South Dakota Pool Services Agreement - Self-Employed

Description

How to fill out Pool Services Agreement - Self-Employed?

If you require to complete, acquire, or create legal document templates, utilize US Legal Forms, the most extensive selection of legal forms available online. Take advantage of the site's straightforward and user-friendly search feature to locate the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to find the South Dakota Pool Services Agreement - Self-Employed with just a few clicks.

If you are already a US Legal Forms customer, sign in to your account and click the Acquire button to obtain the South Dakota Pool Services Agreement - Self-Employed. You can also access forms you previously saved from the My documents section of your account.

Each legal document template you obtain is yours indefinitely. You will have access to every form you saved within your account. Click on the My documents section and choose a form to print or download again.

Be proactive and download, and print the South Dakota Pool Services Agreement - Self-Employed with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- Step 1. Ensure you have chosen the form for the relevant city/state.

- Step 2. Utilize the Review option to examine the form's content. Don’t forget to read the summary.

- Step 3. If you are dissatisfied with the document, use the Search field at the top of the screen to find other forms in the legal document template.

- Step 4. After locating the form you need, select the Buy now button. Choose the pricing plan you prefer and provide your details to register for an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Choose the format of the legal document and download it to your system.

- Step 7. Complete, edit and print or sign the South Dakota Pool Services Agreement - Self-Employed.

Form popularity

FAQ

The 2-year contractor rule refers to the IRS guidelines regarding the classification of workers as independent contractors. It suggests that a worker must meet certain criteria over a 2-year period to maintain independent status. If you're using a South Dakota Pool Services Agreement - Self-Employed, you can help outline the terms that clarify this relationship.

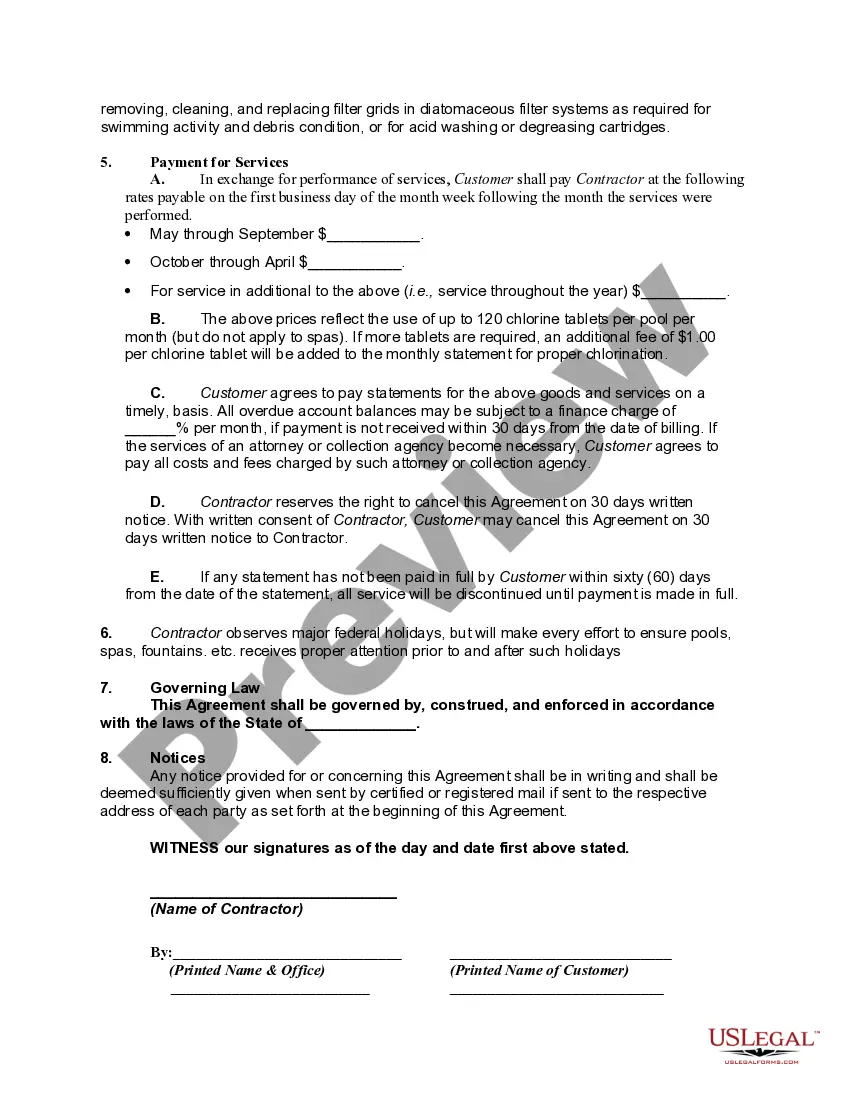

A contractor agreement should include critical elements like the scope of work, payment structure, and timelines for milestone completion. You may also want to add confidentiality and non-compete clauses. A template like the South Dakota Pool Services Agreement - Self-Employed can help ensure that you cover all necessary aspects.

To write a simple contract agreement, identify the key points: parties involved, services offered, payment methods, and duration of work. Use straightforward language to avoid misunderstandings. For pool service professionals, customizing a South Dakota Pool Services Agreement - Self-Employed can simplify this process.

Filling out an independent contractor agreement requires thorough attention to detail. Start by entering the names of both parties, the specific services to be rendered, and the agreed payment terms. A South Dakota Pool Services Agreement - Self-Employed can guide you through the required sections, ensuring you don’t miss anything important.

Writing an independent contractor agreement involves detailing all the essential elements like scope of work, payment terms, and confidentiality clauses. Be sure to define roles clearly to avoid any confusion later. The South Dakota Pool Services Agreement - Self-Employed can provide a useful framework for your own agreement.

An independent contractor agreement typically includes sections for the services provided, payment terms, and project timelines. For specific fields, such as pool services, the agreement might also include safety regulations and maintenance responsibilities. Utilizing a South Dakota Pool Services Agreement - Self-Employed template can simplify this process.

To become a self-employed independent contractor, you first need to decide on the type of services you want to offer. Next, register your business, often as a sole proprietorship or LLC, depending on your preferences. Additionally, using a South Dakota Pool Services Agreement - Self-Employed can help outline your work conditions and protect your interests.

Receiving a 1099 form indicates that you earned income as an independent contractor, which means you are considered self-employed. It is crucial to maintain proper records of your earnings and expenses for tax reporting purposes. A South Dakota Pool Services Agreement - Self-Employed can support you in clarifying your work arrangements and ensuring compliance with tax regulations.

Yes, independent contractors file taxes as self-employed individuals. You report your income using a specific form designed for self-employment, usually a Schedule C. Having a South Dakota Pool Services Agreement - Self-Employed in place helps you keep track of your earnings and expenses, essential for accurate reporting.

Yes, construction services are generally subject to sales tax in South Dakota. If you're providing these services as an independent contractor, it is essential to be aware of your tax obligations. Incorporating a South Dakota Pool Services Agreement - Self-Employed can help establish your services legally and clarify any tax responsibilities.