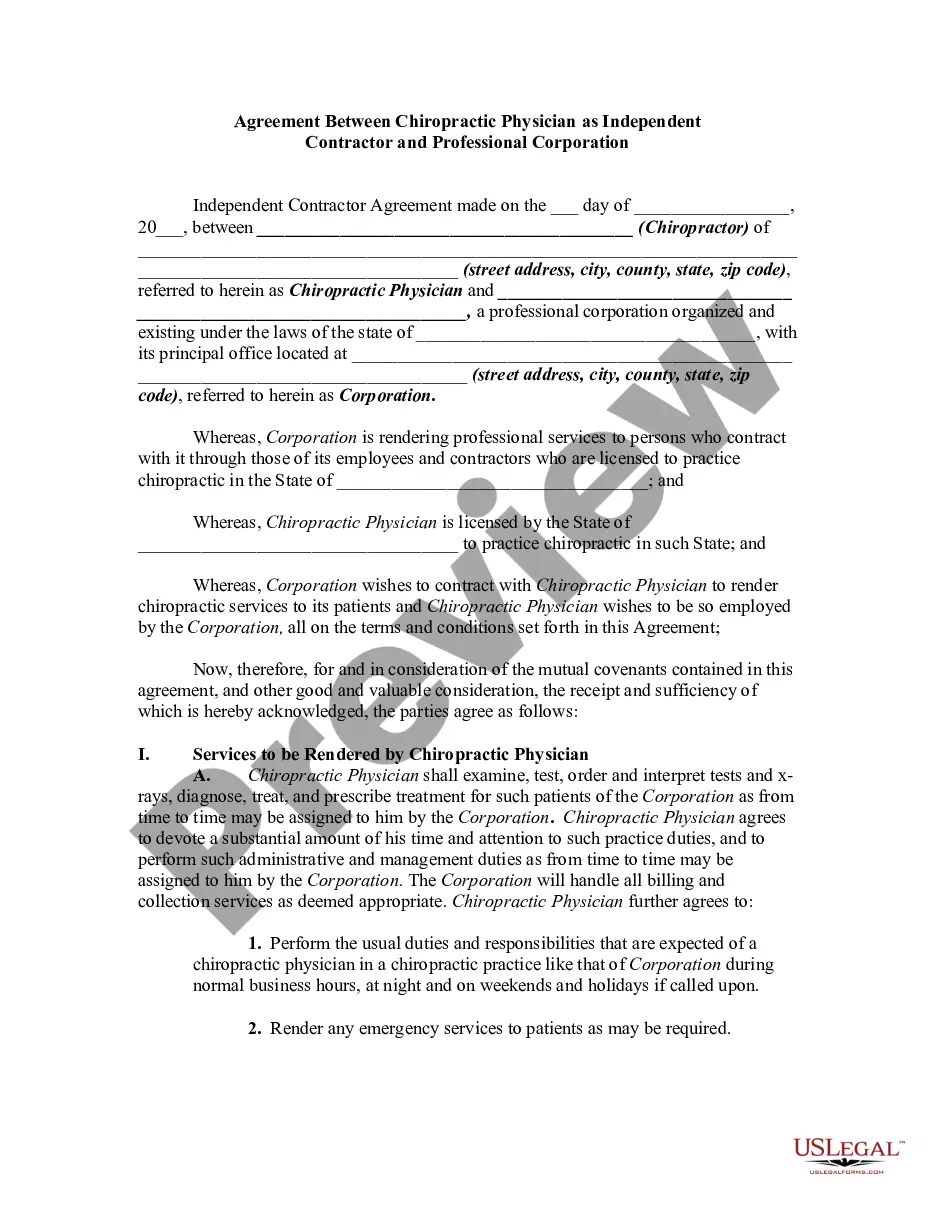

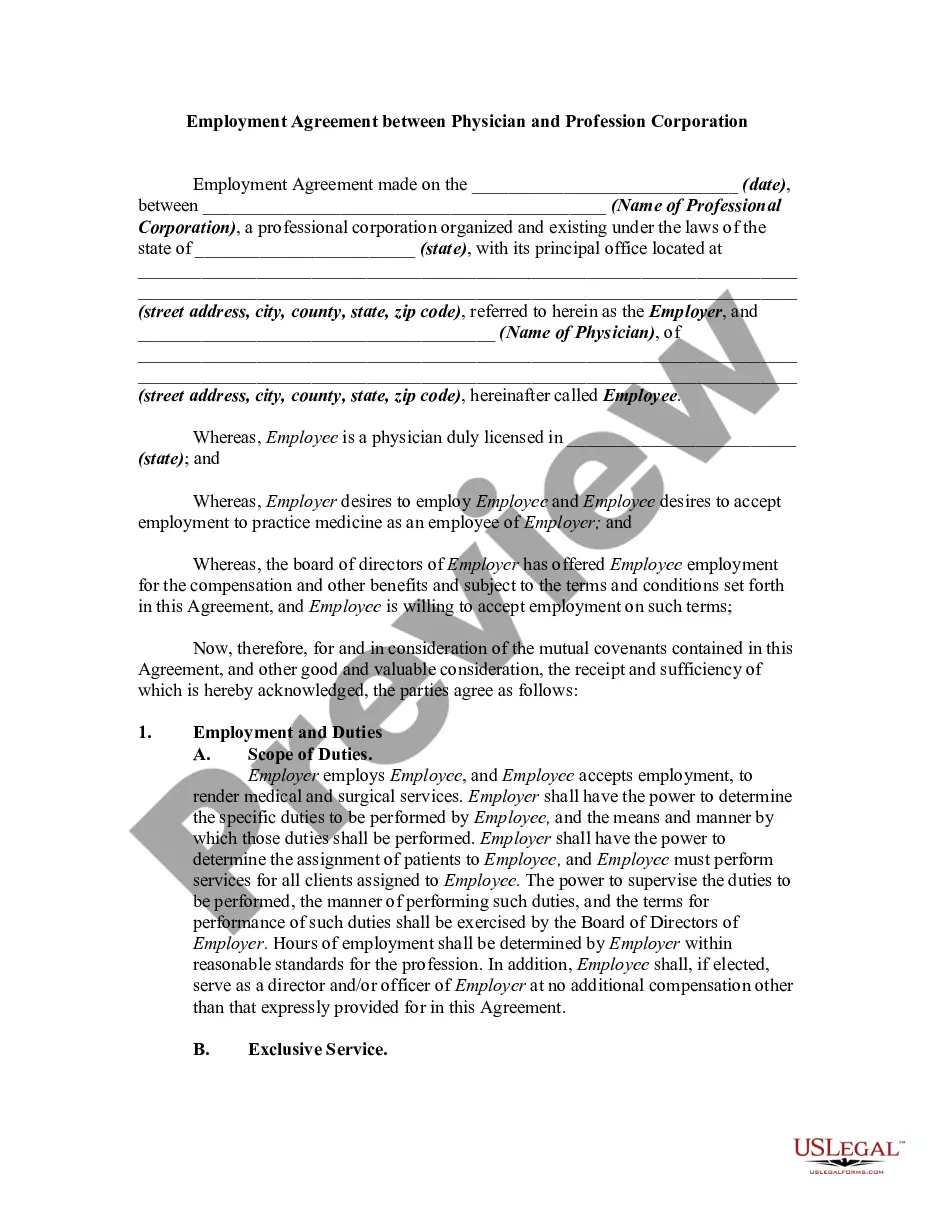

South Dakota Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation

Description

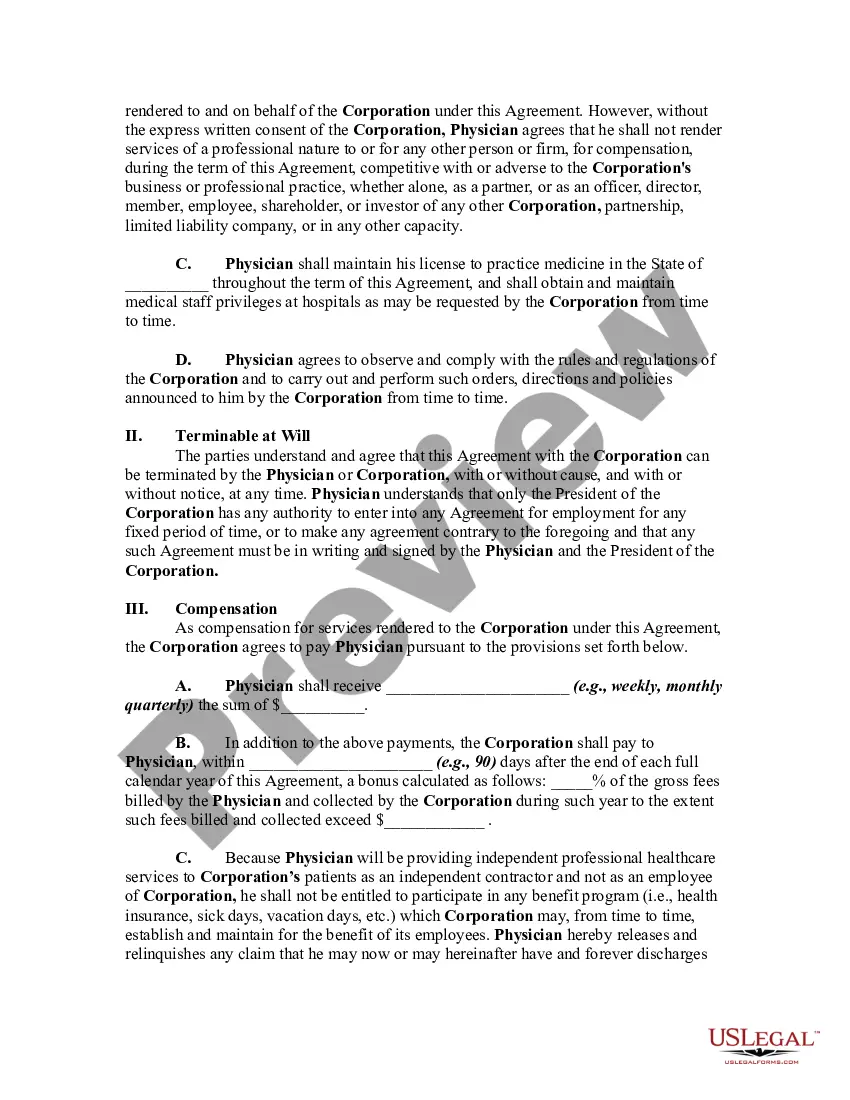

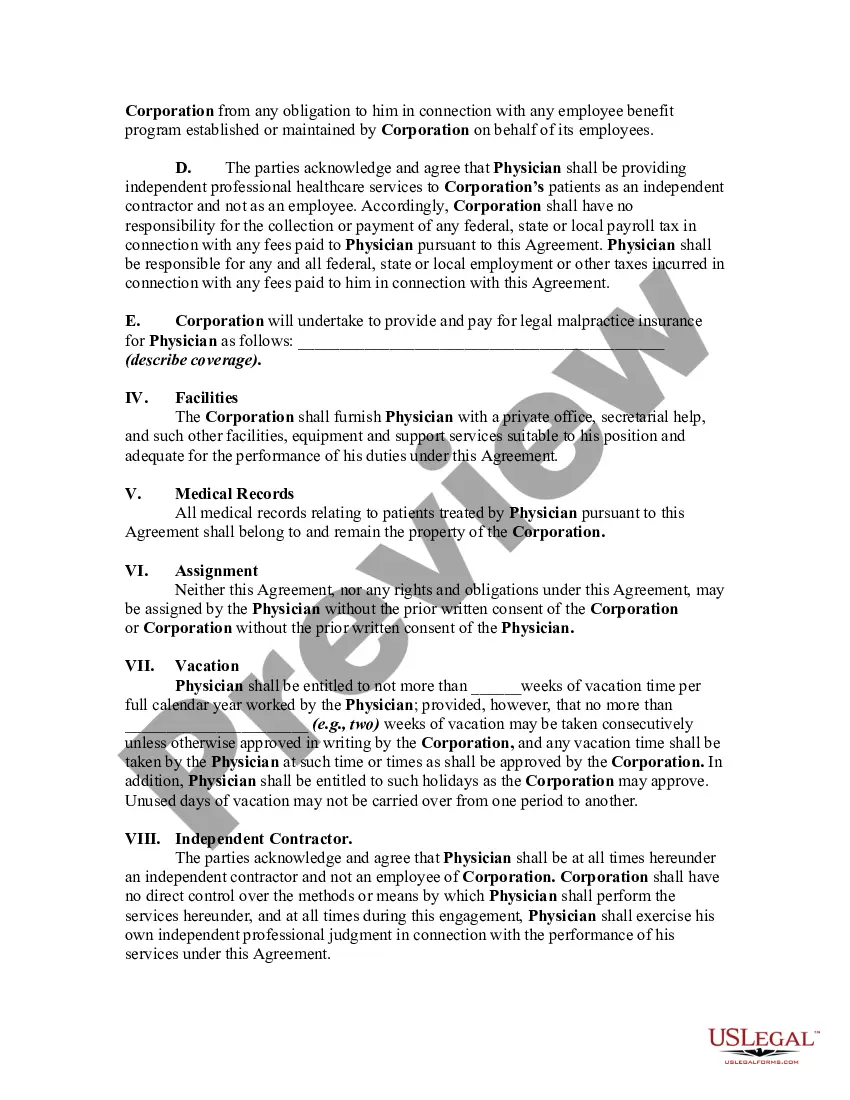

Although no definite rule exists for determining whether one is an independent contractor or an employee, certain indicia of the status of an independent contractor are recognized, and the insertion of provisions embodying these indicia in the contract will help to insure that the relationship reflects the intention of the parties. These indicia generally relate to the basic issue of control. The general test of what constitutes an independent contractor relationship involves which party has the right to direct what is to be done, and how and when. Another important test involves the method of payment of the contractor.

How to fill out Agreement Between Physician As Self-Employed Independent Contractor And Professional Corporation?

Selecting the correct valid document template can be challenging. It goes without saying that there are numerous templates accessible online, but how do you find the specific legitimate form you need.

Visit the US Legal Forms website. This service provides an extensive array of templates, including the South Dakota Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation, which you can utilize for both business and personal purposes. All documents are reviewed by professionals and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Download button to retrieve the South Dakota Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation. Use your account to browse through the legal forms you have previously obtained. Navigate to the My documents section of your account and acquire another copy of the document you require.

Complete, modify, print, and sign the obtained South Dakota Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation. US Legal Forms is the largest catalog of legal forms where you can find various document templates. Leverage the service to download well-crafted documents that adhere to state regulations.

- If you are a new user of US Legal Forms, here are simple steps you should follow.

- First, ensure you have selected the appropriate form for your city/region. You can preview the form using the Preview feature and review the form outline to confirm it is the right one for your needs.

- If the form does not satisfy your requirements, utilize the Search field to find the correct form.

- Once you are sure that the form is suitable, click on the Get now button to obtain the form.

- Select the pricing plan you prefer and enter the necessary information. Create your account and complete the transaction using your PayPal account or a credit card.

- Choose the file format and download the legal document template to your device.

Form popularity

FAQ

Writing an independent contractor agreement involves several key steps: define the working relationship, specify services, and establish payment terms. It's vital to clarify the expectations and responsibilities for both parties upfront. Using a South Dakota Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation ensures you have a comprehensive framework that addresses legal necessities, helping protect both the contractor and the hiring party.

To write a simple contract agreement, start with clear headings that outline the parties involved, the work to be completed, and compensation. Use concise language to eliminate ambiguity and ensure both parties understand their obligations. A South Dakota Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation can serve as a straightforward template to ensure you cover all necessary aspects without overwhelming detail.

Ending a relationship with an independent contractor should be approached professionally and respectfully. Review the terms outlined in your agreement to follow any required procedures for termination. If you've utilized a South Dakota Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation, it will typically include a termination clause that outlines the steps to take.

To write a contract for a contractor, clearly outline the services to be provided, payment details, and deadlines. Include terms related to confidentiality and dispute resolution, if applicable. Additionally, a South Dakota Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation provides a solid framework that you can adapt to your specific needs, ensuring both parties are on the same page.

The best contract for independent contractors is one that clearly defines the scope of work, payment terms, and responsibilities of both parties. A South Dakota Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation can serve as an excellent template, ensuring all critical elements are accurately addressed. By using a well-structured contract, both the contractor and client can avoid misunderstandings and legal issues.

An independent contractor is a person or business that provides services to another entity without being an employee. For example, a physician who operates their own practice and enters into a South Dakota Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation is considered an independent contractor. This agreement outlines the terms and conditions governing their professional relationship.

To politely terminate a contract with a contractor, communicate your decision directly and respectfully. Specify the effective date of termination, referencing the terms of the South Dakota Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation. Offer a brief explanation if relevant, and ensure you settle any outstanding payments. Thank them for their services, affirming a positive conclusion to your collaboration.

To resign as an independent contractor, draft a formal resignation letter that clearly states your intention to end your contract. Reference any relevant agreements, such as the South Dakota Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation. Be sure to give adequate notice as specified in your contract, if applicable, and express your willingness to help transition the work smoothly. Maintaining professionalism is key to preserving relationships for the future.

To write an independent contractor agreement, begin by outlining the scope of work and the responsibilities of each party. Clearly define payment terms, including fees and deadlines, and make sure your agreement aligns with the South Dakota Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation. Include clauses for termination, confidentiality, and dispute resolution. Finally, both parties should sign the agreement to ensure mutual consent.

As an independent contractor, you typically need to fill out essential tax forms, such as the W-9, to provide your taxpayer information. Additionally, when establishing a contract, ensure it adheres to the terms outlined in the South Dakota Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation. Depending on your profession, there may be industry-specific forms or documentation required as well. Always keep thorough records of your income and expenses.