South Dakota Worksheet - New Product or Service

Description

How to fill out Worksheet - New Product Or Service?

Are you in a situation where you need documents for either business or personal purposes nearly every day.

There are numerous legal document templates accessible online, but finding reliable versions isn’t easy.

US Legal Forms offers thousands of form templates, including the South Dakota Worksheet - New Product or Service, which is crafted to meet state and federal requirements.

When you find the correct form, click Buy now.

Choose the pricing plan you prefer, fill in the required information to create your account, and pay for your order using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the South Dakota Worksheet - New Product or Service template.

- If you don’t have an account and wish to start using US Legal Forms, follow these instructions.

- Select the form you need and ensure it is for the correct city/state.

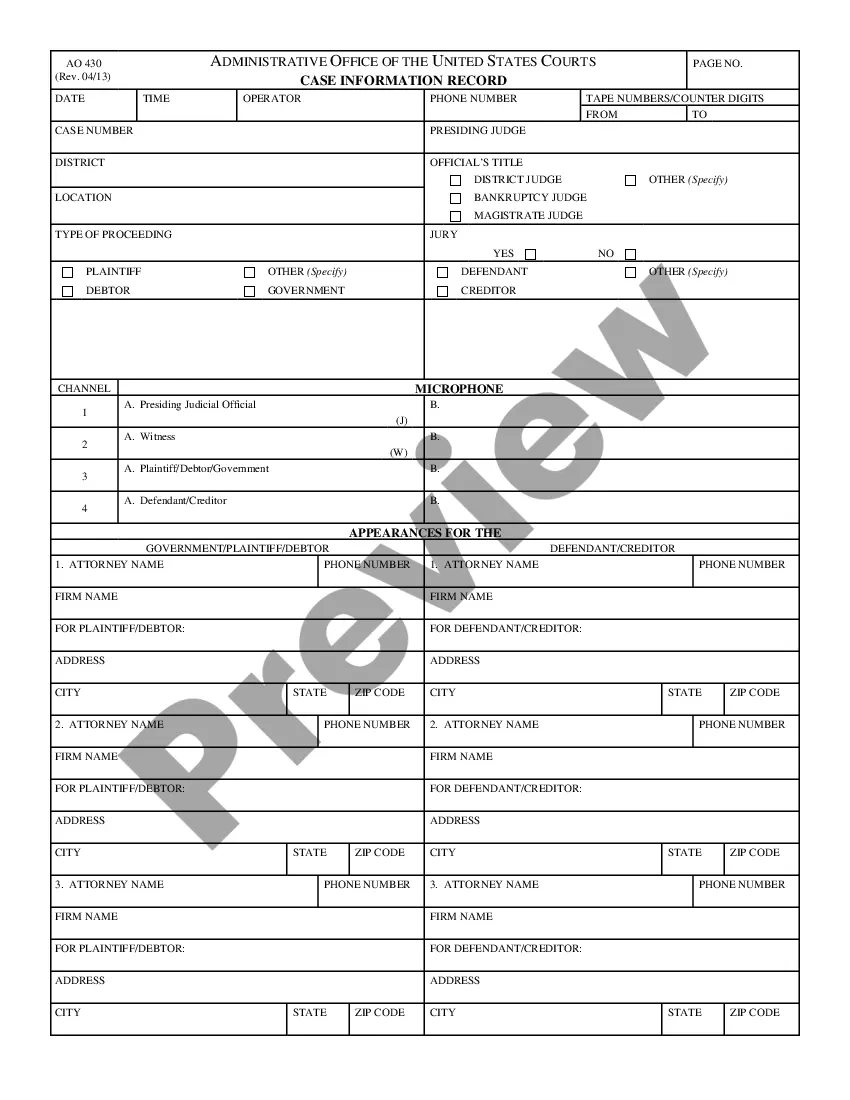

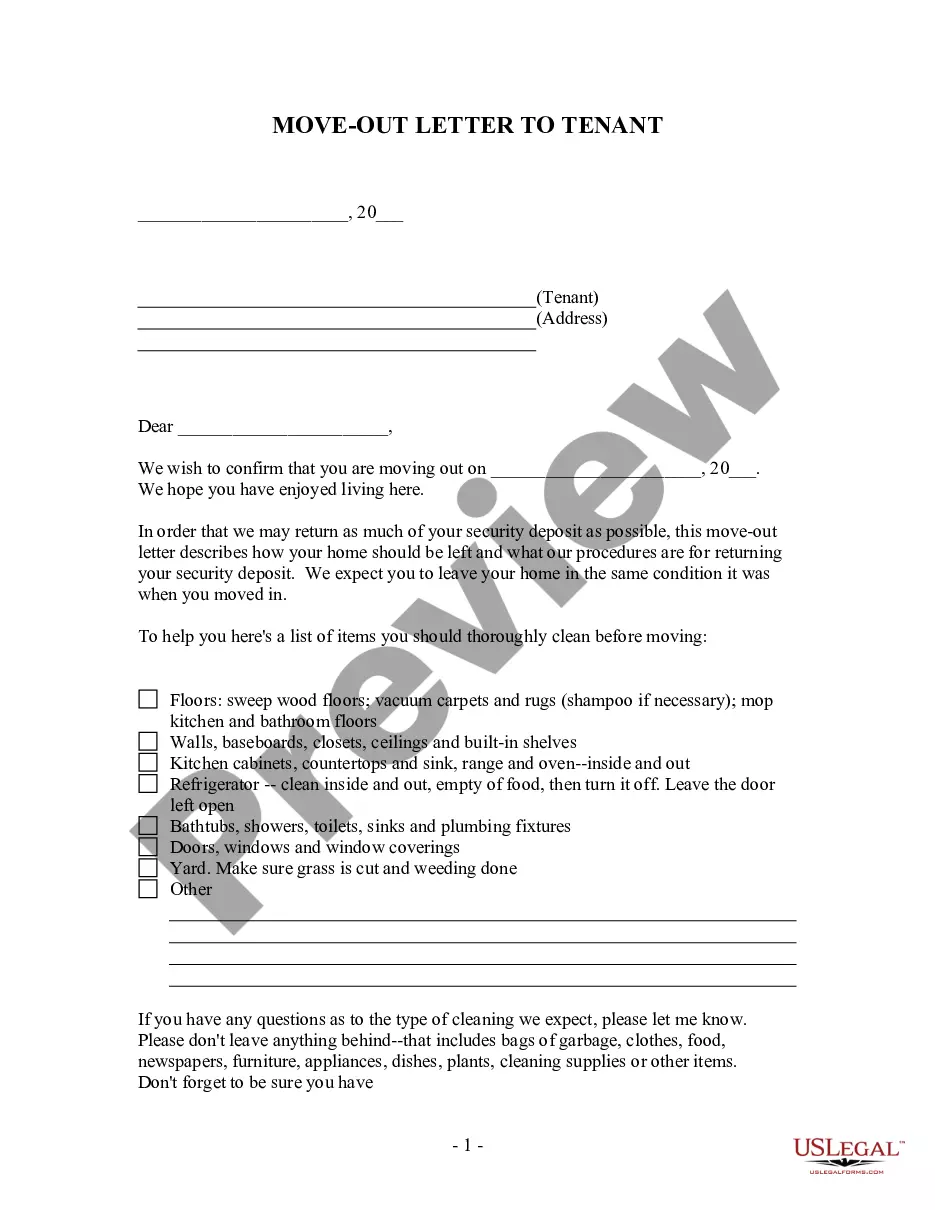

- Utilize the Preview button to review the form.

- Check the description to confirm you have chosen the correct document.

- If the form isn’t what you want, use the Search field to find the form that meets your needs.

Form popularity

FAQ

South Dakota does not have an individual income tax. South Dakota also does not have a corporate income tax. South Dakota has a 4.50 percent state sales tax rate, a max local sales tax rate of 4.50 percent, and an average combined state and local sales tax rate of 6.40 percent.

Are services subject to sales tax in South Dakota? "Goods" refers to the sale of tangible personal property, which are generally taxable. "Services" refers to the sale of labor or a non-tangible benefit. In South Dakota, services are taxable unless specifically exempted.

What is Taxable?Sales of certain food products for human consumption (many groceries)Sales to the U.S. Government.Sales of prescription medicine and certain medical devices.Sales of items paid for with food stamps.

Are services subject to sales tax in South Dakota? "Goods" refers to the sale of tangible personal property, which are generally taxable. "Services" refers to the sale of labor or a non-tangible benefit. In South Dakota, services are taxable unless specifically exempted.

Use tax applies to all goods and services that are used, stored, or consumed in South Dakota. The purchaser or con- sumer is responsible for reporting and remitting the 4% state use tax, plus applicable municipal use tax in the filing period in which the purchaser receives or is invoiced for the goods or services.

Several examples of items that exempt from South Dakota sales tax are prescription medications, farm machinery, advertising services, replacement parts, and livestock. These categories may have some further qualifications before the special rate applies, such as a price cap on clothing items.

Traditional Goods or Services Goods that are subject to sales tax in South Dakota include physical property, like furniture, home appliances, and motor vehicles. The purchase of prescription medication and gasoline are tax-exempt. South Dakota is unique in the fact that almost all services are taxable.

What is South Dakota's Sales Tax Rate? The South Dakota sales tax and use tax rates are 4.5%.