A South Dakota Trust Agreement — Irrevocable is a legal document that establishes a trust in the state of South Dakota. This type of trust agreement is irrevocable, meaning that once it is established, it cannot be changed or terminated without the approval of all beneficiaries. One type of South Dakota Trust Agreement — Irrevocable is the Family Trust. This trust is designed to provide financial security and asset protection for the granter's family members, including spouse, children, grandchildren, and future generations. It allows the granter to transfer assets into the trust, ensuring that they are managed properly and distributed according to the granter's wishes. Another type of South Dakota Trust Agreement — Irrevocable is the Dynasty Trust. This trust is created to preserve wealth for multiple generations. It allows assets to grow and accumulate wealth over time while minimizing estate taxes. The granter can specify how the trust assets should be distributed among beneficiaries, ensuring that future generations benefit from the trust's assets. The South Dakota Trust Agreement — Irrevocable also includes provisions for charitable trusts. These trusts are set up to benefit charitable organizations or causes. The granter can establish a Charitable Remainder Trust, where the granter or other designated beneficiaries receive income from the trust for a specified time before the remaining assets are donated to charity. Alternatively, the granter can create a Charitable Lead Trust, where the charity receives income from the trust for a specified period, and the remaining assets pass to non-charitable beneficiaries afterward. One of the key advantages of a South Dakota Trust Agreement — Irrevocable is the state's favorable trust laws. South Dakota has some of the most flexible and protective trust statutes in the United States. These laws allow for the creation of long-term dynasty trusts, perpetual trusts, and trusts that can exist for several generations. With South Dakota's favorable tax climate and asset protection laws, individuals can establish robust and reliable trusts that can safeguard their wealth and provide for their loved ones for years to come. In summary, South Dakota Trust Agreement — Irrevocable is a legal document that establishes an irrevocable trust in South Dakota. It offers various types of trusts, including Family Trusts, Dynasty Trusts, and Charitable Trusts. South Dakota's trust laws make it an attractive jurisdiction for establishing long-term and asset-protective trusts.

South Dakota Trust Agreement - Irrevocable

Description

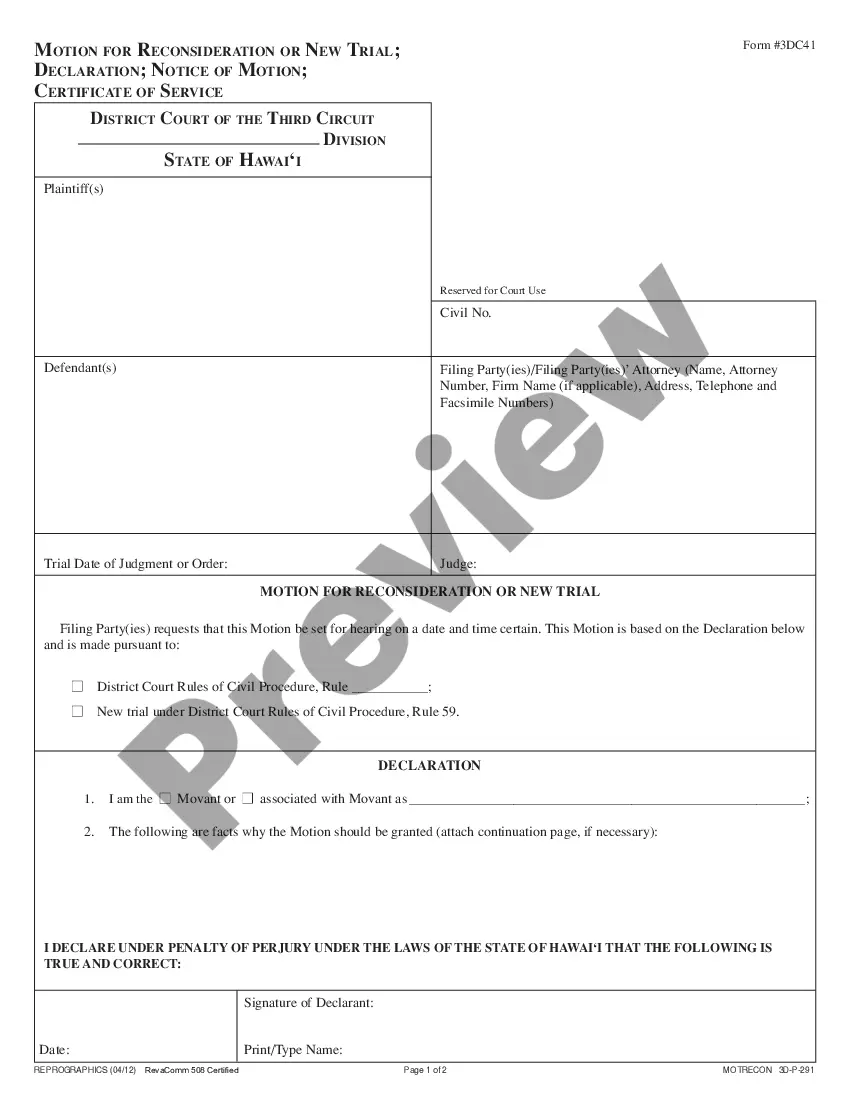

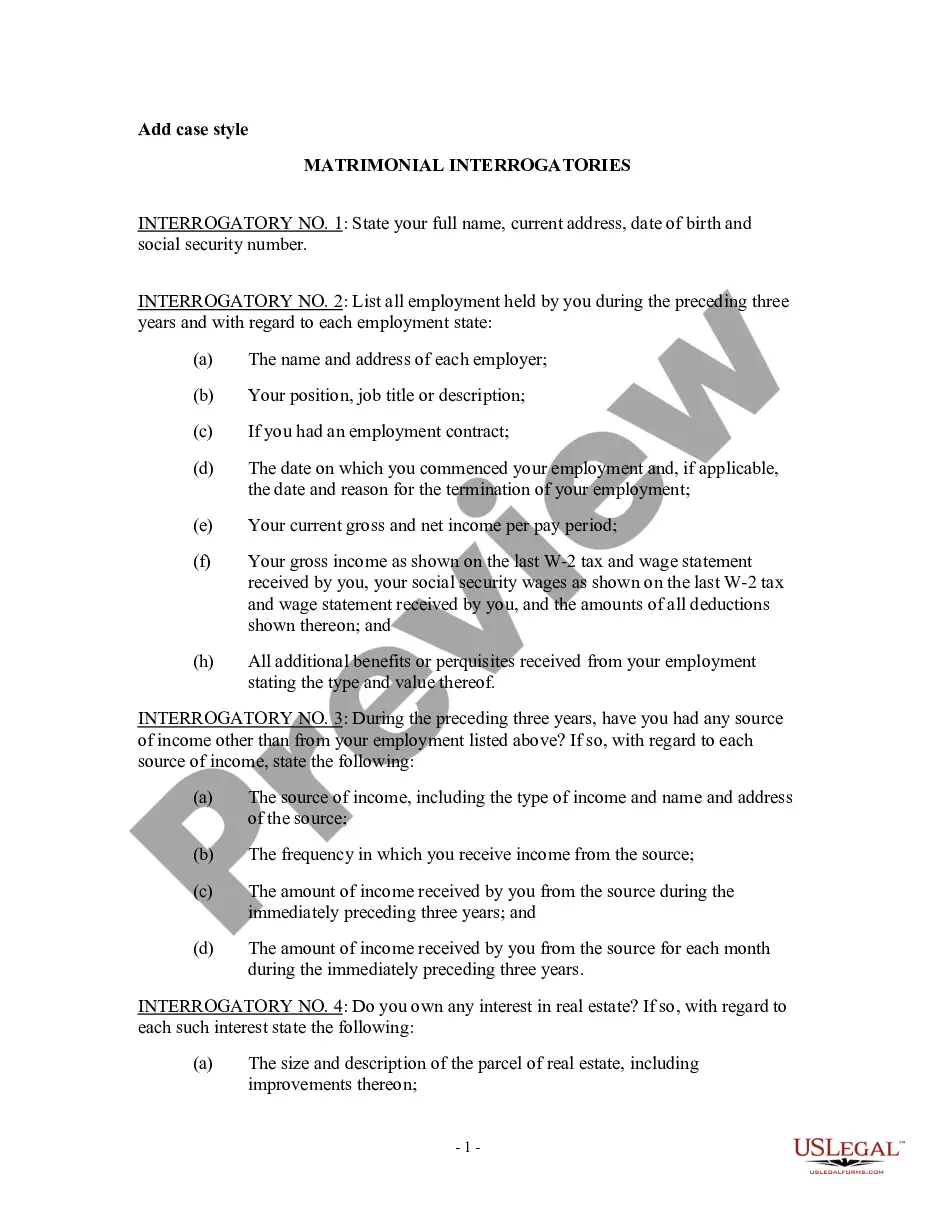

How to fill out South Dakota Trust Agreement - Irrevocable?

If you aim to be thorough, obtain, or create authentic document templates, utilize US Legal Forms, the most extensive collection of valid forms that can be accessed online.

Employ the site’s straightforward and user-friendly search function to find the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Every legal document template you purchase is yours for an extended period. You can access every form you downloaded in your account.

Navigate to the My documents section and choose a form to print or download again. Compete and acquire, and print the South Dakota Trust Agreement - Irrevocable with US Legal Forms. There are countless professional and state-specific forms you can use for your personal or business needs.

- Utilize US Legal Forms to retrieve the South Dakota Trust Agreement - Irrevocable with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to acquire the South Dakota Trust Agreement - Irrevocable.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to check the form’s content. Be sure to read the description.

- Step 3. If you are dissatisfied with the form, utilize the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you desire, click the Buy now button. Choose the pricing plan you prefer and enter your information to register for an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Download the format of the legal form and save it on your device.

- Step 7. Fill out, modify, and print or sign the South Dakota Trust Agreement - Irrevocable.

Form popularity

FAQ

When establishing a South Dakota Trust Agreement - Irrevocable, you can include various assets such as real estate, bank accounts, and investments. The key is to place assets you wish to protect from creditors and ensure they are distributed according to your wishes. Be sure to properly title these assets in the name of the trust. Using uslegalforms can help you navigate what to include and how to organize your trust efficiently.

To form a South Dakota trust, you must first choose a trustee who will manage the assets. Next, create a South Dakota Trust Agreement - Irrevocable that outlines the terms and purpose of the trust. It is vital to specify how assets are to be handled and distributed. You can utilize platforms like uslegalforms to access templates and guidance, ensuring a smooth and compliant setup.

A trust becomes irrevocable when the grantor relinquishes all control over the assets within it. In a South Dakota Trust Agreement - Irrevocable, this means the grantor cannot amend or revoke the trust after it is established. Once the trust is funded, it typically remains in place until the terms of the agreement are fulfilled, ensuring long-term security for your beneficiaries. This permanence can provide peace of mind, knowing your assets will be managed according to your intentions.

When considering an irrevocable trust, many experts point to South Dakota as the best state for establishing a South Dakota Trust Agreement - Irrevocable. South Dakota offers strong asset protection laws, flexible trust terms, and favorable tax benefits. These factors make it an attractive option for individuals looking to secure their financial future without facing heavy restrictions. By choosing South Dakota, you can ensure that your assets are well protected and managed according to your wishes.

Yes, setting up a trust in South Dakota can be genuinely worthwhile due to its beneficial tax laws and strong asset protection features. Many individuals find the privacy and flexibility offered by a South Dakota Trust Agreement - Irrevocable to be highly advantageous. Overall, the decision should align with your financial goals and estate planning needs.

South Dakota is unique in that it does not impose a state income tax on trusts. This means that a South Dakota Trust Agreement - Irrevocable may allow you to retain more of your assets for your beneficiaries. Understanding this tax structure is essential for effective estate planning and maximizing your financial benefits.

Opening a trust in South Dakota can offer many advantages, such as tax benefits and strong asset protection laws. The state's modern trust statutes are designed to make trust management easier and more efficient. If you're looking to secure your wealth and ensure privacy, a South Dakota Trust Agreement - Irrevocable might be the right choice for you.

Modifying an irrevocable trust in South Dakota is possible, but it requires specific legal processes. You may need to file a petition in court to seek permission for changes, depending on the circumstances. Consulting with an attorney experienced with South Dakota Trust Agreement - Irrevocable can help navigate these complex modifications.

South Dakota consistently ranks as a top choice for establishing an irrevocable trust. Its robust legal framework provides significant protections for your assets while allowing for privacy and flexibility. Therefore, if you're considering a South Dakota Trust Agreement - Irrevocable, you're making a wise decision for long-term financial security.

Filing a South Dakota trust involves drafting a trust agreement and having it notarized. You must identify the trust's trustee and beneficiaries as well. Once completed, you can officially fund the trust by transferring assets, ensuring it operates under the guidelines of a South Dakota Trust Agreement - Irrevocable.