota sales tax are prescription medications, farm machinery, advertising services, replacement parts, and livestock.

According to the Tax Code1, the following are exempt from paying taxes and therefore may be issued Certificate of Tax Exemption: Individuals with no income, minimum wage earners, and those whose taxable income does not exceed PHP 250,000.

An official document that gives someone special permission not to do or pay something: a medical/tax exemption certificate.

An exemption certificate is the form presented by an exempt organization or individual to the seller when making a tax-exempt purchase. Exemptions are based on the customer making the purchase and always require documentation. Different purchasers may be granted exemptions under a state's statutes.

Sellers must keep exemption certificates in their records for three years. If the purchaser doesn02bct provide the seller with a properly completed exemption certificate, the seller must collect sales tax. An exemption certificate may be issued for a single purchase or as a blanket certificate.

Traditional Goods or Services Goods that are subject to sales tax in South Dakota include physical property, like furniture, home appliances, and motor vehicles. The purchase of prescription medication and gasoline are tax-exempt. South Dakota is unique in the fact that almost all services are taxable.

Eligibility for Certificate of Exemption They can instead apply for a Certificate of Exemption, which is issued free of charge. However, as residents not residing in Hong Kong are not required to register for Hong Kong identity cards, they are not required to apply for the Certificate of Exemption.