South Dakota Employment Application for Accountant

Description

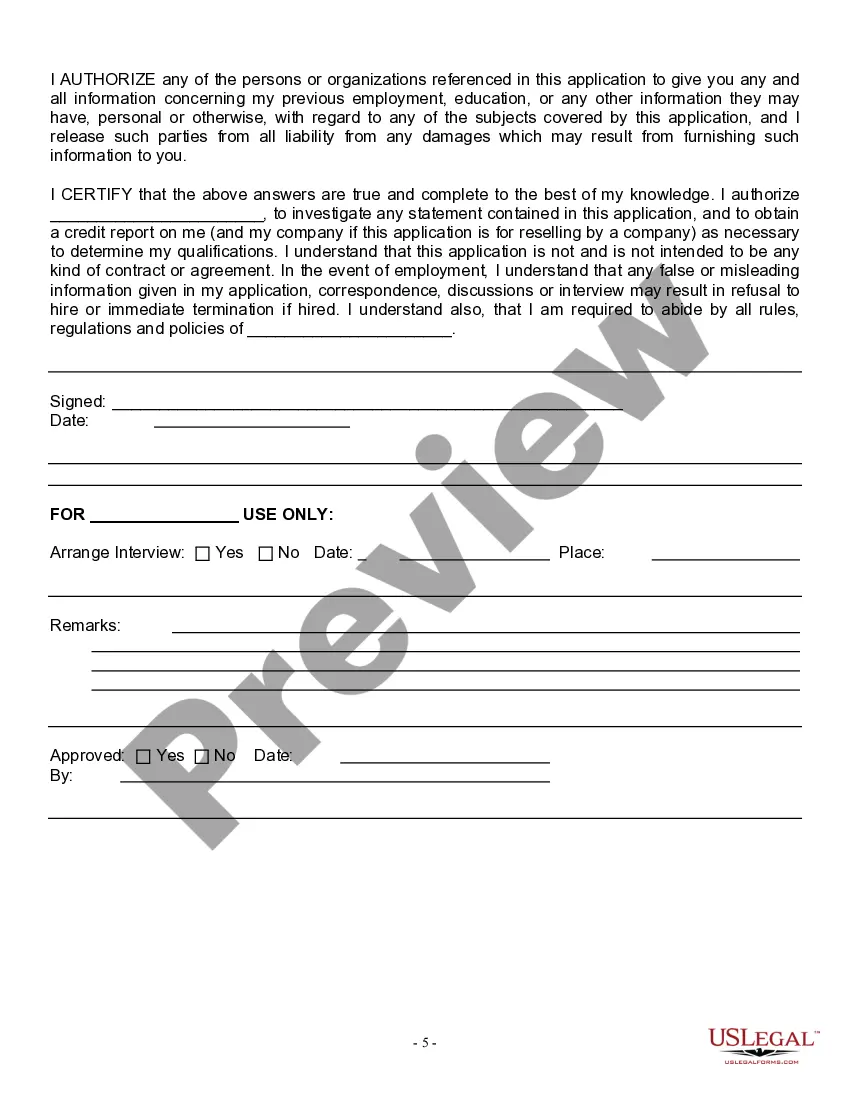

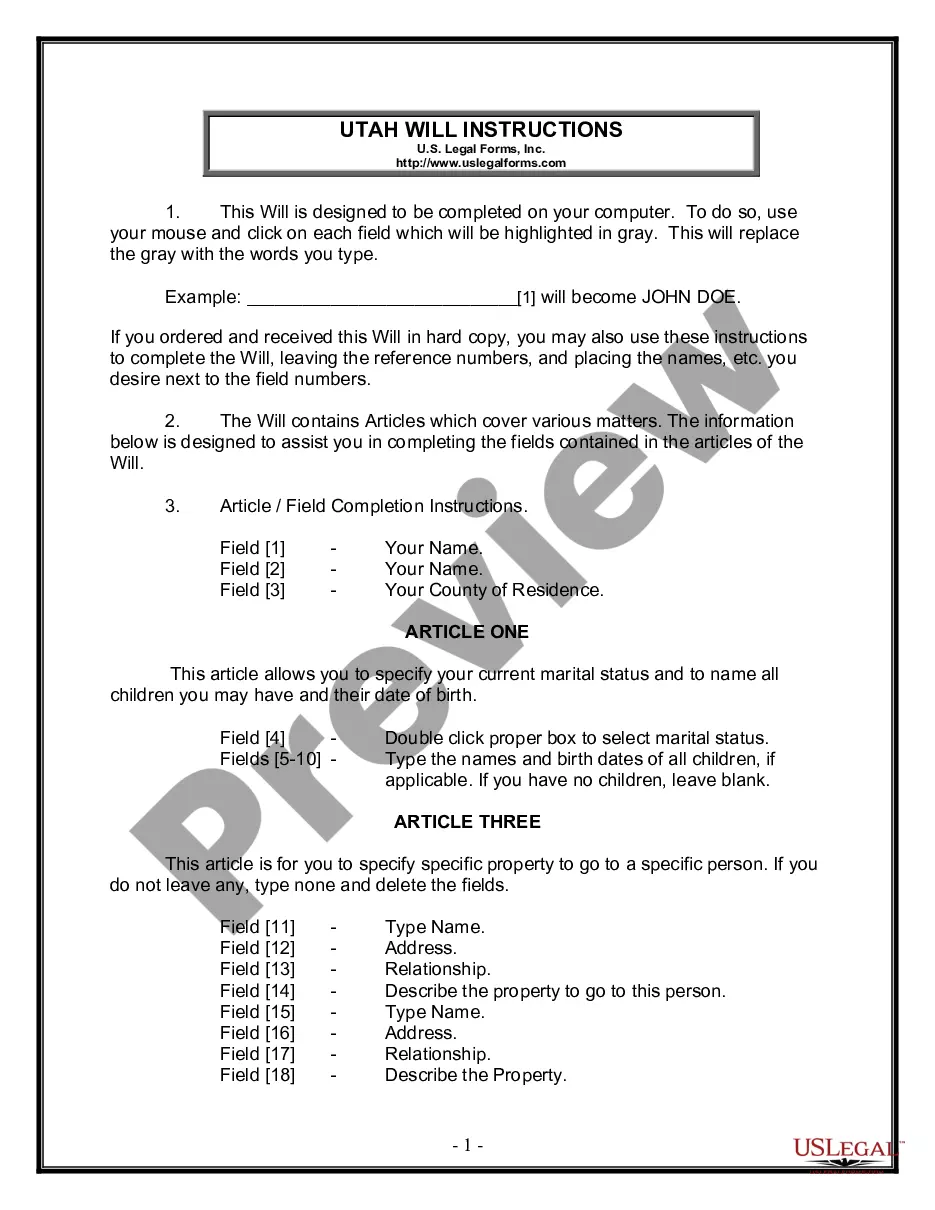

How to fill out Employment Application For Accountant?

You can spend hours online searching for the legal document template that satisfies the state and federal requirements you need.

US Legal Forms provides a vast selection of legal forms that can be reviewed by professionals.

You can download or print the South Dakota Employment Application for Accountant from their service.

To retrieve another version of your form, utilize the Search field to find the template that suits your needs.

- If you already have a US Legal Forms account, you may Log In and then select the Download option.

- Afterward, you can complete, modify, print, or sign the South Dakota Employment Application for Accountant.

- Every legal document template you acquire is yours permanently.

- To obtain another copy of any purchased form, navigate to the My documents section and click the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for your county/region that you selected.

- Review the form description to confirm you have chosen the accurate form.

Form popularity

FAQ

Steps to Become a CPA in South DakotaComplete 150 semester hours of college-level education in accounting.Submit the Uniform CPA Initial Examination Application.Pass the Uniform CPA Examination.Complete the AICPA ethics course and exam.Accumulate the required hours of experience.Apply for the CPA Certificate.More items...

South Dakota CPA Exam Fees The cost to take all four sections of the CPA exam in South Dakota is $863.20. The re-examination registration fee varies is $30 per section.

Colorado Requirements Overview: With no requirement to be a US Citizen, a resident of CO, or a certain age, it makes Colorado one of the easiest states to sit for the CPA exam and become licensed.

Get Your Education. a.Take The Uniform CPA Exam.Gain The Necessary Experience.Get Your South Dakota CPA License.Stay Current Through Continuing Professional Education in South Dakota.

It's no secret. Passing the CPA exam all but guarantees that if you play your cards right you will make well over $1 million dollars more during your entire career than if you never passed the CPA exam. Imagine what you could do with an extra million dollars!

4. Get Your Wisconsin CPA LicenseCompleted 150 semester hours of college education and received at least a bachelor's degree through an accredited program.Passed the Uniform CPA Exam. Examination scores are sent directly to the applicant by NASBA.Completed one year of public accounting experience or the equivalent.

Read on to find out how to become a CPA in four simple steps.Step 1: Verify your state's CPA licensing requirements.Step 2: Complete your degree and gain experience.Step 3: Pass the CPA Exam.Step 4: Finalize your certification.

Steps to Become a CPA in South DakotaComplete 150 semester hours of college-level education in accounting.Submit the Uniform CPA Initial Examination Application.Pass the Uniform CPA Examination.Complete the AICPA ethics course and exam.Accumulate the required hours of experience.Apply for the CPA Certificate.More items...

South Dakota CPA Exam Fees The cost to take all four sections of the CPA exam in South Dakota is $863.20. The re-examination registration fee varies is $30 per section.