South Dakota Escrow Check Receipt Form

Description

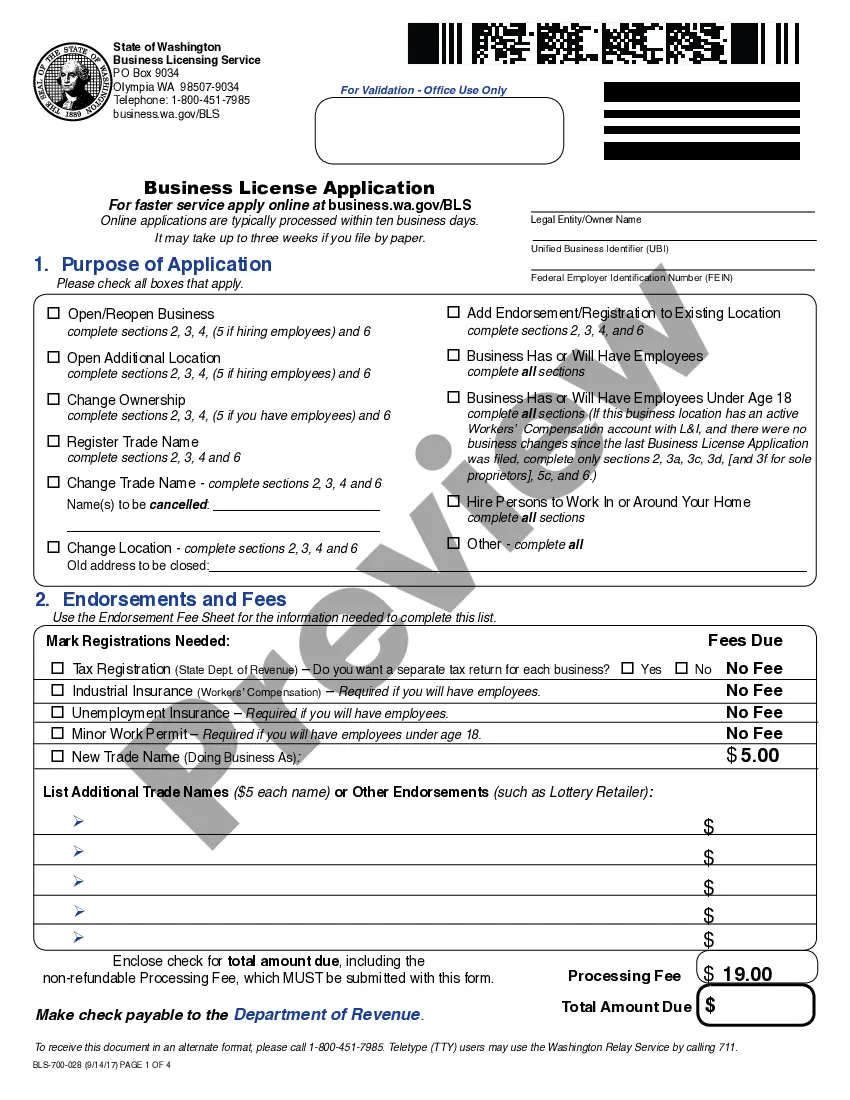

How to fill out Escrow Check Receipt Form?

You can devote numerous hours online looking for the legal document format that meets the federal and state requirements you seek.

US Legal Forms provides thousands of legal templates that can be reviewed by professionals.

You can conveniently obtain or print the South Dakota Escrow Check Receipt Form from my service.

Review the form description to ensure you have chosen the right form. If available, utilize the Preview button to inspect the format as well.

- If you already have a US Legal Forms account, you can Log In and then click the Download button.

- Afterward, you can complete, modify, print, or sign the South Dakota Escrow Check Receipt Form.

- Each legal template you obtain is your permanent property.

- To get another copy of any purchased form, go to the My documents tab and click the relevant button.

- If you're using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct format for the region/city of your choice.

Form popularity

FAQ

An escrow receipt is a formal acknowledgment that verifies funds have been placed in escrow for a specific transaction. This document outlines the details of the escrow arrangement, including all parties involved and the agreed-upon terms. By using the South Dakota Escrow Check Receipt Form, you ensure that all parts of the transaction are clearly outlined and documented for both parties.

An escrow receipt is a document provided by the escrow agent confirming that funds or assets are held in escrow. It serves as proof that the transaction is underway and can be referred to in case of disputes. Obtaining the South Dakota Escrow Check Receipt Form not only provides you with an official record but also boosts confidence in the transaction process.

The escrow payment refers to the funds held by an escrow service until certain conditions are fulfilled during a transaction. This payment protects both the buyer and seller by ensuring that the agreement is honored before funds are exchanged. Using the South Dakota Escrow Check Receipt Form helps document this payment and confirms that both parties are secure in the process.

An escrow form is a legal document used to outline the terms and conditions of an escrow agreement. It details the roles of each party, the amount being held, and the conditions for releasing the funds. You can easily access the South Dakota Escrow Check Receipt Form to streamline your escrow transactions and ensure compliance with all necessary regulations.

Yes, cashier checks are often recognized as good funds since they are guaranteed by a bank. This means the bank has already verified the funds are available. Using a cashier check when completing a transaction with the South Dakota Escrow Check Receipt Form increases trust and security during the escrow process.

To complete an escrow transaction, first, identify a trustworthy escrow agent or service. Next, both the buyer and seller agree on the terms, and the buyer deposits the funds into escrow. Finally, once all conditions are met, the South Dakota Escrow Check Receipt Form confirms the release of funds to the seller, ensuring a smooth transaction.

Proof of escrow refers to the documentation that confirms funds or assets are held by a third party during a transaction. It demonstrates that the seller and buyer have agreed on the terms of the deal. With the South Dakota Escrow Check Receipt Form, you can easily access proof that escrow funds are secure, ensuring both parties meet their obligations.

When managing an escrow transaction, you typically write your escrow check to the escrow agent or the title company handling the closing. Ensure you include detailed instructions and reference information on the check to avoid confusion. Always keep a copy of the South Dakota Escrow Check Receipt Form for your records to document the transaction. If you have questions, platforms like uslegalforms can help navigate the process smoothly.

In South Dakota, various goods and services are subject to sales tax, including tangible personal property and certain services. Examples include sales of clothing, electronics, and prepared food. However, specific exemptions apply, so it's essential to familiarize yourself with what your business offers. Utilizing the South Dakota Escrow Check Receipt Form provides clarity for your transactions when handling taxable and non-taxable items.

You can register for sales tax in South Dakota by completing the online application available on the South Dakota Department of Revenue’s website. The registration process will require you to provide your business information and the types of products or services you offer. After your application is approved, you will receive a sales tax license, and you can start collecting sales tax. Don’t forget to keep the South Dakota Escrow Check Receipt Form handy for related transactions.