South Dakota UCC-1 for Personal Credit

Description

How to fill out UCC-1 For Personal Credit?

If you wish to access, download, or print sanctioned document templates, utilize US Legal Forms, the premier repository of legal forms available on the web.

Take advantage of the website's straightforward and convenient search function to locate the documents you require.

Various templates for business and personal use are categorized by types and jurisdictions, or keywords.

Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other types from the legal form template.

Step 4. Once you have identified the form you need, click the Buy Now button. Choose the pricing plan you prefer and enter your credentials to register for an account.

- Utilize US Legal Forms to obtain the South Dakota UCC-1 for Personal Credit with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and then click the Download button to retrieve the South Dakota UCC-1 for Personal Credit.

- You can also access forms you have previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form’s details. Make sure to check the information.

Form popularity

FAQ

To file a UCC-1, you need specific information such as the debtor's name, the secured party's name, and a description of the collateral. The South Dakota UCC-1 for Personal Credit requires that this information is complete and accurate to be valid. You also need to file the form with the Secretary of State's office to have it recognized legally. Utilizing platforms like uslegalforms can simplify this process for you.

Yes, you can file a UCC-1 on an individual. The South Dakota UCC-1 for Personal Credit allows you to secure your interests against the individual's personal assets. Proper identification of the debtor and clear descriptions of the collateral will ensure a valid filing. This approach aids in protecting your investment.

A UCC filing can appear on a personal credit report. When you file a South Dakota UCC-1 for Personal Credit, it becomes a matter of public record. Therefore, potential lenders may see this filing when assessing the debtor's creditworthiness. Understanding the impact of UCC filings can inform your financial decisions.

Yes, you can file a UCC against an individual. The South Dakota UCC-1 for Personal Credit can be used to secure an interest in the personal assets of an individual debtor. It's important to ensure you accurately identify the debtor and provide a clear description of the collateral. This filing helps protect your rights as a creditor.

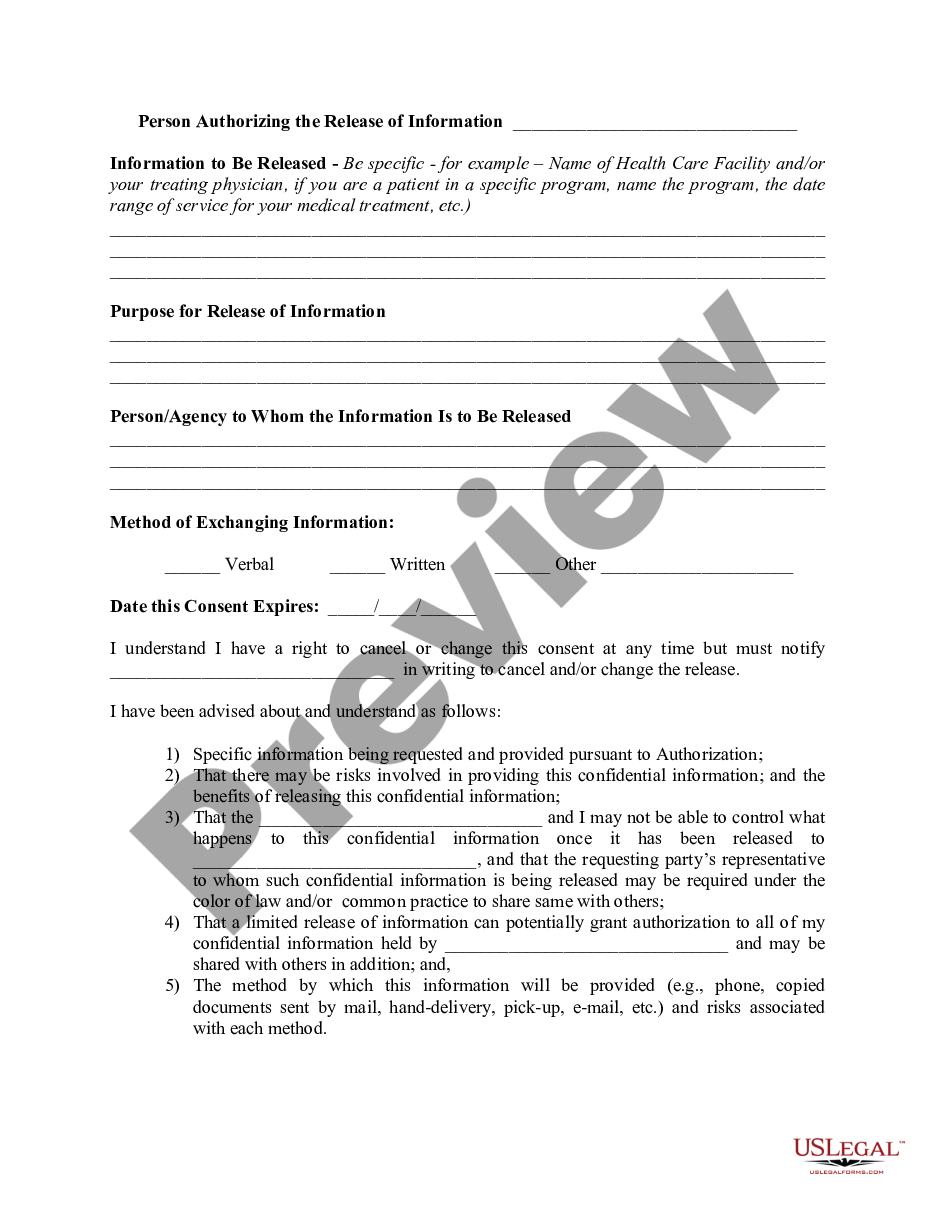

Filling out a UCC-1 form is a straightforward process. Begin by providing your name and address, followed by the debtor's name and address. Then, describe the collateral or personal property you are securing with the South Dakota UCC-1 for Personal Credit. Finally, sign and date the form before submitting it to the appropriate state office for filing.

Yes, the UCC does apply to personal property. The South Dakota UCC-1 for Personal Credit allows parties to secure their interests in personal assets. This filing serves to establish a legal claim against the property, providing the creditor with certain rights. Thus, understanding the role of UCC filings can help you protect your investments effectively.

A UCC filing is a public notice that identifies that you have an outstanding debt obligation. Most lenders (particularly online lenders) use this to secure a business loan. It's sometimes called a UCC lien, or general lien, on business assets.

Additionally, a UCC filing does not natively impact your credit score. But a UCC filing does appear on your credit report, and it could affect whether you will qualify for other financing forms later down the road. For example, say that you receive funding from one lender who filed a UCC lien on some of your assets.

Filing a UCC-1 allows creditors to collateralize or secure their loan by utilizing the personal property assets of their customers. In the event of the customer defaulting on their loan or filing for bankruptcy, a UCC-1 elevates the lender's status to a secured creditor, ensuring they will be paid.

Uniform Commercial Code1 statement is a legal notice filed by creditors as a way to publicly declare their rights to potentially obtain the personal properties of debtors who default on business loans they extend.