South Dakota Non-Exclusive Online Affiliate Program Agreement

Description

How to fill out Non-Exclusive Online Affiliate Program Agreement?

US Legal Forms - one of the most extensive collections of legal documents in the United States - provides a range of legal form templates that you can download or print.

By using the website, you can discover thousands of forms for business and personal uses, categorized by types, states, or keywords. You can find the latest versions of forms such as the South Dakota Non-Exclusive Online Affiliate Program Agreement in just minutes.

If you already have an account, Log In and obtain the South Dakota Non-Exclusive Online Affiliate Program Agreement from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms from the My documents tab in your account.

Every template added to your account has no expiration date and belongs to you forever. Therefore, to download or print another copy, simply go to the My documents section and click on the form you desire.

Access the South Dakota Non-Exclusive Online Affiliate Program Agreement with US Legal Forms, the most extensive collection of legal form templates. Utilize a myriad of professional and state-specific templates that satisfy your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

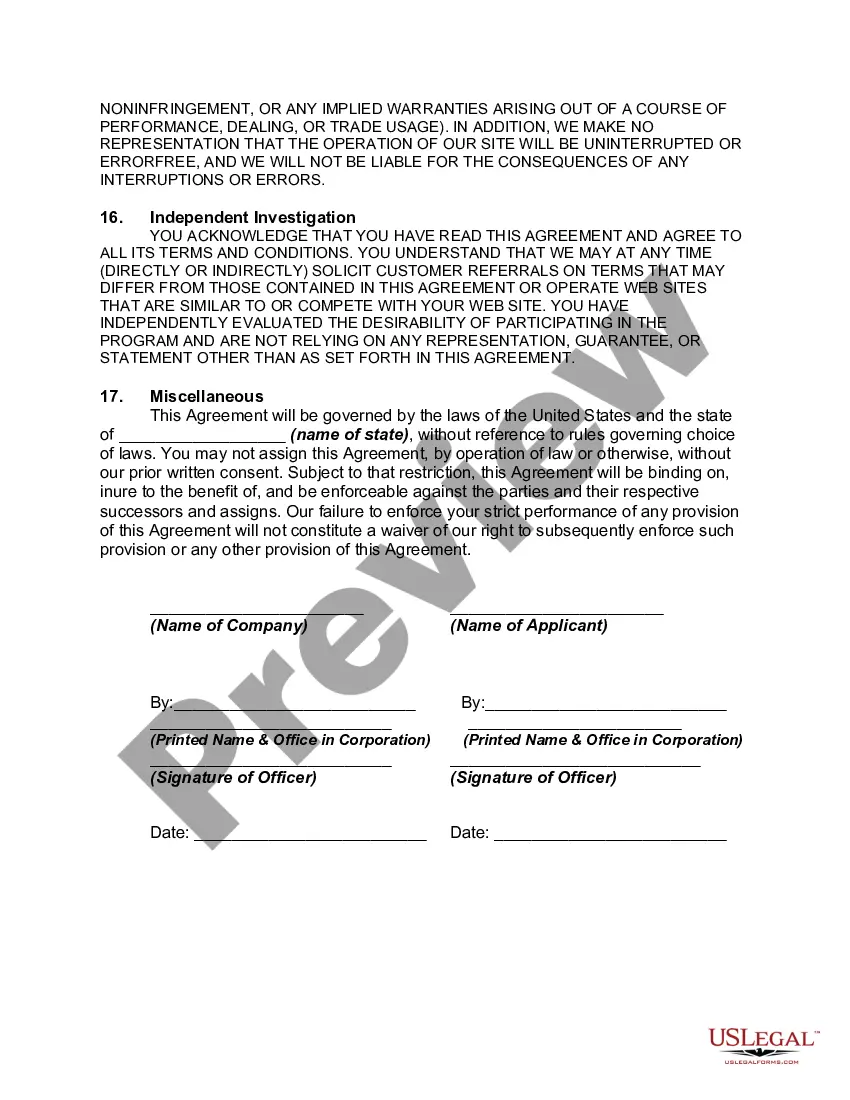

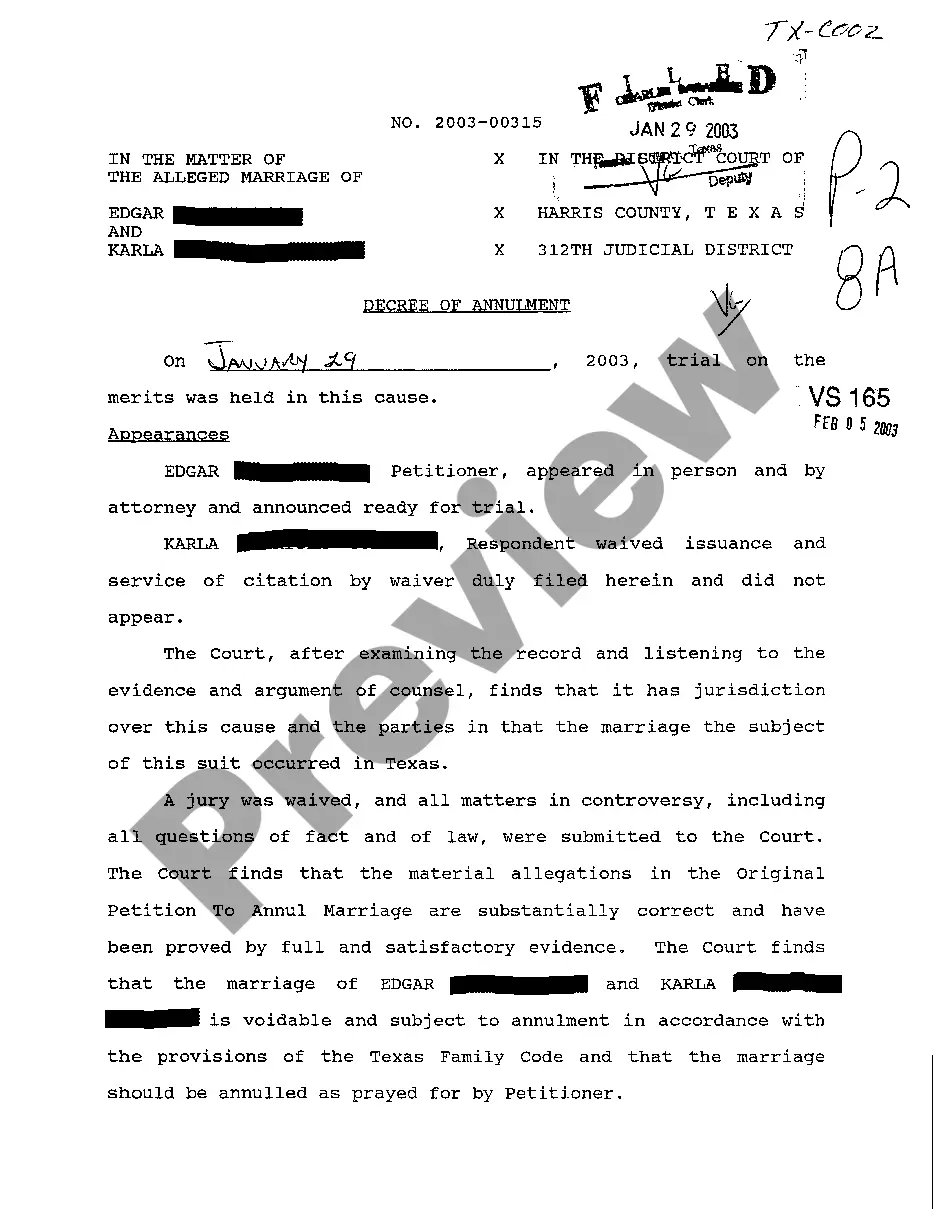

- Ensure you have selected the correct form for your city/county. Click the Preview button to review the form's content.

- Examine the form summary to confirm that you have selected the right form.

- If the form does not meet your requirements, utilize the Search option at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking on the Buy now button. Then, choose the payment plan you prefer and provide your information to register for an account.

- Proceed with the transaction. Use your credit card or PayPal account to complete the payment.

- Select the format and download the form to your device.

- Make modifications. Fill out, alter, print, and sign the downloaded South Dakota Non-Exclusive Online Affiliate Program Agreement.

Form popularity

FAQ

Yes, making $100 a day with affiliate marketing is achievable, but it requires dedication and strategic planning. By utilizing a South Dakota Non-Exclusive Online Affiliate Program Agreement, you can structure your partnerships effectively, potentially increasing your revenue. Focus on building a targeted audience, selecting quality products, and employing smart marketing techniques to maximize your earnings over time.

In South Dakota, you generally do not need a specific license to engage in affiliate marketing. However, it's crucial to follow all local business regulations and tax laws. By entering into a South Dakota Non-Exclusive Online Affiliate Program Agreement, you can ensure that you comply with relevant guidelines while operating your affiliate business. This agreement provides a framework to protect you and your partners, creating a secure environment for your marketing efforts.

Writing a simple contract between two people involves clearly marking the contract's intent and each person's obligations. Provide details on what each individual will deliver, along with any timelines and payment information. A solid example to consider is the South Dakota Non-Exclusive Online Affiliate Program Agreement, which can guide you in creating a straightforward yet effective contract.

To write a simple contract agreement, start with the names of the parties and a brief purpose of the contract. Clearly list the responsibilities of each party and any payment or exchange terms in straightforward language. A helpful resource for structuring your agreement is the South Dakota Non-Exclusive Online Affiliate Program Agreement, which simplifies the essentials.

To write a formal agreement between two parties, use a structured format that includes a title, introductory statement, and precise terms of the agreement. Be sure to define key terms and include details regarding payment, timelines, and responsibilities. Utilizing resources like the South Dakota Non-Exclusive Online Affiliate Program Agreement can provide guidance on creating a formal, effective document.

To write a contract agreement between two parties, start by clearly identifying each party involved. Include the specific terms of the agreement, such as obligations, payment details, and timelines. Using a template like the South Dakota Non-Exclusive Online Affiliate Program Agreement can help streamline this process and ensure you cover all essential components.

To determine if you have nexus in a state, evaluate your business activities, including physical presence, employees, or sales made through affiliates. If you sell products or services directly to consumers in South Dakota or have affiliates promoting your business there, nexus likely exists. For clarity on how this impacts agreements like the South Dakota Non-Exclusive Online Affiliate Program Agreement, consulting experts on platforms like uslegalforms is advisable.

An affiliate nexus is the connection established by an affiliate marketing relationship that may create tax obligations in a state. If an affiliate earns commissions from sales generated through their efforts in South Dakota, nexus is established. This relationship highlights the importance of knowing your obligations under the South Dakota Non-Exclusive Online Affiliate Program Agreement.

Nexus identifies the relationship between a business and a state that can trigger tax collecting responsibilities. When a business has nexus, it may need to register for state taxes, file reports, and comply with regulations. This concept is vital for affiliates operating under agreements like the South Dakota Non-Exclusive Online Affiliate Program Agreement.

Click-through nexus occurs when a business has connections to a state through online links or referrals, resulting in sales. If an affiliate marketer in South Dakota sends customers to your site and you earn revenue, you may establish click-through nexus. Understanding this is important when engaging in the South Dakota Non-Exclusive Online Affiliate Program Agreement.