South Dakota General Journal

Description

How to fill out General Journal?

If you require to complete, obtain, or download sanctioned document templates, utilize US Legal Forms, the largest repository of legal forms available online.

Employ the site's user-friendly and convenient search to find the documents you need.

Various templates for businesses and personal use are organized by categories and jurisdictions, or keywords.

Every legal document template you download is yours permanently. You have access to every template in your account.

Select the My documents section and choose a form to print or download again. Be proactive and acquire, and print the South Dakota General Journal with US Legal Forms. There are numerous professional and state-specific templates available for your business or personal requirements.

- Utilize US Legal Forms to obtain the South Dakota General Journal in just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click on the Download button to retrieve the South Dakota General Journal.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have chosen the form for the correct city/state.

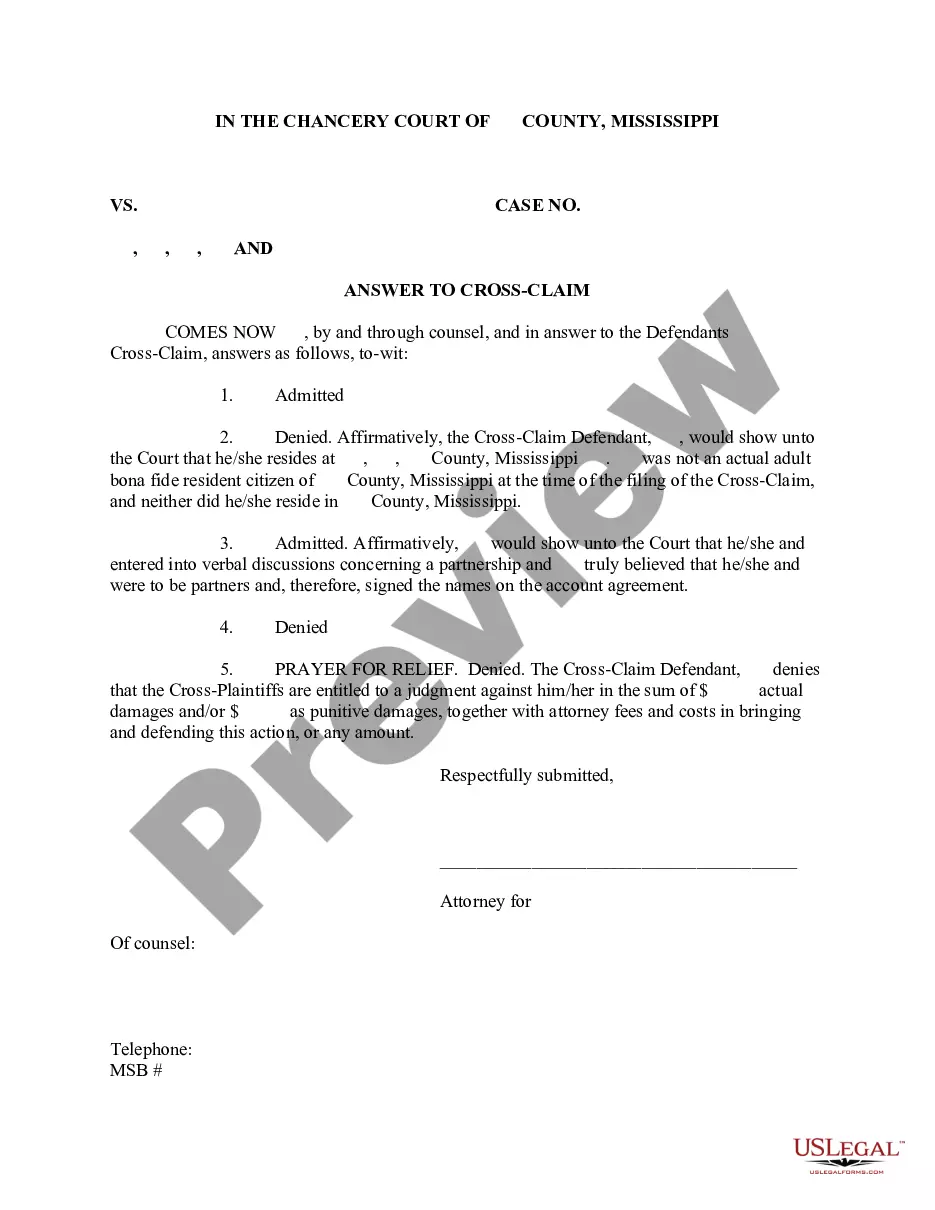

- Step 2. Use the Preview option to review the form's content. Make sure to read all the information.

- Step 3. If you are dissatisfied with the form, use the Search box at the top of the screen to find other versions of the legal form template.

- Step 4. After locating the form you need, click the Buy now button. Choose your preferred pricing plan and enter your details to create an account.

- Step 5. Process the transaction. You may use your credit card or PayPal account to complete the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the South Dakota General Journal.

Form popularity

FAQ

Whether freight is taxable in your case largely depends on state laws. In South Dakota, the taxation of freight charges is closely tied to the nature of the goods involved in the transaction. To stay compliant, refer to the South Dakota General Journal for explicit guidelines tailored to your situation.

A variety of goods and services are taxable in South Dakota, including retail sales, certain services, and some memberships. The specifics can vary, so it's crucial to stay informed. The South Dakota General Journal serves as a helpful resource to clarify what falls under taxable categories.

Freight charges in South Dakota are typically taxable when they are part of the sale of goods. If you are handling taxable items, be aware that these charges may also be assessed sales tax. For more in-depth exploration of this topic, the South Dakota General Journal can offer essential details.

Yes, janitorial services are generally taxable in South Dakota. The tax applies to various cleaning services provided to businesses and residential areas. Consult the South Dakota General Journal for comprehensive insights and specific cases to navigate these regulations effectively.

Memberships in South Dakota may be subject to sales tax, depending on the nature of the service provided. It's important to review the specifics, as certain organizations may offer tax-exempt memberships. Always refer to the South Dakota General Journal for detailed information about taxation on memberships.

Yes, freight can be taxable depending on the state laws. In South Dakota, the rules about freight charges can change based on the situation. You'll want to consult the South Dakota General Journal for the most accurate guidelines to ensure compliance.

You only need to file a DBA in states where you conduct business under a different name. Each state has its own regulations regarding DBAs, so it is vital to check local requirements. The South Dakota General Journal offers comprehensive information to help you understand these obligations across different states.

To legally write a DBA, you should clearly identify your business name, type of business, and the owner's legal name. Ensure that the format adheres to the local requirements outlined in the South Dakota General Journal. When in doubt, uslegalforms provides templates and guides to help you navigate the process efficiently.

In South Dakota, you can fill out your DBA application online in certain counties. Access the South Dakota General Journal for digital filing options. Once completed, follow the required process to submit your application online or print it out and file it in person at your local office.

Filing a lien in South Dakota involves completing a lien statement and submitting it to the appropriate office, usually the county register of deeds. You will need to include specific details about the debt and the property involved. For more detailed steps, refer to the South Dakota General Journal or consider using uslegalforms for easy document preparation.