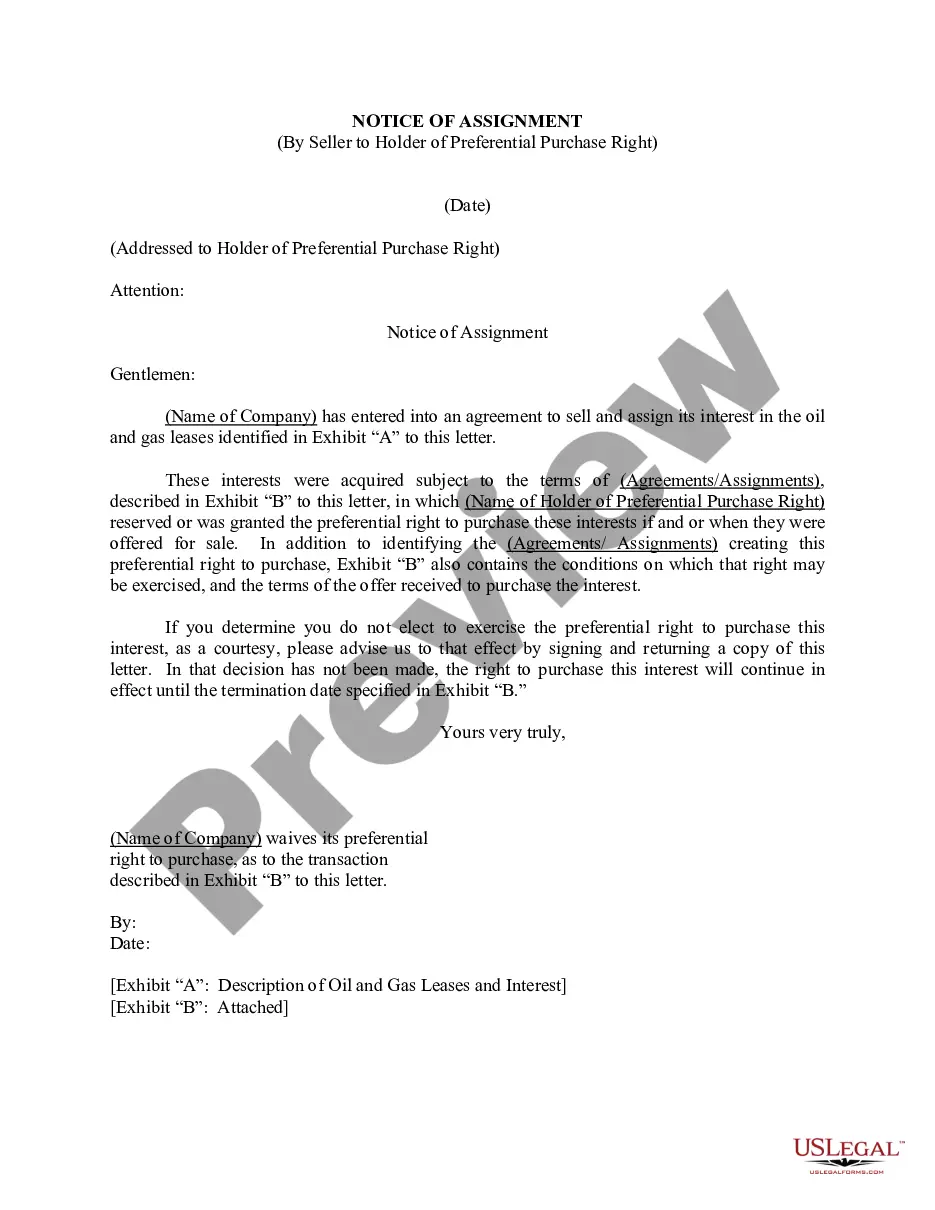

The Truth-in-Lending Act (TILA) is part of the Federal Consumer Credit Protection Act. The purpose of the TILA is to make full disclosure to debtors of what they are being charged for the credit they are receiving. TILA applies only to consumer credit transactions. Consumer credit is credit for personal or household use and not commercial use. This form was designed to cover an situation where the Seller is not a creditor as defined by the TILA.

South Dakota Installment Sale not covered by Federal Consumer Credit Protection Act with Security Agreement

Description

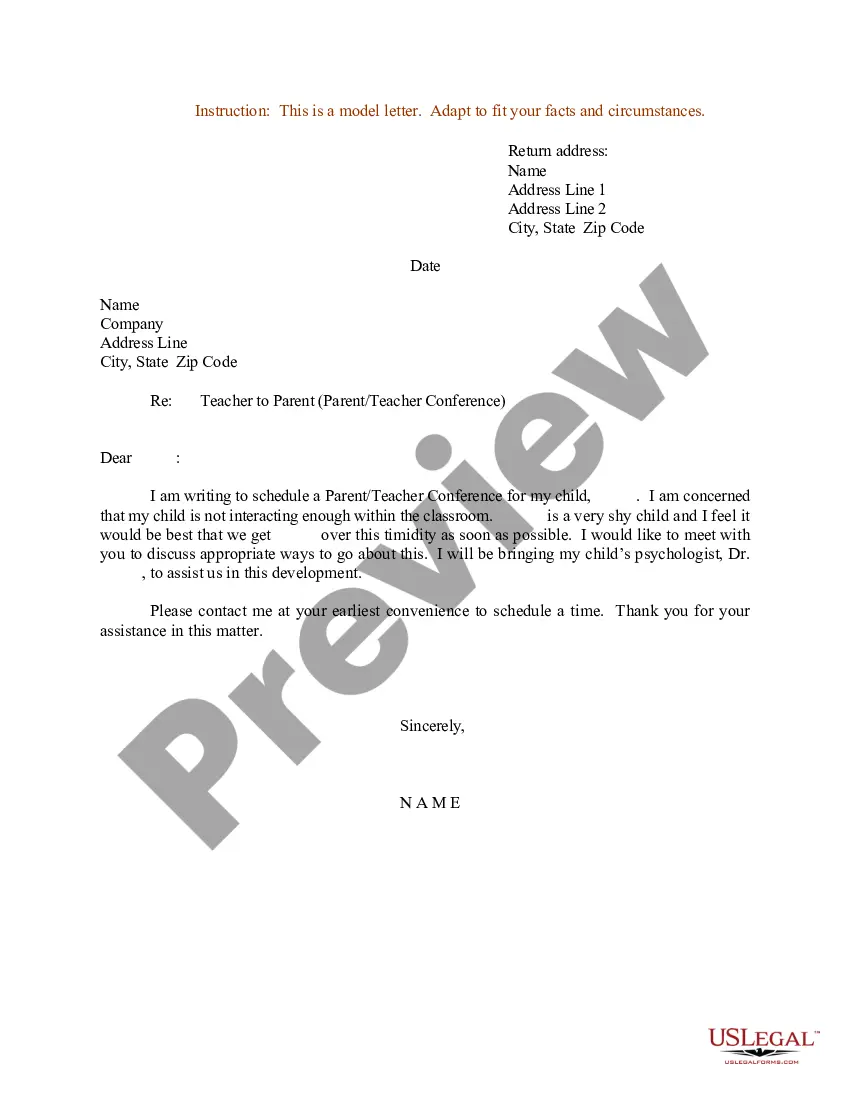

How to fill out Installment Sale Not Covered By Federal Consumer Credit Protection Act With Security Agreement?

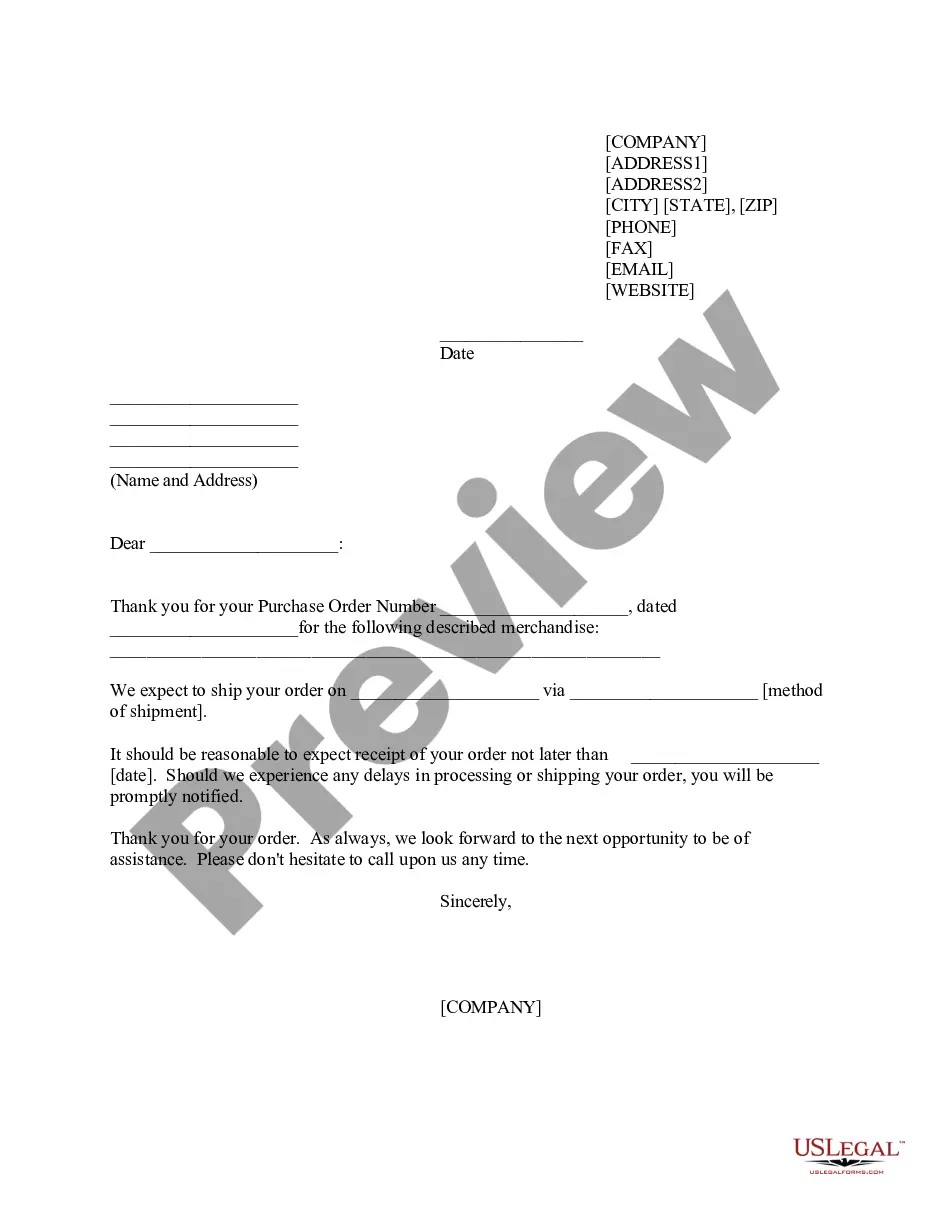

US Legal Forms - one of the most substantial collections of legal documents in the United States - offers a vast selection of legal document templates that you can download or print.

By utilizing the website, you can find thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can obtain the latest versions of forms such as the South Dakota Installment Sale not governed by the Federal Consumer Credit Protection Act with Security Agreement in just moments.

If you already have a subscription, Log In and download the South Dakota Installment Sale not governed by the Federal Consumer Credit Protection Act with Security Agreement from your US Legal Forms library. The Download button is available on every form you explore. You can access all previously downloaded forms within the My documents tab of your account.

Make changes. Fill out, modify, print, and sign the downloaded South Dakota Installment Sale not covered by the Federal Consumer Credit Protection Act with Security Agreement.

Each template added to your account has no expiration date and belongs to you permanently. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you desire.

- If you are using US Legal Forms for the first time, here are simple steps to help you begin.

- Verify you have chosen the correct form for your area/county. Click the Preview button to review the form's details.

- Examine the form information to confirm you have selected the right document.

- If the form does not meet your needs, utilize the Lookup section at the top of the screen to find one that suits you.

- Once satisfied with the form, validate your selection by clicking the Purchase now button. Then select your preferred pricing plan and provide your details to create an account.

- Complete the transaction. Use your Visa, Mastercard, or PayPal account to finalize the payment.

- Choose the format and download the form onto your device.

Form popularity

FAQ

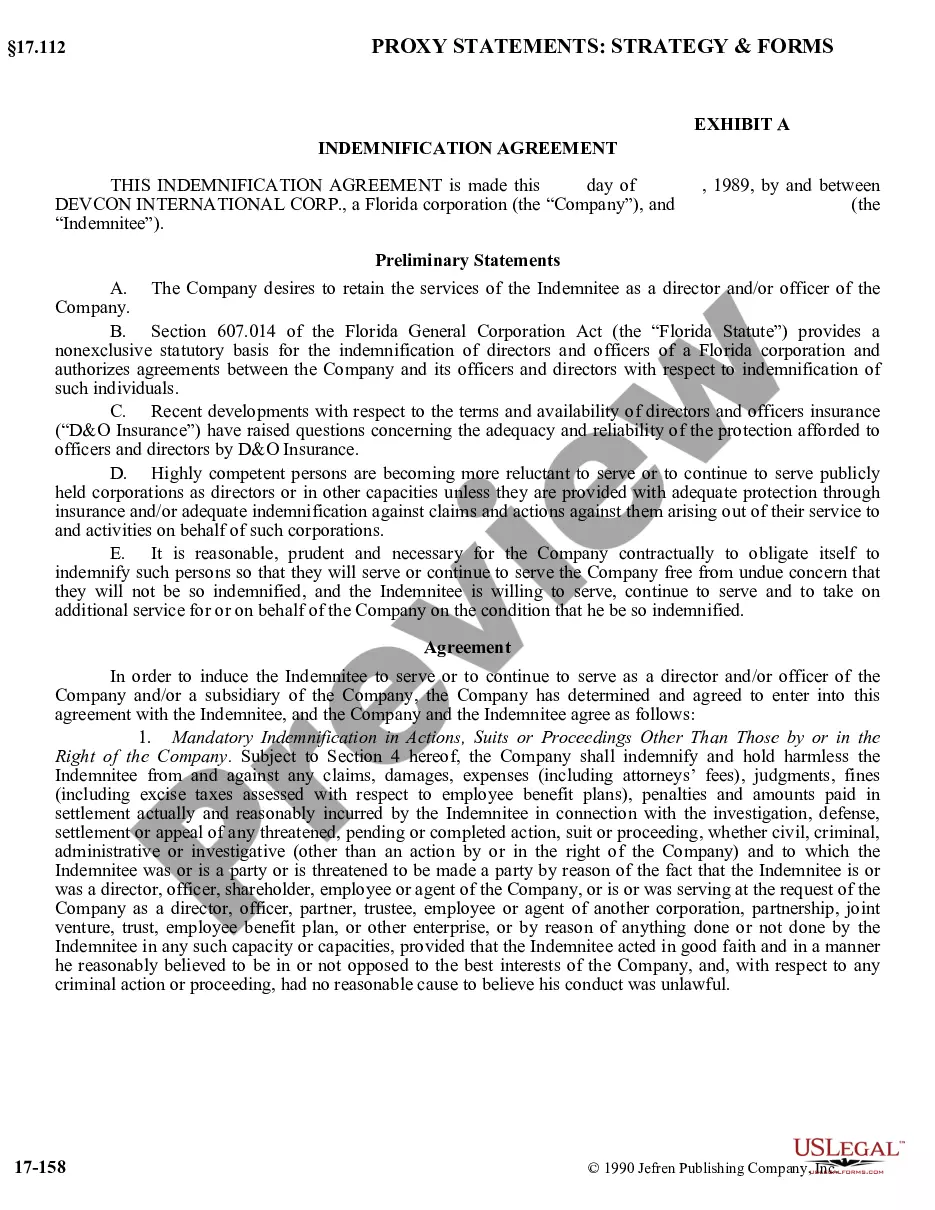

In South Dakota, debts usually become uncollectible after six years, as prescribed by the statute of limitations. During this period, creditors can act to recover outstanding debts. Understanding this timeline is vital for effective financial planning. If you’re navigating issues related to the South Dakota Installment Sale not covered by Federal Consumer Credit Protection Act with Security Agreement, utilizing platforms like uslegalforms can provide necessary legal assistance and clarity.

Generally, a 10-year-old debt in South Dakota is likely considered uncollectible, as it exceeds the six-year statute of limitations for most debts. Creditors typically cannot initiate legal proceedings for debts that are past this period. However, a 10-year old debt might still impact your credit report. Awareness of the South Dakota Installment Sale not covered by Federal Consumer Credit Protection Act with Security Agreement is crucial in navigating older debts.

A debt typically becomes uncollectible in South Dakota after the statute of limitations expires, which is usually six years for most debts. At this point, a creditor can no longer take legal action to recoup the amount owed. Knowing this information is essential for both creditors and debtors alike. The South Dakota Installment Sale not covered by Federal Consumer Credit Protection Act with Security Agreement can further assist in understanding these limits.

In South Dakota, the statute of limitations for collecting most debts is generally six years. This means that creditors can pursue collections for this length of time. It’s important to recognize that certain types of debt may have different timeframes. With South Dakota Installment Sale not covered by Federal Consumer Credit Protection Act with Security Agreement, understanding these timelines helps you plan your financial strategies.

The Unfair Claims Practices Act in South Dakota protects consumers by regulating how insurance companies handle claims. This law ensures that insurers treat policyholders fairly, providing timeliness and transparency in their claims processes. Specifically, regarding financial agreements like the South Dakota Installment Sale not covered by Federal Consumer Credit Protection Act with Security Agreement, understanding this act helps consumers recognize their rights and the standards insurers must follow. If you need further clarification on your rights or any specific claims, UsLegalForms offers resources tailored to help navigate these situations effectively.

Law 22 42 6 in South Dakota relates to various offenses against property, outlining specific actions that constitute crimes. This statute provides a foundation for understanding property rights and responsibilities. If you're exploring a South Dakota installment sale not covered by Federal Consumer Credit Protection Act with Security Agreement, having knowledge of such laws can provide greater confidence in your transactions. For comprehensive information about legal agreements, consider using the uslegalforms platform.

Statute 22 42 5.1 in South Dakota focuses on certain criminal offenses and the penalties associated with them. It sets forth definitions and consequences for actions that may affect public safety. For individuals considering a South Dakota installment sale not covered by the Federal Consumer Credit Protection Act with Security Agreement, being aware of these legal implications can aid in making informed decisions.

Codified law 26 8a 8 in South Dakota pertains to the legal framework governing custody arrangements. It provides guidelines regarding the wellbeing of children in custody cases, ensuring their best interests are prioritized. When dealing with South Dakota installment sales not covered by federal regulations, having clarity on various legal statutes like this one can help you navigate the process effectively.

The 43 4 38 law in South Dakota addresses the regulations surrounding certain types of property transactions. This statute outlines specific circumstances under which an installment sale may occur, particularly in relation to real estate. Importantly, the law clarifies that such installment sales are not covered by the Federal Consumer Credit Protection Act with Security Agreement. Understanding this law is crucial for those engaged in South Dakota installment sales.

Yes, South Dakota does have a right to cure law, which provides individuals an opportunity to correct contractual breaches before facing legal consequences. This law is especially beneficial when navigating agreements like South Dakota Installment Sale not covered by Federal Consumer Credit Protection Act with Security Agreement. Being informed about this law can assist parties in resolving issues amicably and efficiently.