South Dakota Promissory Note - Payable on Demand

Description

How to fill out Promissory Note - Payable On Demand?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal template forms that you can download or print. By using the website, you can discover thousands of forms for business and personal use, organized by categories, regions, or keywords.

You can access the latest versions of forms such as the South Dakota Promissory Note - Payable on Demand in mere seconds.

If you already have a subscription, Log In and obtain the South Dakota Promissory Note - Payable on Demand from your US Legal Forms library. The Download button will appear on each form you view. You can access all previously downloaded forms in the My documents section of your account.

Edit the document. Fill in, modify, print, and sign the downloaded South Dakota Promissory Note - Payable on Demand.

Each template you've added to your account does not have an expiration date and is yours permanently. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the form you need.

- If you're using US Legal Forms for the first time, here are simple instructions to help you get started.

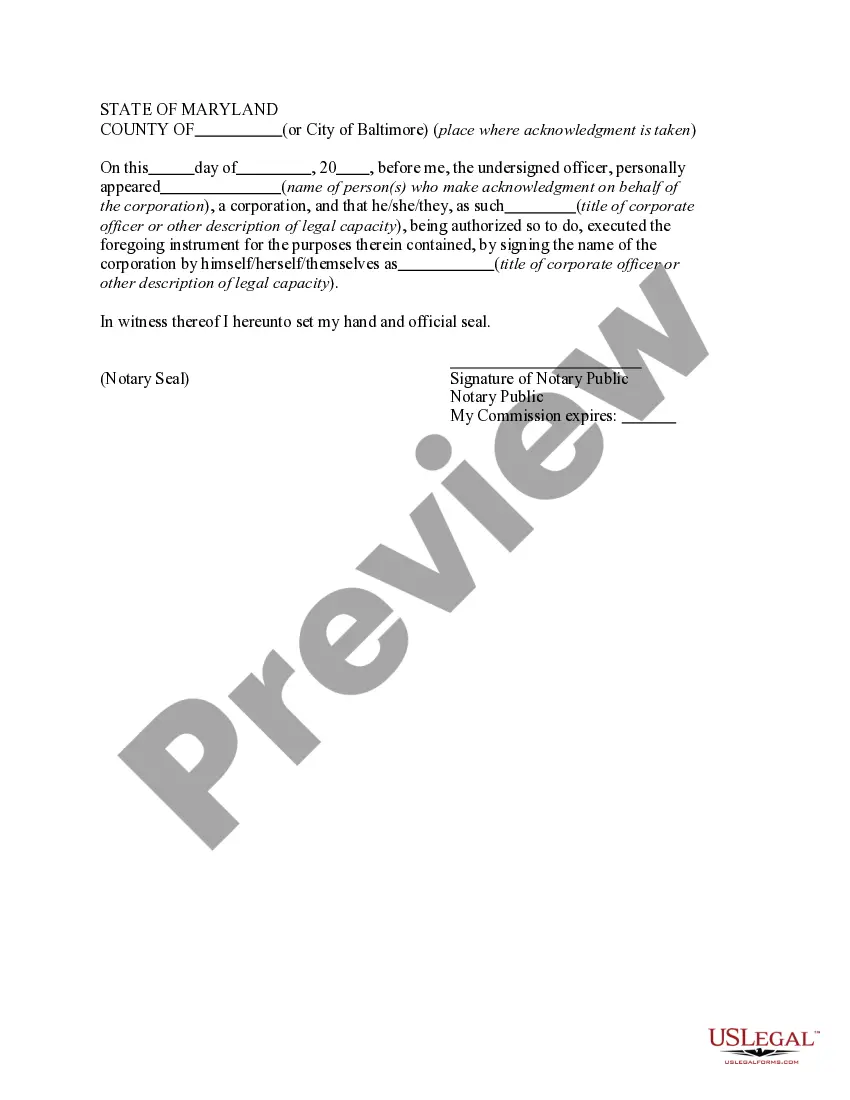

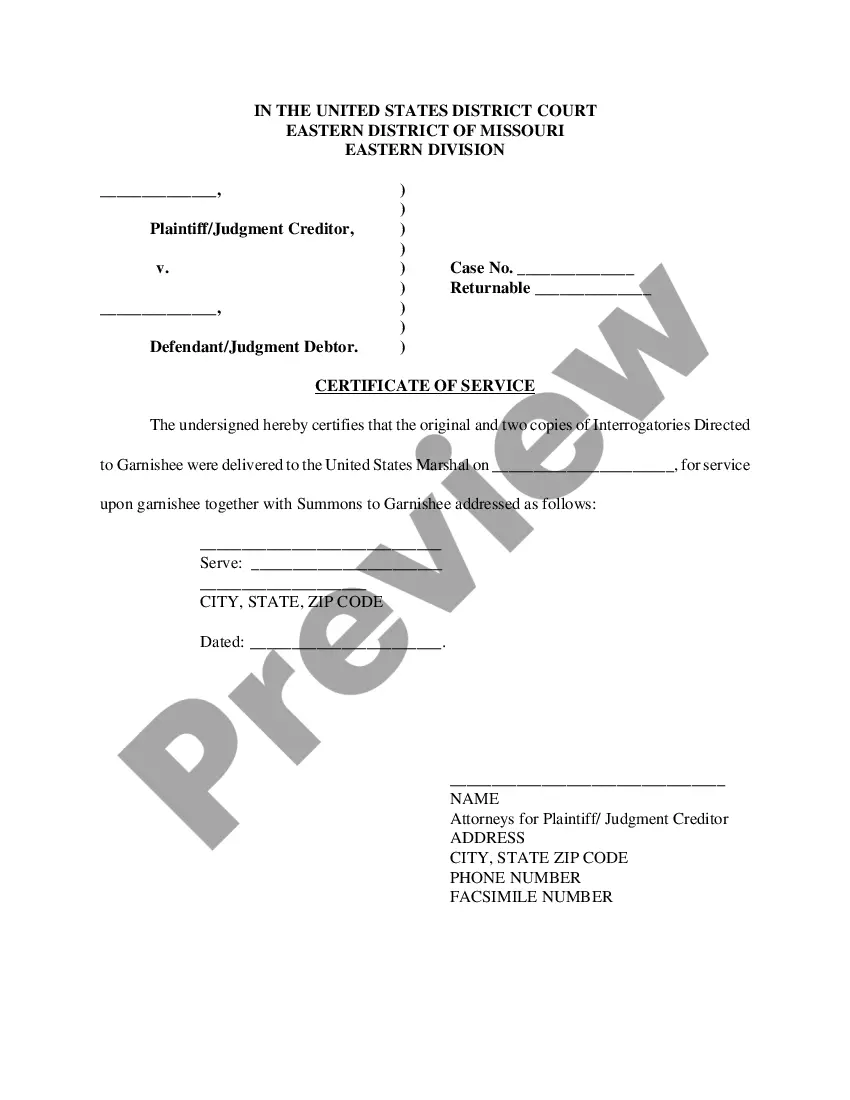

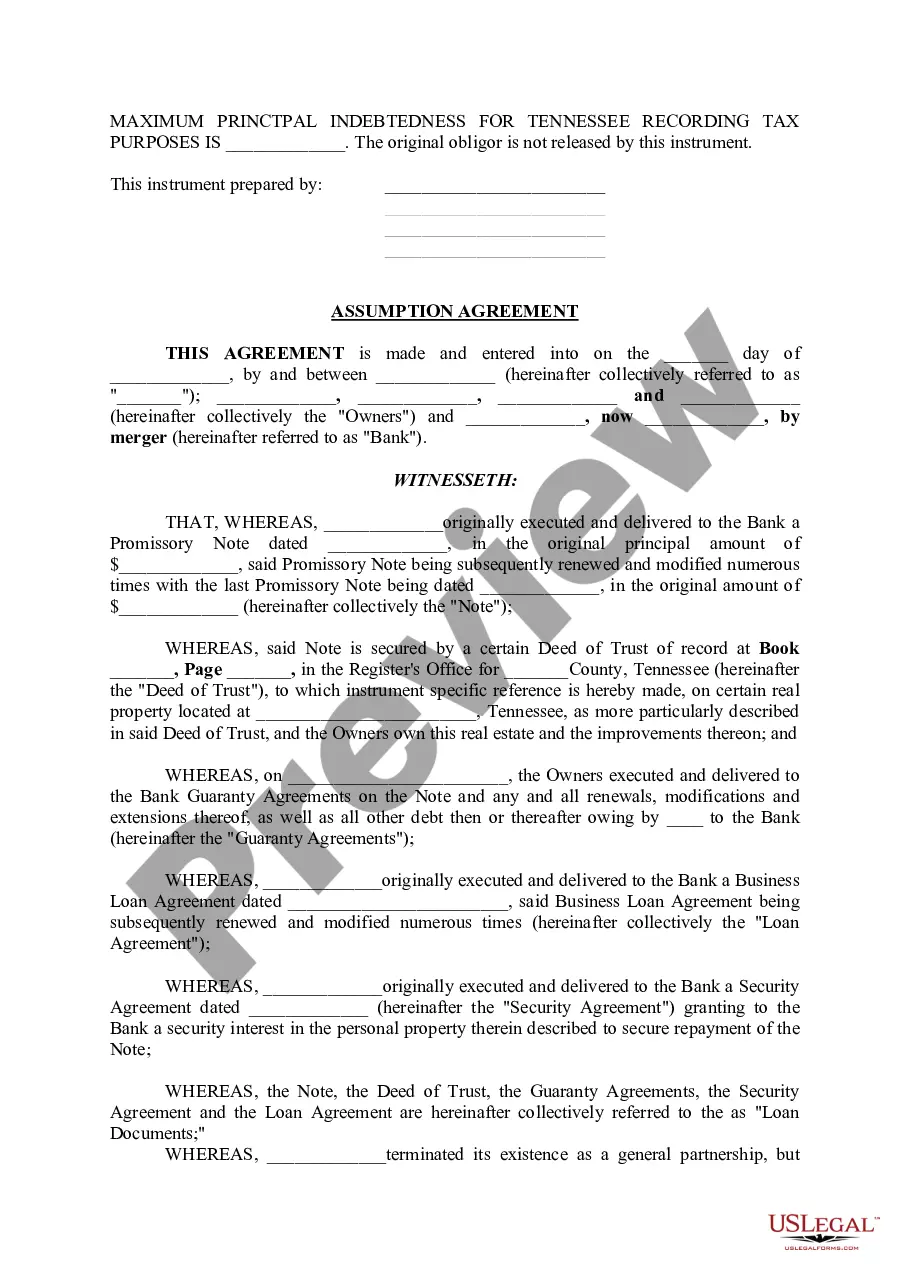

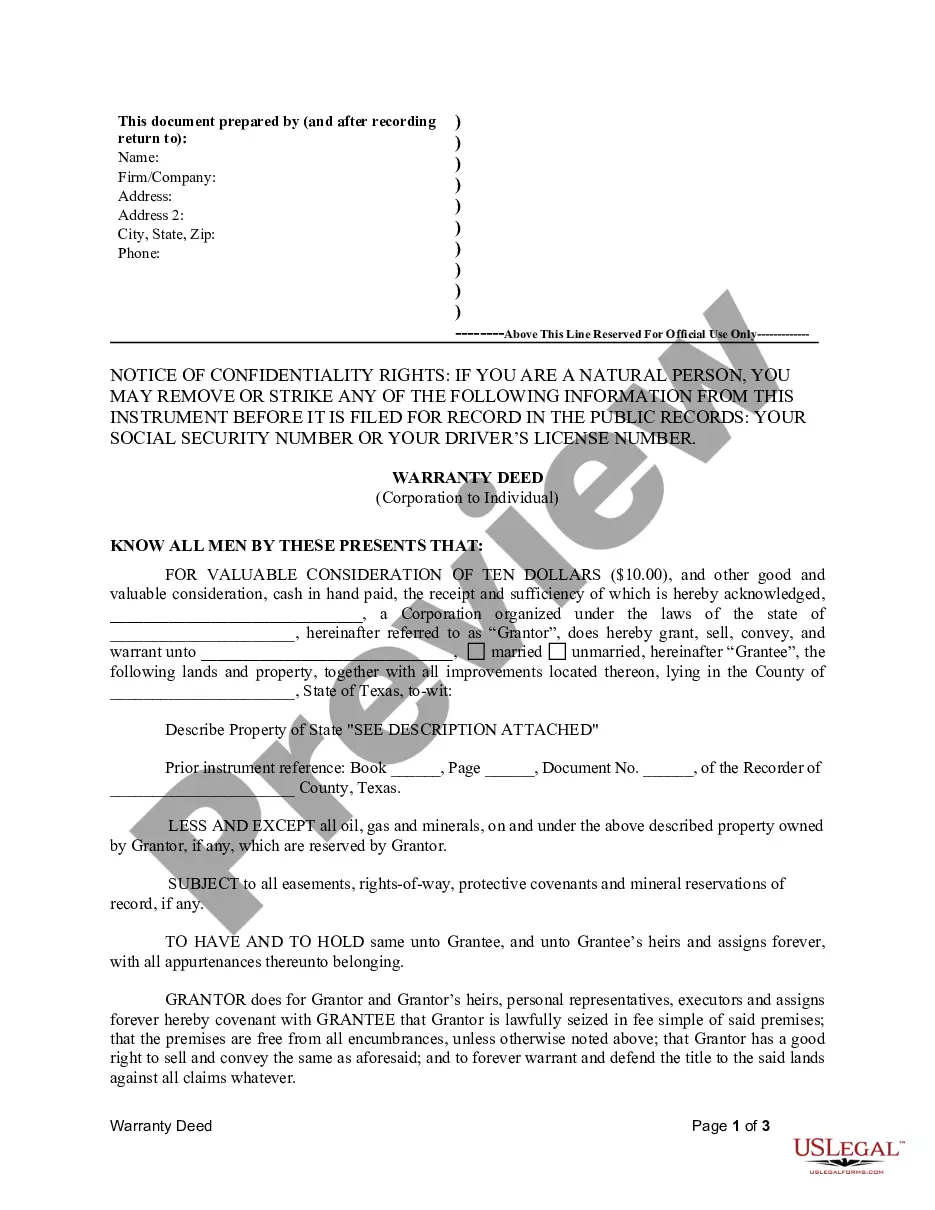

- Ensure that you have selected the correct form for your region/area. Click on the Preview button to review the form's content. Check the form description to confirm that you’ve selected the right form.

- If the form does not meet your needs, use the Search box at the top of the screen to find the one that does.

- Once you are satisfied with the form, confirm your selection by clicking the Purchase now button. Then, choose the payment plan you prefer and provide your information to register for the account.

- Process the transaction. Use your credit card or PayPal account to complete the transaction.

- Choose the format and download the form to your device.

Form popularity

FAQ

Being payable on demand means the lender can request immediate repayment at any time without prior notice. This condition places a responsibility on the borrower to be financially prepared for such requests. Creating a South Dakota Promissory Note - Payable on Demand ensures that all parties understand this crucial aspect of the agreement.

Section 29A 3 1201 of the South Dakota Codified Laws outlines the governing laws for promissory notes, ensuring enforceability and clarity. This section is vital for anyone drafting a South Dakota Promissory Note - Payable on Demand, as it specifies the legal standards that must be adhered to. Familiarizing yourself with these laws can help prevent issues during repayment.

The primary difference lies in the repayment terms. A standard promissory note typically has a fixed repayment schedule, while a demand promissory note allows the lender to collect the owed amount at any time. Understanding these distinctions is crucial, especially when drafting a South Dakota Promissory Note - Payable on Demand, where immediate repayment can be requested.

A promissory note payable on demand is a written promise where the borrower agrees to repay the lender upon the lender's request. This type of note provides flexibility for the lender, allowing them to collect the owed amount at their discretion. It is essential to use a properly formatted South Dakota Promissory Note - Payable on Demand to ensure all legal requirements are met.

A joint promissory note payable on demand combines the features of a joint promissory note with the stipulation that the lender can request payment at any time. This means the borrowers must be ready to meet their financial obligations whenever the lender makes a demand. By utilizing a South Dakota Promissory Note - Payable on Demand, parties can ensure clarity in their repayment expectations.

A joint promissory note is a financial document where two or more parties agree to repay a specified amount to a lender. Each signer is equally responsible for the debt outlined in the South Dakota Promissory Note - Payable on Demand. This means that if one party defaults, the other can be held accountable for the entire amount. This arrangement fosters trust and cooperation between the parties involved.

To fill a demand promissory note correctly, start with a clear title and the date. Then, enter the names and addresses of both the borrower and lender. Include the principal amount and any interest that may apply, ensuring to specify that it is payable on demand. Always remember to have both parties sign to affirm their understanding and agreement.

The format of a South Dakota Promissory Note - Payable on Demand typically follows a structured layout. Begin with a title indicating it is a promissory note, followed by the date. You should include sections for borrower and lender details, the principal amount, interest rate, and repayment terms. This clear format helps ensure all essential information is covered.

In South Dakota, the statute of limitations on debt is typically six years for written contracts, including promissory notes. Understanding this timeframe is crucial when dealing with a South Dakota Promissory Note - Payable on Demand, as it affects your rights regarding debt collection.

Yes, you can demand payment on a promissory note that is payable on demand. This type of note allows you to request repayment at any time, providing you with more control over your investment. Utilizing a South Dakota Promissory Note - Payable on Demand can enhance your financial strategy.