South Dakota Sample Letter for Disputed Balance Notice

Description

How to fill out Sample Letter For Disputed Balance Notice?

Have you found yourself in a situation where you require documentation for both business or personal reasons almost every day.

There are many legal document templates accessible online, but finding ones you can trust isn’t easy.

US Legal Forms provides thousands of document templates, such as the South Dakota Sample Letter for Disputed Balance Notice, which are designed to comply with state and federal regulations.

Select a convenient format and download your copy.

Explore all the document templates you have purchased in the My documents menu. You can obtain an additional copy of the South Dakota Sample Letter for Disputed Balance Notice anytime, if needed. Just navigate to the required form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and prevent errors. The service provides professionally crafted legal document templates that can be used for various purposes. Create your account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the South Dakota Sample Letter for Disputed Balance Notice template.

- If you do not have an account and would like to start using US Legal Forms, follow these instructions.

- Locate the document you need and ensure it is for the correct city/county.

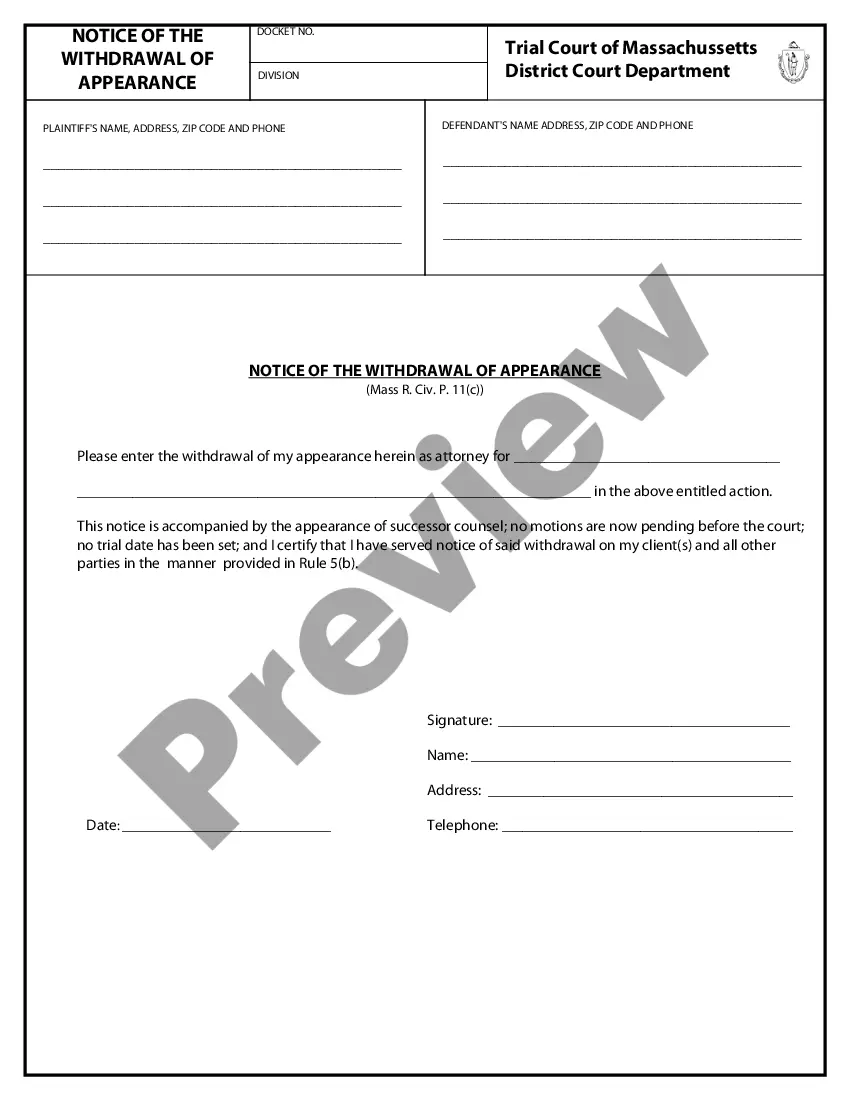

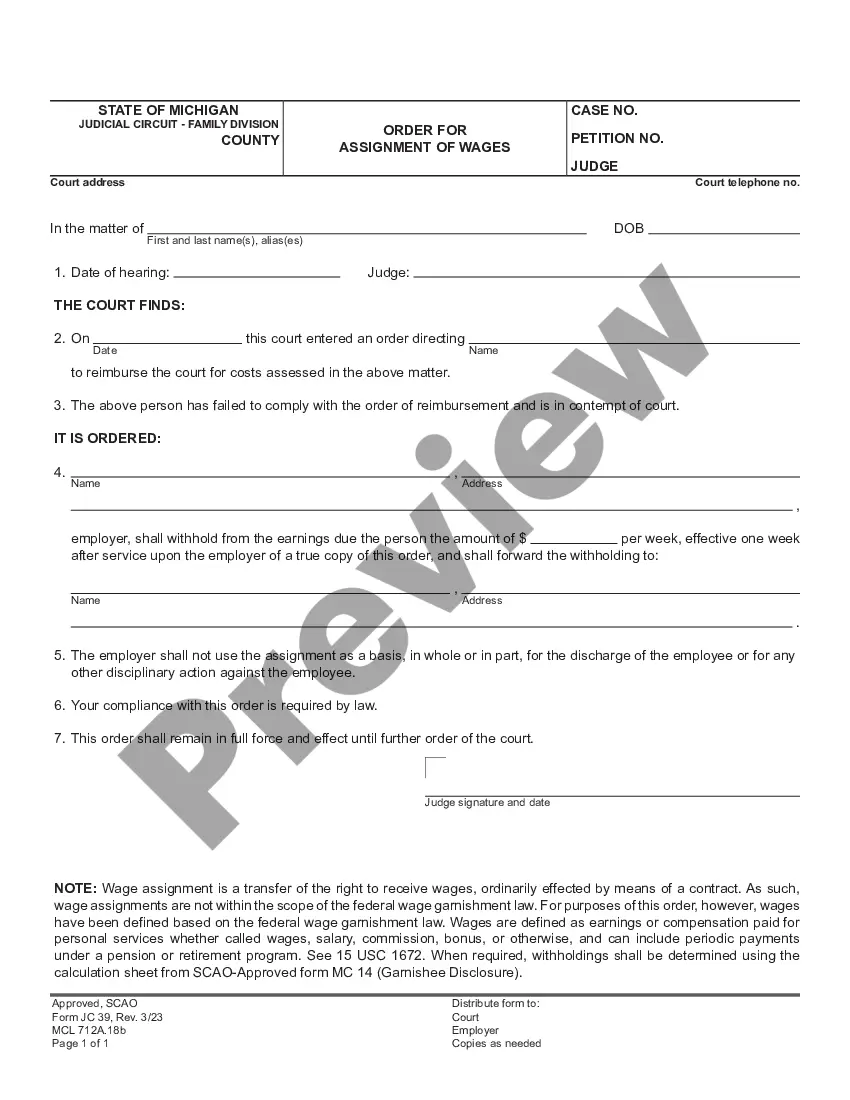

- Use the Review button to review the form.

- Examine the details to ensure you have selected the right document.

- If the document isn’t what you are looking for, utilize the Lookup area to find the form that suits your needs and requirements.

- Once you locate the correct document, click Purchase now.

- Choose the pricing plan you desire, fill in the necessary information to create your account, and complete the purchase using your PayPal or credit card.

Form popularity

FAQ

To write a letter of debt dispute, be sure to include your personal information as well as the creditor’s details. State the reason for your dispute clearly, providing any necessary documentation to back your claims. A South Dakota Sample Letter for Disputed Balance Notice can serve as a useful template, ensuring you include all relevant information for a successful dispute.

A good dispute letter is clear, concise, and factual. Start with your contact information, followed by a clear description of the dispute, including relevant account details. Consider utilizing a South Dakota Sample Letter for Disputed Balance Notice for a structured approach that covers all necessary points and maintains professionalism.

Writing a billing dispute letter involves stating the details of your account, the disputed amount, and the reasons for your dispute. Clearly document any errors and include any supporting information that backs your claim. Using a South Dakota Sample Letter for Disputed Balance Notice can help you create an effective letter that conveys your position clearly.

To dispute a billing issue, start by reviewing your bill carefully. Identify any discrepancies and note the specific charges that you believe are incorrect. A well-structured South Dakota Sample Letter for Disputed Balance Notice can guide you in articulating your concerns to the billing department effectively.

To dispute a bill in writing, you should first gather all relevant documents, including statements and receipts. Next, compose your letter clearly stating the dispute, the amount in question, and any supporting evidence. To make the process easier, you can use a South Dakota Sample Letter for Disputed Balance Notice to format your letter correctly.

When writing a letter to request proof of debt, be clear and concise. State your reasons for the request, include your account details, and ask for specific documentation to verify the debt. This letter is essential for your records, and you can refer to the South Dakota Sample Letter for Disputed Balance Notice for a helpful format.

A reasonable offer to settle a debt usually ranges from 30% to 70% of the total amount owed, depending on various factors like your financial situation and the creditor's policies. It is wise to start with a lower amount and negotiate upwards if necessary. The South Dakota Sample Letter for Disputed Balance Notice can help frame your offer professionally.

A sample letter for a settlement offer typically includes a clear statement of the debt, the amount you propose to settle, and any relevant circumstances regarding your financial situation. It’s important to be polite but firm, emphasizing your intent to resolve the matter. The South Dakota Sample Letter for Disputed Balance Notice can serve as an excellent reference.

In your complaint letter to a credit card company, clearly outline the issue you are experiencing, along with any relevant account details. Be specific about what you want from them, whether it be a resolution, adjustment, or feedback. For drafting your complaint effectively, the South Dakota Sample Letter for Disputed Balance Notice can serve as an excellent guide.

To write a debt dispute letter, include your account information alongside clear identification of the disputed charges. Explain why you believe the charges are incorrect, and request a formal investigation. The South Dakota Sample Letter for Disputed Balance Notice can provide you with a strong framework for your letter.