South Dakota Assignment of Domain Name in Conjunction with Asset Purchase Agreement

Description

How to fill out Assignment Of Domain Name In Conjunction With Asset Purchase Agreement?

Are you presently in a circumstance where you require documents for either business or particular purposes nearly every day.

There are numerous authorized form templates accessible online, but locating ones you can rely on isn't straightforward.

US Legal Forms provides a vast array of form templates, such as the South Dakota Assignment of Domain Name in Conjunction with Asset Purchase Agreement, designed to comply with federal and state regulations.

If you find the suitable form, click Buy now.

Select the pricing option you prefer, fill out the required details to complete your order, and pay for your purchase using your PayPal or credit card. Choose a convenient file format and download your copy. You can access all the form templates you have purchased in the My documents section. You may obtain an additional copy of the South Dakota Assignment of Domain Name in Conjunction with Asset Purchase Agreement anytime, if needed. Simply click on the desired form to download or print the document template. Use US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors. The service provides properly crafted legal document templates that can be utilized for various purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the South Dakota Assignment of Domain Name in Conjunction with Asset Purchase Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for your specific city/region.

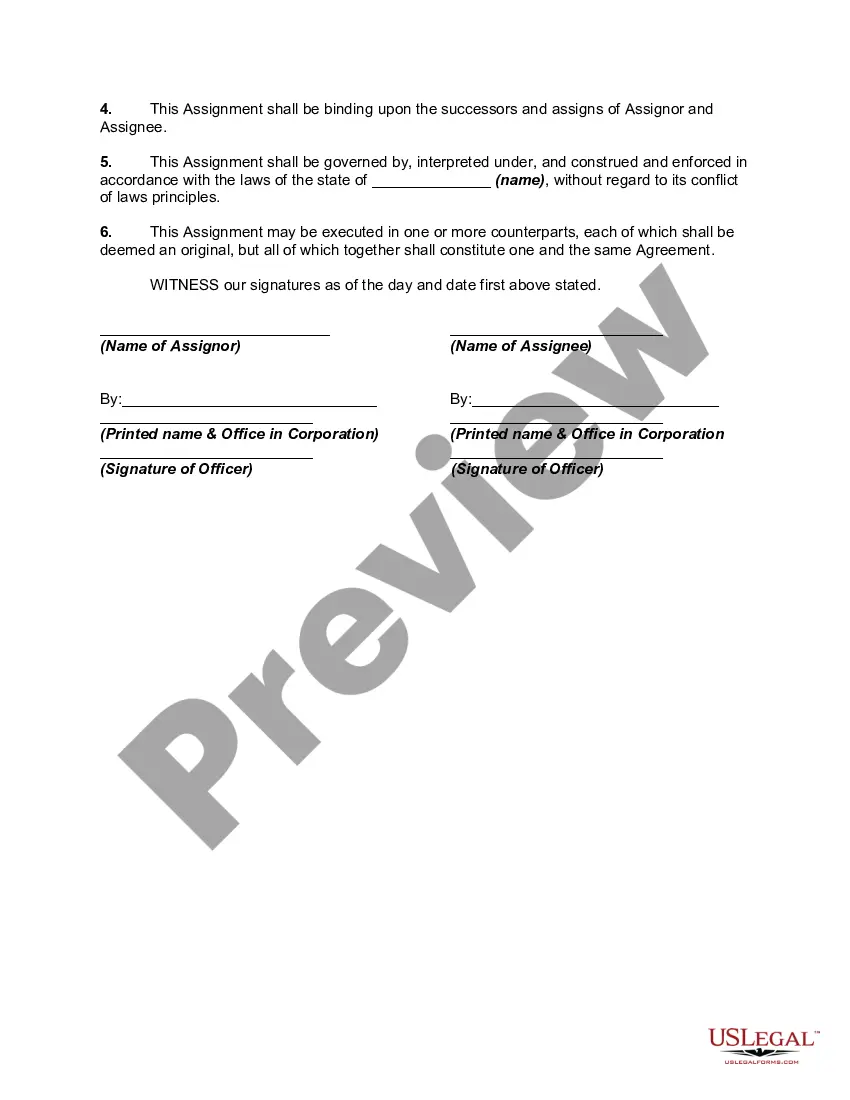

- Use the Preview button to review the form.

- Check the description to verify that you have selected the correct form.

- If the form isn’t what you’re looking for, utilize the Research section to find the form that meets your needs and specifications.

Form popularity

FAQ

Parts of an Asset Purchase AgreementRecitals. The opening paragraph of an asset purchase agreement includes the buyer and seller's name and address as well as the date of signing.Definitions.Purchase Price and Allocation.Closing Terms.Warranties.Covenants.Indemnification.Governance.More items...

Any change in control of Party X resulting from a merger, consolidation, stock transfer or asset sale shall be deemed an assignment or transfer for purposes of this Agreement that requires Party Y's prior written consent.

An asset purchase involves just the assets of a company. In either format, determining what is being acquired is critical. This article focuses on some of the important categories of assets to consider in a business purchase: real estate, personal property, and intellectual property.

A domain name assignment is the transfer of an owner's property rights in a given domain name or names. Such transfers may occur on their own or as parts of larger asset sales or purchases. Domain name assignments both provide records of ownership and transfer and protect the rights of all parties.

In an asset purchase transaction, the vendor is the company that owns the assets. The vendor sells some or all of its assets to the purchaser resulting in a transfer of such assets, including those desired contracts to which the company is a party to. Such transfer of the contracts will be done by way of an assignment.

In an asset purchase, the buyer will only buy certain assets of the seller's company. The seller will continue to own the assets that were not included in the purchase agreement with the buyer. The transfer of ownership of certain assets may need to be confirmed with filings, such as titles to transfer real estate.

Provisions of an APA may include payment of purchase price, monthly installments, liens and encumbrances on the assets, condition precedent for the closing, etc. An APA differs from a stock purchase agreement (SPA) under which company shares, title to assets, and title to liabilities are also sold.

The asset purchase agreement is often drafted up towards the end of the negotiation stage, so that the parties can have a final record of their agreement. The document essentially operates as a contract, creating legally binding duties on each of the parties involved.

Voting Rights and OwnershipUnlike an asset purchase, where the buyer simply buys the assets of the company, an equity purchaser actually buys the company itself, which can be beneficial if the company is performing well or has additional value as a going concern.