South Dakota Charitable Remainder Inter Vivos Unitrust Agreement

Description

How to fill out Charitable Remainder Inter Vivos Unitrust Agreement?

US Legal Forms - one of the most notable collections of legal documents in the United States - offers a diverse selection of legal form templates that you can download or print.

Through the site, you can access thousands of forms for business and personal uses, organized by categories, states, or keywords. You can find the latest versions of forms like the South Dakota Charitable Remainder Inter Vivos Unitrust Agreement in just a few moments.

If you hold a membership, Log In and retrieve the South Dakota Charitable Remainder Inter Vivos Unitrust Agreement from the US Legal Forms library. The Download button will appear on every document you view. You can find all previously acquired forms in the My documents section of your account.

If you are content with the form, confirm your selection by clicking the Buy now button. Then, choose your preferred payment plan and provide your information to create an account.

Complete the transaction. Use a credit card or PayPal account to finalize the purchase. Select the format and download the form to your device. Make edits. Fill out, modify, and print and sign the downloaded South Dakota Charitable Remainder Inter Vivos Unitrust Agreement.

Each template you save to your account has no expiration date and is yours forever. So, if you wish to download or print another copy, just go to the My documents section and click on the form you need. Access the South Dakota Charitable Remainder Inter Vivos Unitrust Agreement with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements.

- To get started with US Legal Forms, here's a simple guide.

- Ensure you have selected the correct form for your region/county.

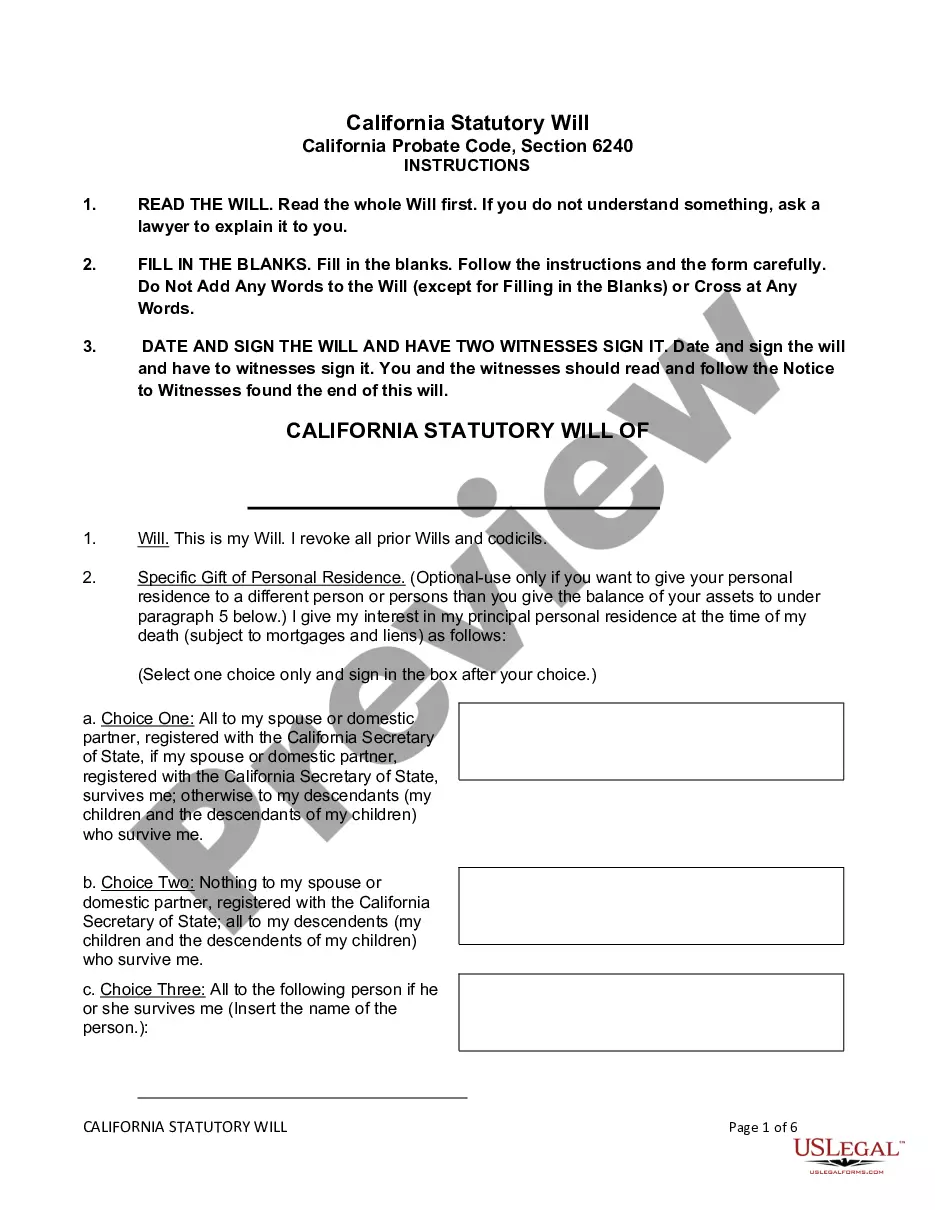

- Choose the Review option to inspect the content of the form.

- Review the form details to ensure you’ve selected the appropriate one.

- If the form does not meet your requirements, utilize the Search field at the top of the page to find one that does.

Form popularity

FAQ

A charitable remainder unitrust functions by allowing you to donate assets, receive income based on a percentage of the trust's value, and benefit from tax deductions. The South Dakota Charitable Remainder Inter Vivos Unitrust Agreement defines how the trust operates, ensuring you and your beneficiaries receive annual distributions. Once the trust ends, the remaining funds go to a charity of your choice. Thus, you enjoy immediate financial support and contribute to a cause you care about.

A charitable remainder unitrust (CRUT) is an arrangement where you transfer assets into a trust, and it pays you a percentage of its value each year. With the South Dakota Charitable Remainder Inter Vivos Unitrust Agreement, you enjoy income while supporting a charitable organization. After your lifetime or the trust term ends, the remaining assets go to that charity. This setup allows you to give back while received regular income, making it an appealing option.

The main difference lies in how income distributions are calculated. A charitable remainder trust distributes a fixed amount annually, while a charitable remainder Unitrust, such as the South Dakota Charitable Remainder Inter Vivos Unitrust Agreement, pays a fixed percentage of the trust's value each year. This distinction impacts the flexibility and potential growth of the payout amounts. Understanding these differences is essential for aligning your philanthropic goals with financial strategies.

Setting up a Charitable Remainder Unitrust (CRUT) involves several key steps, including selecting a trustee and determining the charitable beneficiaries. The South Dakota Charitable Remainder Inter Vivos Unitrust Agreement provides a solid framework for establishing these parameters. Formulating an agreement that outlines your intentions and terms is crucial. Consulting with a legal or financial advisor can ensure that the setup meets both your financial goals and compliance requirements.

The unitrust amount is calculated based on the fair market value of the trust's assets at a specific time, generally annually. For the South Dakota Charitable Remainder Inter Vivos Unitrust Agreement, the trust documents will specify the valuation date. Each year, a percentage will be applied to this value to determine the income distributed to beneficiaries. This method offers a degree of flexibility and growth potential linked to investment performance.

The primary form used for a charitable trust is IRS Form 5227. This form captures essential details about the trust's operations, including income and distributions. When you establish a South Dakota Charitable Remainder Inter Vivos Unitrust Agreement, using the correct form is crucial for transparency and regulatory compliance, ensuring your trust meets the necessary legal requirements.

Yes, you can add additional funds or assets to a charitable remainder Unitrust, which provides flexibility for ongoing contributions. This feature allows you to increase the potential income for your beneficiaries while further supporting your charitable goals. When managing your South Dakota Charitable Remainder Inter Vivos Unitrust Agreement, consulting with professionals can help you optimize any additional contributions effectively.

Currently, IRS Form 5227 cannot be filed electronically; it must be submitted in paper form. This requirement can create challenges for some trustees, making compliance more complicated. By utilizing reliable platforms like uslegalforms, you can simplify the process of understanding and filing the necessary paperwork for your South Dakota Charitable Remainder Inter Vivos Unitrust Agreement.

A charitable remainder trust generally files IRS Form 5227, which is used to report the trust's income, deductions, and distributions. This form helps track the income beneficiaries receive, as well as the charitable organization benefiting from the trust. When establishing a South Dakota Charitable Remainder Inter Vivos Unitrust Agreement, it’s essential to correctly manage the filing process for compliance and tax benefits.

A Charitable Remainder Trust (CRT) allows the donor to receive income during their lifetime, with the remaining assets going to charity after their death. In contrast, a Charitable Lead Trust (CLT) provides income to the charity for a set period, after which the remaining assets return to the donor or their heirs. Understanding these nuances is crucial when considering a South Dakota Charitable Remainder Inter Vivos Unitrust Agreement, especially for effective financial planning.