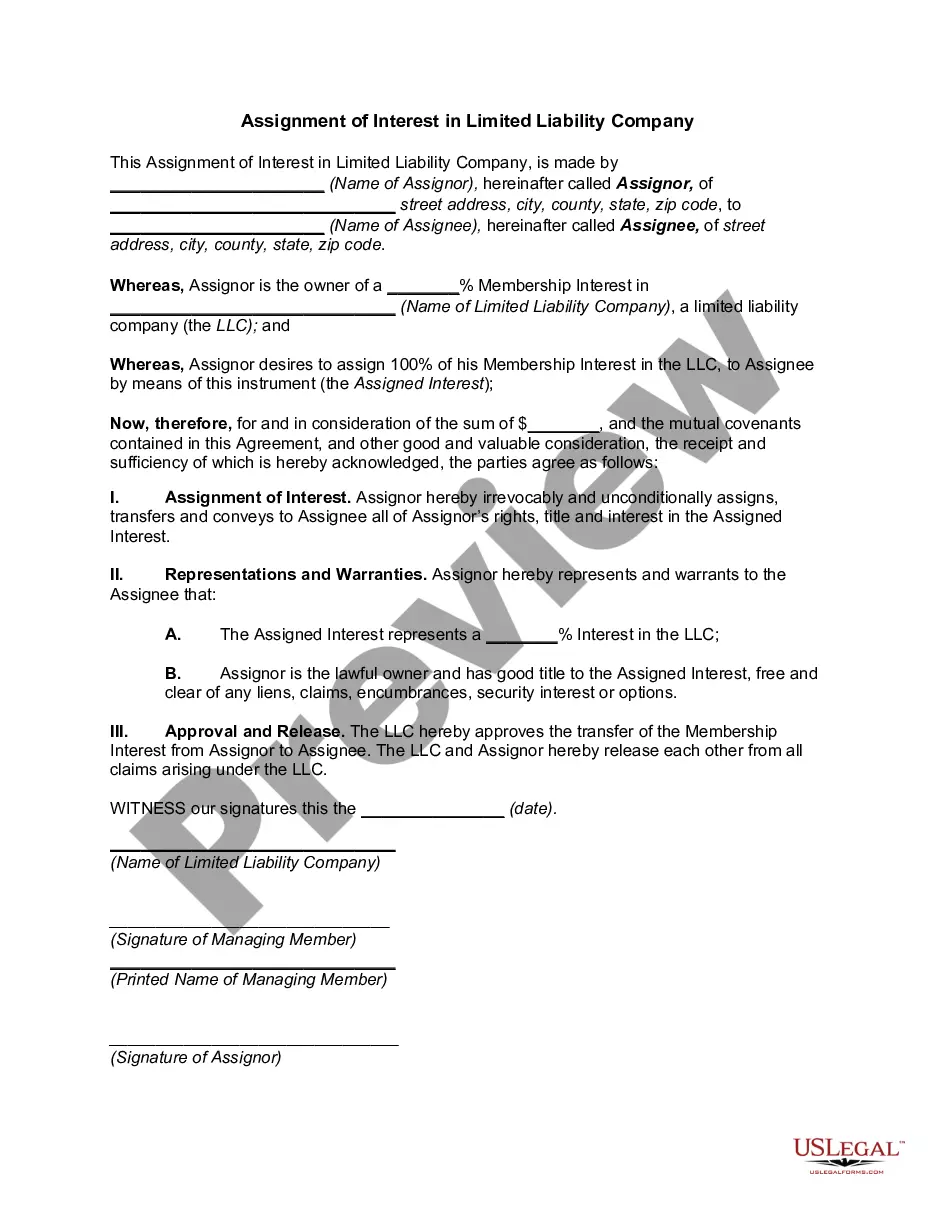

If you have to complete, acquire, or printing authorized file themes, use US Legal Forms, the most important selection of authorized types, which can be found on the web. Make use of the site`s basic and handy search to get the paperwork you require. Various themes for company and personal purposes are categorized by types and says, or keywords and phrases. Use US Legal Forms to get the South Dakota Sale and Assignment of a Percentage Ownership Interest in a Limited Liability Company in just a number of mouse clicks.

In case you are presently a US Legal Forms customer, log in in your account and click the Obtain switch to obtain the South Dakota Sale and Assignment of a Percentage Ownership Interest in a Limited Liability Company. You can even entry types you earlier saved within the My Forms tab of your respective account.

If you use US Legal Forms initially, refer to the instructions under:

- Step 1. Be sure you have selected the shape for the correct area/land.

- Step 2. Use the Review method to check out the form`s content. Don`t forget about to learn the outline.

- Step 3. In case you are unhappy with the form, take advantage of the Lookup discipline near the top of the monitor to find other types in the authorized form design.

- Step 4. When you have identified the shape you require, click the Buy now switch. Choose the prices program you like and add your accreditations to sign up for the account.

- Step 5. Method the purchase. You may use your bank card or PayPal account to complete the purchase.

- Step 6. Select the file format in the authorized form and acquire it on the device.

- Step 7. Total, edit and printing or indicator the South Dakota Sale and Assignment of a Percentage Ownership Interest in a Limited Liability Company.

Every authorized file design you purchase is your own property permanently. You have acces to every single form you saved within your acccount. Click on the My Forms area and select a form to printing or acquire again.

Compete and acquire, and printing the South Dakota Sale and Assignment of a Percentage Ownership Interest in a Limited Liability Company with US Legal Forms. There are millions of specialist and condition-certain types you can use for your personal company or personal needs.