This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

South Dakota Agreement to Incorporate to Erect Commercial Builder with Builder and Marketing Agent to become Shareholders in the Corporation and the Building to be Transferred to New Corporation

Description

How to fill out Agreement To Incorporate To Erect Commercial Builder With Builder And Marketing Agent To Become Shareholders In The Corporation And The Building To Be Transferred To New Corporation?

It is feasible to invest multiple hours on the internet searching for the valid document template that meets the federal and state requirements you desire.

US Legal Forms offers a vast array of valid forms that are reviewed by experts.

You can download or print the South Dakota Agreement to Incorporate to Erect Commercial Builder with Builder and Marketing Agent to become Shareholders in the Corporation and the Building to be Transferred to New Corporation through the services.

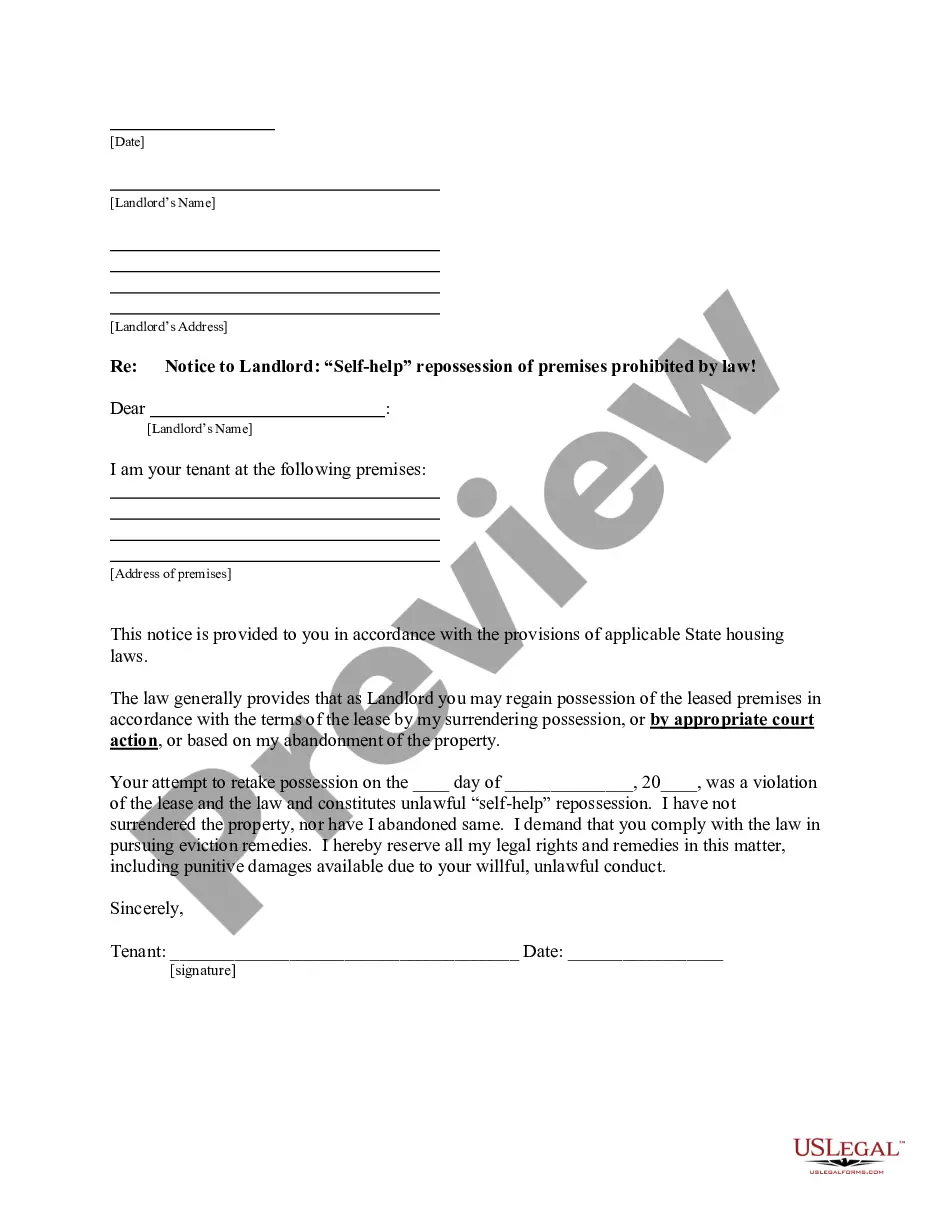

If available, use the Review button to examine the document template as well.

- If you already have a US Legal Forms account, you can sign in and click on the Download button.

- Then, you can complete, modify, print, or sign the South Dakota Agreement to Incorporate to Erect Commercial Builder with Builder and Marketing Agent to become Shareholders in the Corporation and the Building to be Transferred to New Corporation.

- Every valid document template you purchase is yours to keep permanently.

- To obtain an additional copy of any purchased form, go to the My documents tab and click on the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have chosen the correct document template for the county/region you select.

- Review the form summary to confirm you have made the right selection.

Form popularity

FAQ

known example of a corporation is Tesla, Inc., which designs and manufactures electric vehicles and energy storage solutions. Corporations like Tesla demonstrate how large companies operate and reinvest profits back into innovation. Using the South Dakota Agreement to Incorporate to Erect Commercial Builder with Builder and Marketing Agent to become Shareholders in the Corporation and the Building to be Transferred to New Corporation can help you emulate this success on a smaller scale as you build your business.

Any legal entity formed to conduct business can be deemed a corporation, such as multinational companies like Apple or established local businesses. These entities enjoy benefits like limited liability, which means shareholders are not personally liable for corporate debts. By creating an arrangement under the South Dakota Agreement to Incorporate to Erect Commercial Builder with Builder and Marketing Agent to become Shareholders in the Corporation and the Building to be Transferred to New Corporation, you can establish your own corporation and leverage these benefits for growth.

A corporation can take various forms, including C-corporations, S-corporations, and limited liability companies (LLCs). Each of these structures allows for different tax treatments and shareholder arrangements. For instance, a C-corporation can have unlimited shareholders, and it pays taxes on its profits independently. When considering options like the South Dakota Agreement to Incorporate to Erect Commercial Builder with Builder and Marketing Agent to become Shareholders in the Corporation and the Building to be Transferred to New Corporation, potential business owners should understand which corporation type best suits their needs.

An LLC in South Dakota offers numerous advantages, including protection from personal liability and flexibility in management. This structure allows you to separate personal finances from business obligations, reducing your risk. With a South Dakota Agreement to Incorporate to Erect Commercial Builder with Builder and Marketing Agent to become Shareholders in the Corporation and the Building to be Transferred to New Corporation, you can take full advantage of these protections while promoting growth and efficiency in your business.

South Dakota does not impose a corporate income tax on LLCs, making it a favorable state for business owners. This tax structure allows you to reinvest profits back into your business. When you create a South Dakota Agreement to Incorporate to Erect Commercial Builder with Builder and Marketing Agent to become Shareholders in the Corporation and the Building to be Transferred to New Corporation, you can maximize your financial freedom while complying with state laws.

Yes, South Dakota is often recognized as an excellent state for starting a business due to its business-friendly environment and policies. The lack of a corporate income tax is a major attraction, helping entrepreneurs retain more profits. By crafting a South Dakota Agreement to Incorporate to Erect Commercial Builder with Builder and Marketing Agent to become Shareholders in the Corporation and the Building to be Transferred to New Corporation, you can take advantage of the state's welcoming approach to business.

Yes, South Dakota requires all LLCs to designate a registered agent. This ensures that your business receives important legal documents and correspondence. When you implement a South Dakota Agreement to Incorporate to Erect Commercial Builder with Builder and Marketing Agent to become Shareholders in the Corporation and the Building to be Transferred to New Corporation, having a reliable registered agent streamlines communications and keeps your business compliant with state laws.

While many states offer advantages for LLC formation, South Dakota stands out due to its low fees and favorable business climate. By utilizing a South Dakota Agreement to Incorporate to Erect Commercial Builder with Builder and Marketing Agent to become Shareholders in the Corporation and the Building to be Transferred to New Corporation, business owners can leverage these benefits effectively. Overall, South Dakota balances ease of operation with strong legal protections, making it a prime choice.

A South Dakota LLC provides significant benefits for business owners, including limited liability protection and flexible management structures. Establishing a South Dakota Agreement to Incorporate to Erect Commercial Builder with Builder and Marketing Agent to become Shareholders in the Corporation and the Building to be Transferred to New Corporation can enhance your business credibility. Additionally, LLCs in South Dakota enjoy favorable tax treatment, making them an appealing choice for entrepreneurs.

Yes, if you plan to operate your business within South Dakota, registration is a crucial step. By establishing your South Dakota Agreement to Incorporate to Erect Commercial Builder with Builder and Marketing Agent to become Shareholders in the Corporation and the Building to be Transferred to New Corporation, you will meet state regulations and gain legal protection. Using platforms like uslegalforms can simplify this process and help you navigate the necessary paperwork.