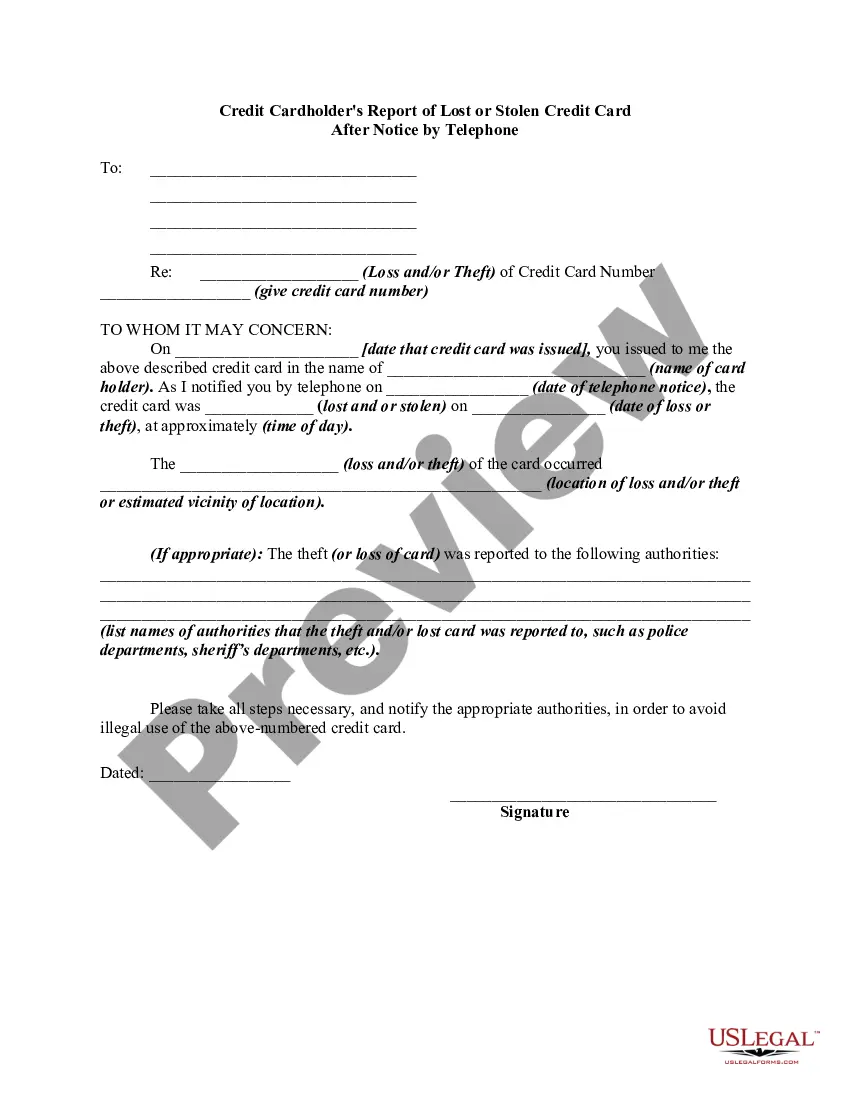

South Dakota Credit Cardholder's Report of Lost or Stolen Credit Card

Description

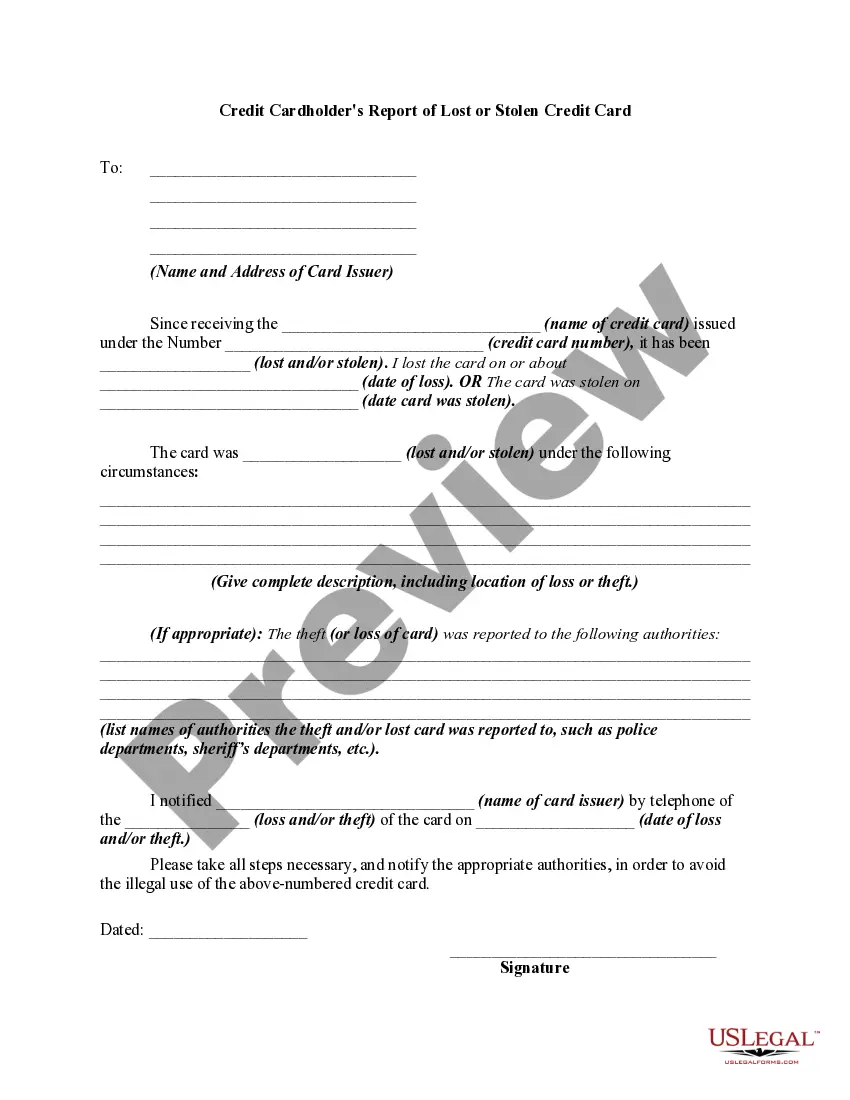

How to fill out Credit Cardholder's Report Of Lost Or Stolen Credit Card?

If you wish to comprehensive, acquire, or produce legitimate papers web templates, use US Legal Forms, the biggest variety of legitimate kinds, which can be found on the web. Take advantage of the site`s easy and convenient lookup to discover the paperwork you want. Numerous web templates for business and personal uses are sorted by types and says, or key phrases. Use US Legal Forms to discover the South Dakota Credit Cardholder's Report of Lost or Stolen Credit Card in a handful of click throughs.

In case you are already a US Legal Forms consumer, log in to your profile and click on the Download key to have the South Dakota Credit Cardholder's Report of Lost or Stolen Credit Card. Also you can access kinds you in the past saved from the My Forms tab of your profile.

Should you use US Legal Forms for the first time, refer to the instructions below:

- Step 1. Be sure you have selected the shape for the correct city/region.

- Step 2. Take advantage of the Review solution to examine the form`s information. Do not neglect to learn the explanation.

- Step 3. In case you are unsatisfied with all the form, make use of the Research area at the top of the display to get other types of the legitimate form web template.

- Step 4. Upon having identified the shape you want, click on the Buy now key. Opt for the costs program you choose and include your accreditations to sign up on an profile.

- Step 5. Process the purchase. You can use your Мisa or Ьastercard or PayPal profile to complete the purchase.

- Step 6. Pick the file format of the legitimate form and acquire it on the gadget.

- Step 7. Comprehensive, revise and produce or indication the South Dakota Credit Cardholder's Report of Lost or Stolen Credit Card.

Every legitimate papers web template you acquire is your own property for a long time. You have acces to each and every form you saved in your acccount. Select the My Forms portion and pick a form to produce or acquire once more.

Be competitive and acquire, and produce the South Dakota Credit Cardholder's Report of Lost or Stolen Credit Card with US Legal Forms. There are thousands of professional and state-certain kinds you can utilize for your business or personal needs.

Form popularity

FAQ

Scammers can use a lost credit card to make fraudulent purchases. But they can also use the information on your card to scam your lender or bank into giving them access to your funds or even opening new accounts in your name.

Step 1. Call your credit card issuer. Call your credit card issuer immediately to report the loss or theft of your missing card. Typically, you would check the back of the card for the telephone number to call.

What to Do If Credit Card Theft Happens to You. In the event that your credit card is stolen in the United States, federal law limits the liability of cardholders to $50, regardless of the amount charged on the card by the unauthorized user.

5 steps to take immediately if your credit card is lost or stolen How to report credit card fraud. ... Contact your credit card issuer. ... Change your login information. ... Monitor your credit card statement. ... Review your credit report and dispute any fraud on it. ... Protect yourself from future credit card fraud. ... Bottom line.

Call ? or get on the mobile app ? and report the loss or theft to the bank or credit union that issued the card as soon as possible. Federal law says you're not responsible to pay for charges or withdrawals made without your permission if they happen after you report the loss.

Online: The card issuer's website usually has an option to request a new credit card online. Mobile app: You can use many credit cards' mobile apps to request a replacement credit card directly within the app.

When you lose your credit card, you can avoid an impact to your finances by reporting the card lost or missing immediately. In general, a lost or stolen credit card will have no impact on your credit score. In most cases, you will not be held responsible for charges on a lost or stolen card.

Also, if an unauthorized charge to your ATM is reported to your bank statement, you are liable for the full amount unless you report the charge within 60 days of the date the statement is sent to you. In other words, report the loss/theft of your ATM card immediately.