The right of an employee to compensation is based on either an express or implied contract. Whether the employment contract is express or implied, it need not be formalized in order for the terms of employment to begin. Once employment has begun, the employment contract represents the right of the employee to be paid the wages agreed upon for services he or she has performed and the right of an employer to receive the services for which the wages have been paid.

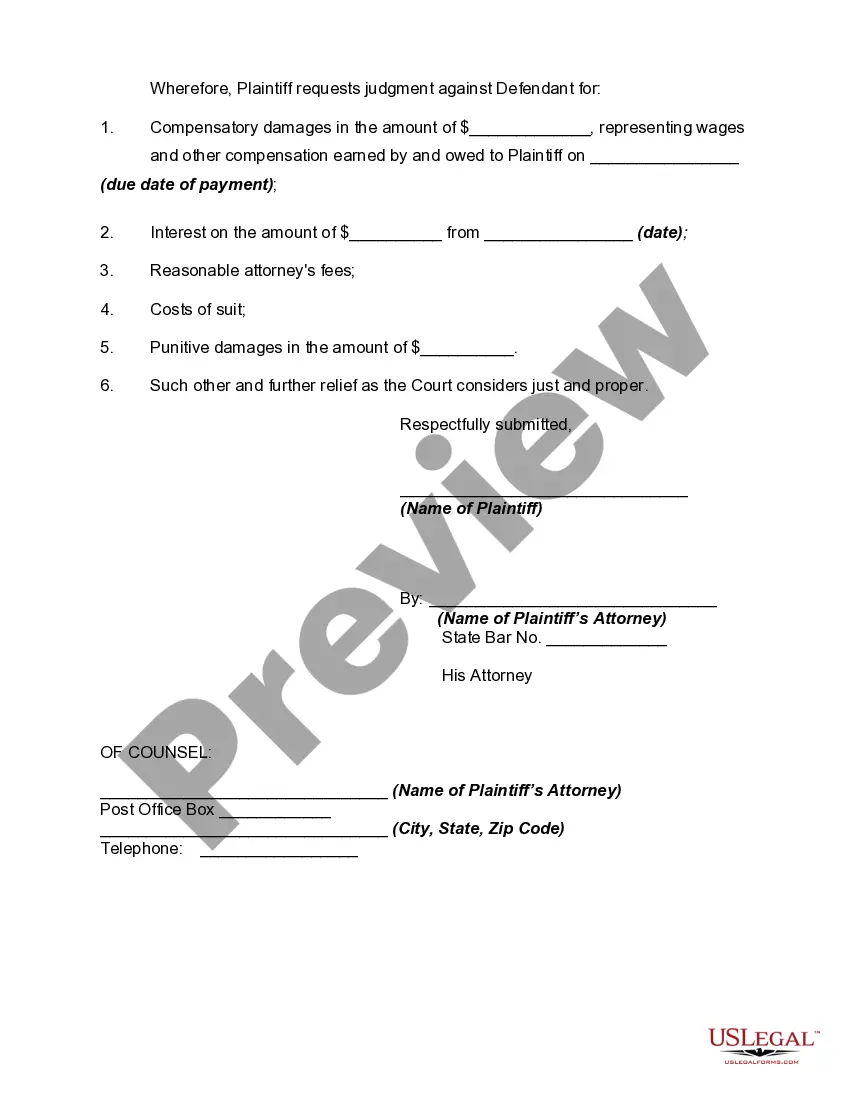

South Dakota Complaint for Recovery of Unpaid Wages

Description

How to fill out Complaint For Recovery Of Unpaid Wages?

Are you presently within a placement that you need to have papers for sometimes business or personal purposes virtually every working day? There are plenty of authorized document templates available on the net, but discovering ones you can rely isn`t simple. US Legal Forms offers thousands of kind templates, just like the South Dakota Complaint for Recovery of Unpaid Wages, that happen to be composed to meet federal and state demands.

When you are presently informed about US Legal Forms internet site and have your account, simply log in. After that, it is possible to down load the South Dakota Complaint for Recovery of Unpaid Wages web template.

If you do not offer an accounts and would like to begin to use US Legal Forms, adopt these measures:

- Find the kind you want and ensure it is to the correct town/region.

- Utilize the Preview switch to review the form.

- See the explanation to actually have chosen the right kind.

- When the kind isn`t what you are searching for, make use of the Lookup area to find the kind that suits you and demands.

- If you obtain the correct kind, just click Get now.

- Choose the costs prepare you desire, complete the specified details to produce your bank account, and purchase the order making use of your PayPal or bank card.

- Choose a hassle-free document structure and down load your backup.

Find all of the document templates you may have bought in the My Forms food selection. You can get a extra backup of South Dakota Complaint for Recovery of Unpaid Wages any time, if possible. Just click the necessary kind to down load or produce the document web template.

Use US Legal Forms, by far the most considerable assortment of authorized types, in order to save efforts and prevent faults. The assistance offers appropriately produced authorized document templates which can be used for a variety of purposes. Make your account on US Legal Forms and commence creating your life easier.

Form popularity

FAQ

Q: When an employee voluntarily terminates employment, when is the final paycheck due? A: The law requires that all wages be paid on the next regular payday after an employee quits. The law does allow an employer to withhold the final paycheck until the employee returns any property that belongs to the employer.

?No employer may discriminate between employees on the basis of sex, by paying wages to any employee in any occupation in this state at a rate less than the rate at which the employer pays any employee of the opposite sex for comparable work on jobs which have comparable requirements relating to skill, effort, and ...

Payment of accrued, unused vacation on termination is also not addressed by state statutes. Because South Dakota's Legislature and its courts have not provided any information about vacation leave, employers are free to create their own policies regarding vacation leave and PTO payout at termination.

Nonexempt Status - The Fair Labor Standards Act requires that all employees that are not exempt be entitled to overtime pay (compensatory time off - public employers) of at least one-and-one-half times (1 ½) his/her regular rate for hours worked in excess of 40 in any workweek.

Employers must pay employees at least once a month or on regular agreed-upon paydays that the employer specifies in advance. Employers may pay wages by check, cash, or direct deposit to the employee's bank account, unless an employer and employee agree to another form of payment. SD Codified Laws § 60-11-9.

Employment relationships in South Dakota may be 'terminated at will,' which means an employer does not need a specific reason to fire an employee. This is the same concept as an employee not needing a specific reason to quit a job. Generally, the only exceptions to this rule are when: A contract for employment exists.

One cannot be terminated because of his or her color, race, religious beliefs or ancestry. Employers also cannot terminate those who have existing contracts, those who refuse to commit crimes on the employer's behalf or those who are engaging in actions such as seeking worker's compensation from the employer.