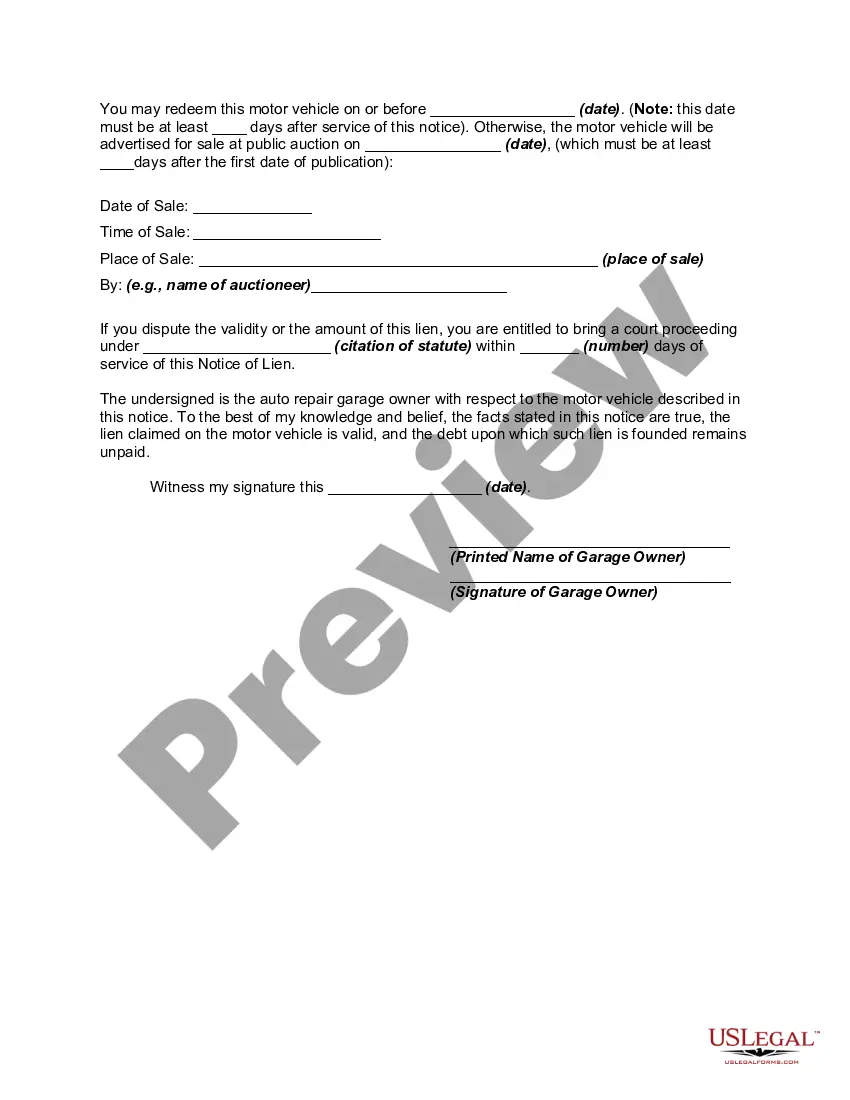

This lien is a mechanic's lien to secure payment for work and materials in repairing an automobile or other motor vehicle. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

South Dakota Notice of Lien by Owner of Auto or Car Repair Garage and Notice of Sale

Description

How to fill out Notice Of Lien By Owner Of Auto Or Car Repair Garage And Notice Of Sale?

Discovering the right legitimate record template could be a have difficulties. Obviously, there are plenty of themes available on the Internet, but how can you get the legitimate develop you will need? Make use of the US Legal Forms web site. The support provides 1000s of themes, like the South Dakota Notice of Lien by Owner of Auto or Car Repair Garage and Notice of Sale, that can be used for business and personal demands. All of the varieties are examined by experts and meet up with federal and state specifications.

In case you are previously listed, log in to your account and then click the Down load button to have the South Dakota Notice of Lien by Owner of Auto or Car Repair Garage and Notice of Sale. Utilize your account to check throughout the legitimate varieties you possess bought in the past. Proceed to the My Forms tab of your account and have yet another version in the record you will need.

In case you are a whole new consumer of US Legal Forms, allow me to share easy recommendations that you should comply with:

- Very first, make certain you have selected the right develop for your metropolis/area. You can look through the form using the Review button and read the form outline to make certain this is basically the best for you.

- When the develop will not meet up with your requirements, utilize the Seach area to find the appropriate develop.

- When you are certain the form would work, click on the Buy now button to have the develop.

- Pick the rates prepare you would like and enter the needed info. Design your account and pay money for your order utilizing your PayPal account or Visa or Mastercard.

- Opt for the submit format and download the legitimate record template to your device.

- Full, edit and produce and sign the attained South Dakota Notice of Lien by Owner of Auto or Car Repair Garage and Notice of Sale.

US Legal Forms is the largest collection of legitimate varieties that you can discover various record themes. Make use of the company to download expertly-made files that comply with express specifications.

Form popularity

FAQ

If you want to transfer ownership of a boat, car, or horse in South Dakota, you need a bill of sale.

How to file a mechanics lien in South Dakota Prepare your South Dakota mechanics lien form. ... Serve a copy of the South Dakota mechanics lien on the owner. ... Record the South Dakota mechanics lien with the Register of Deeds. ... Enforce/release the South Dakota mechanics lien.

Hear this out loud PauseThe state's tax system is among the most retiree-friendly in the country. It has no income tax, relatively low sales taxes, high property taxes and no estate or inheritance taxes.

South Dakota counties can choose to sell or keep tax liens on delinquent properties. Three years after a tax lien certificate is sold, the lienholder may then apply for a tax deed, which grants absolute title to the lienholder. The property owner has the right to redeem until the tax deed is issued.

About South Dakota Notice of Intent to Lien Form No one wants to be forced to file a mechanics lien, and this document gives all of the parties involved one final chance to take care of the payment issues on a project. This form advises the party that a lien will be filed if payment is not received within 10 days.

Hear this out loud PauseYou must be 65 years old or older OR disabled (as defined by the Social Security Act). You must own the property. Un-remarried widow/widowers of persons previously qualified may still qualify. Income limits apply.

Hear this out loud PauseOverview. Minnesota Tax Lien Judgment Certificates are no longer sold. The Minnesota Legislature abolished the certificate sale process in 1974 as found in Minnesota Statutes, Chapter 280.001.

Here's how the process of tax lien investing works. The Local Municipality Creates A Tax Lien Certificate. ... The Tax Lien Certificate Is Put Up For Auction. ... Investors Bid On The Tax Lien Certificate. ... Winning Investor Takes Control Of The Tax Lien Certificate. ... Investor Pays The Amount Of Taxes Owed. ... Repayment Or Foreclosure.