South Dakota Bill of Sale of Goods or Personal Property

Description

A bill of sale is a document that transfers ownership of an asset from a seller to the buyer. It can also serve as a basic agreement for sale of goods, and a sales receipt.

How to fill out Bill Of Sale Of Goods Or Personal Property?

If you need to thoroughly download or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Use the site's straightforward and convenient search function to find the documents you require.

An assortment of templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click on the Buy now option. Select the payment plan you prefer and enter your information to create an account.

Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to locate the South Dakota Bill of Sale of Goods or Personal Property in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and select the Download option to obtain the South Dakota Bill of Sale of Goods or Personal Property.

- You can also access forms you previously downloaded from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Confirm you have chosen the form for the correct city/state.

- Step 2. Utilize the Review process to examine the form's content. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

Yes, a handwritten bill of sale will work in South Dakota, as long as it includes the necessary components. A South Dakota Bill of Sale of Goods or Personal Property, even if handwritten, should accurately detail the item's description, the transaction date, and signatures. This document can effectively protect the interests of both parties during the sale.

Certainly, you can do a handwritten bill of sale in South Dakota. A handwritten South Dakota Bill of Sale of Goods or Personal Property is a straightforward way to document the sale. Just make sure you provide all relevant information and that both parties sign the document for it to hold value.

Yes, you can handwrite a bill of sale in South Dakota. A handwritten South Dakota Bill of Sale of Goods or Personal Property is legal and can serve its purpose effectively. Just ensure that it includes all necessary details, such as the item description, transaction date, and signatures from both parties to validate it.

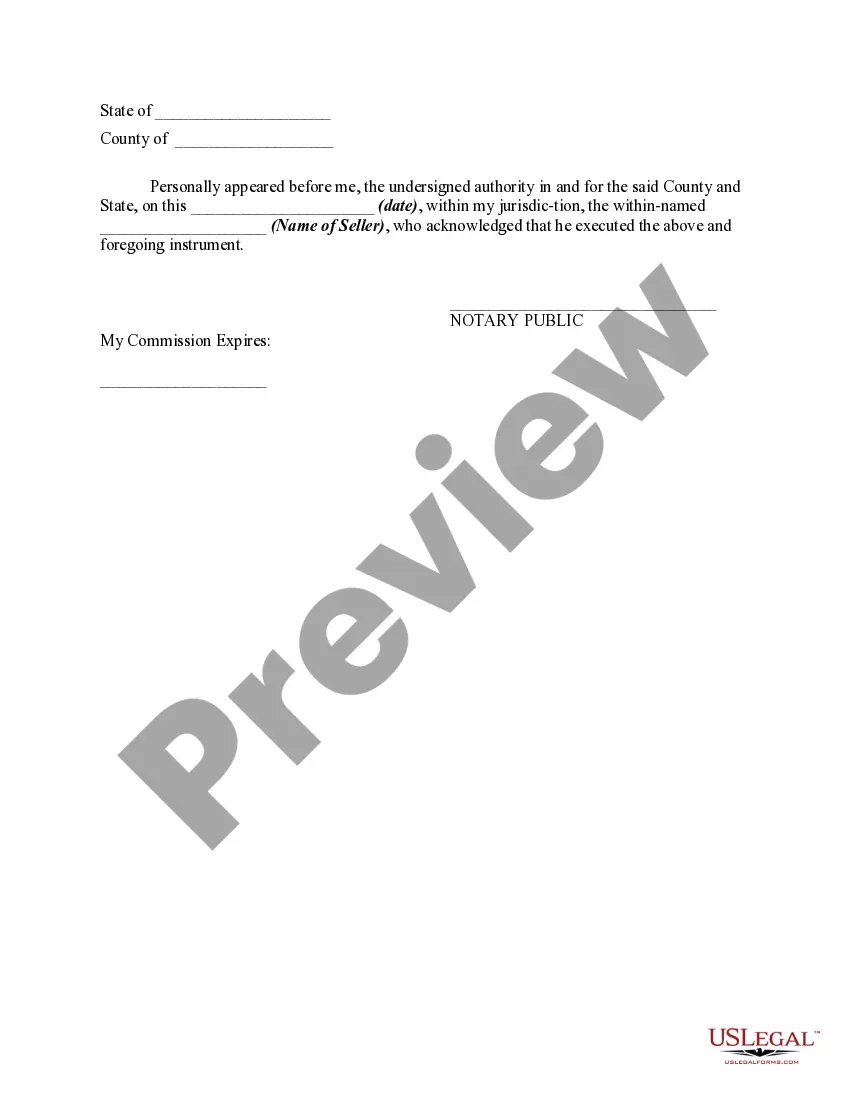

In South Dakota, a bill of sale does not need to be notarized to be considered valid. However, having a South Dakota Bill of Sale of Goods or Personal Property notarized can add an extra layer of security and credibility to the document. This step might be beneficial for high-value items or when the parties involved want additional assurance.

Yes, a bill of sale is legal in South Dakota even if it is not notarized. However, having the document notarized can provide extra protection in disputes. Utilizing a South Dakota Bill of Sale of Goods or Personal Property can help solidify the transaction without needing notarization.

In South Dakota, a bill of sale does not need to be notarized to be considered legal. However, having it notarized can add an additional layer of security for both the buyer and seller. If you're using a South Dakota Bill of Sale of Goods or Personal Property, it can help clarify the transaction details, but notarization isn't a requirement.

Yes, you can write a bill of sale by hand in South Dakota as long as it contains all necessary details. Include the names of both parties, a description of the item being sold, and any terms of the sale. Having a South Dakota Bill of Sale of Goods or Personal Property can help you ensure that nothing is overlooked in this informal process.

When selling a car in South Dakota, you need to fill out the title with accurate information. Start by entering the buyer's name, address, and the sale date. Sign the title in the seller's section and make sure to provide the odometer reading at the time of sale. Using a South Dakota Bill of Sale of Goods or Personal Property as a supplement can provide additional protection in the transaction.

Yes, you may need to report the sale of personal property, especially if it involves significant amounts or taxable items. In South Dakota, transactions involving a South Dakota Bill of Sale of Goods or Personal Property could require reporting for tax purposes. It's wise to keep accurate records of your sales and consult tax regulations or a professional if you’re unsure about your obligations.

While a receipt can provide evidence of a transaction, it typically lacks the comprehensive details needed in a bill of sale. A South Dakota Bill of Sale of Goods or Personal Property ensures all essential elements are included, making ownership transfer clearer and more enforceable. It is always advisable to use a formal bill of sale for significant transactions instead of relying solely on a receipt.