This form is a Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith-Jury Trial Demand. Adapt to your specific circumstances. Don't reinvent the wheel, save time and money.

South Dakota Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand

Description

How to fill out Complaint For Wrongful Termination Of Insurance Under ERISA And For Bad Faith - Jury Trial Demand?

Are you currently in a circumstance where you frequently require documents for either professional or personal purposes? There are numerous legal document templates accessible online, but finding reliable versions isn't straightforward.

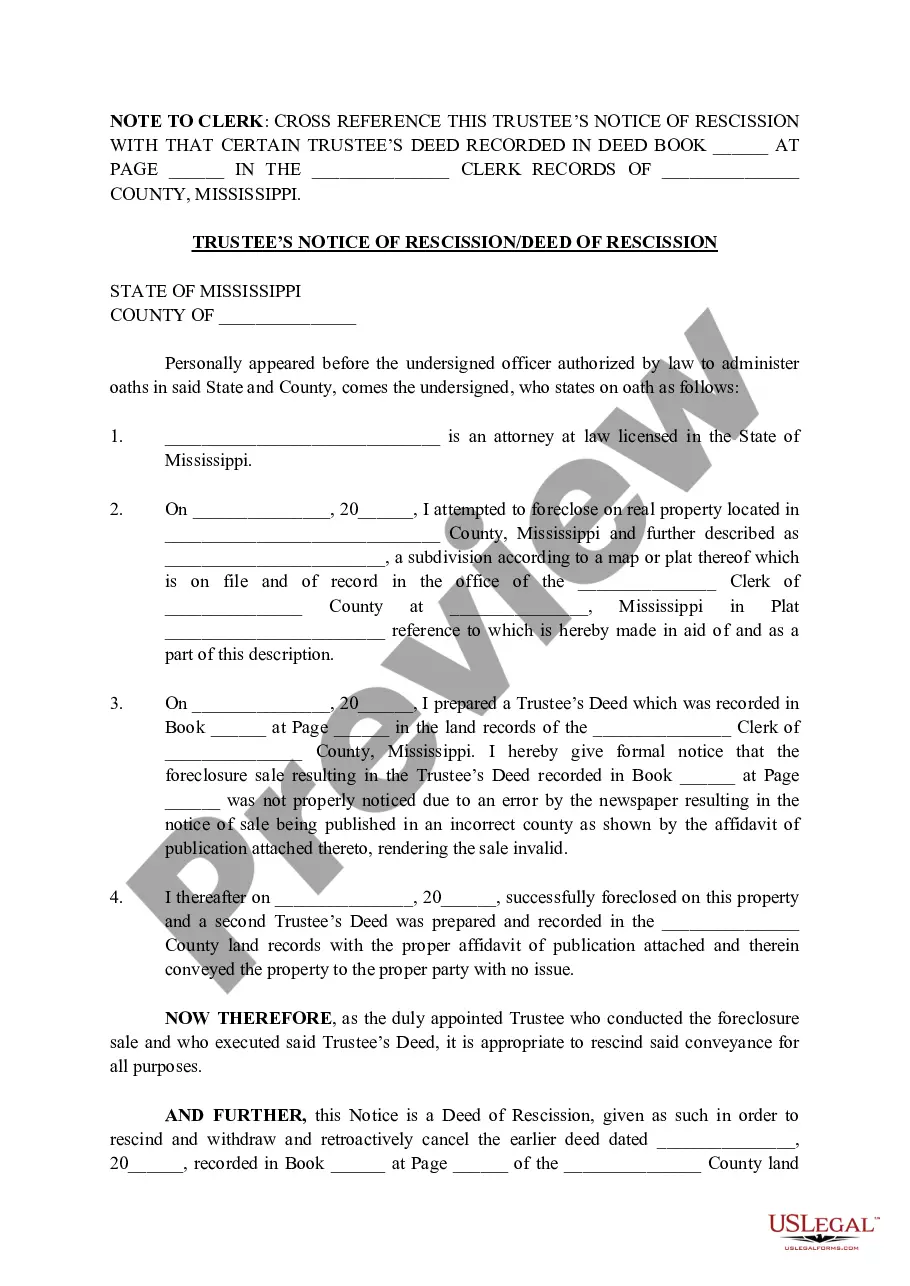

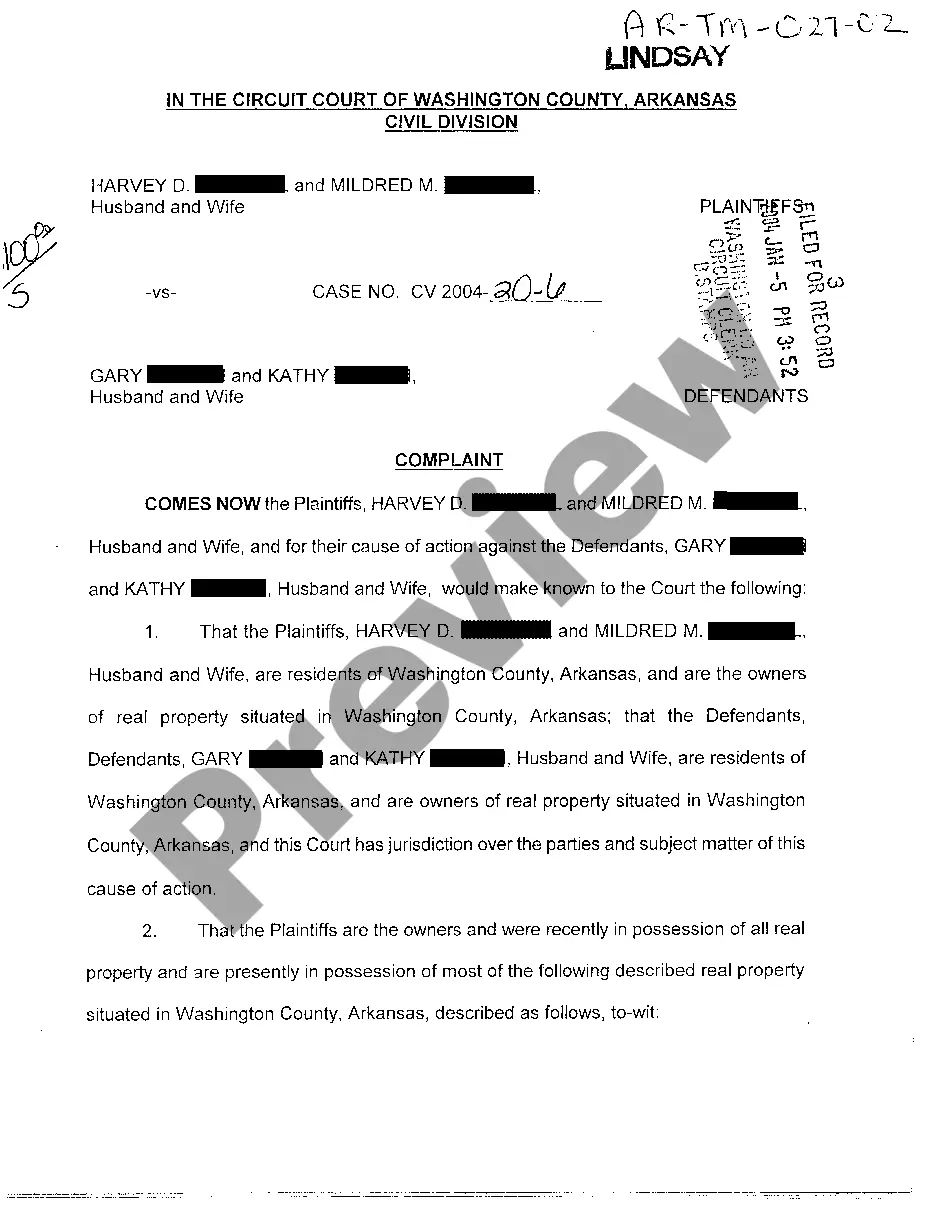

US Legal Forms provides a vast array of form templates, including the South Dakota Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand, which can be downloaded to comply with local and federal regulations.

If you are already acquainted with the US Legal Forms website and possess an account, simply Log In. Afterward, you can download the South Dakota Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand template.

Choose a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents menu. You can obtain another copy of South Dakota Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand anytime if necessary. Just follow the required form to download or print the document template. Use US Legal Forms, one of the most comprehensive collections of legal forms, to save time and avoid mistakes. The service offers professionally crafted legal document templates that you can use for various purposes. Create your account on US Legal Forms and start making your life a bit easier.

- Create an account if you don't have one and wish to start using US Legal Forms.

- Search for the form you need and confirm it is for your specific city/state.

- Use the Review option to inspect the form.

- Read the description to ensure you have chosen the correct form.

- If the form isn't what you want, utilize the Lookup section to find the form that meets your needs.

- Once you locate the appropriate form, click on Purchase now.

- Select the pricing plan you prefer, provide the necessary information to create your account, and complete the purchase using your PayPal or credit card.

Form popularity

FAQ

If an insurance agent has made a misrepresentation, it could significantly impact your claim and your relationship with the insurance company. Misrepresentation can lead to denied claims or even cancellation of your policy. It is essential to document any misrepresentation and consider filing a South Dakota Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand. Platforms like uslegalforms can assist you in formulating a solid case based on the evidence you collect.

To prove that an insurance company acted in bad faith, you must demonstrate that they failed to act reasonably in handling your claim. This can include denying a valid claim without a legitimate reason or failing to investigate your claim thoroughly. Gathering evidence, such as communication records and any documentation of the claim process, is vital when preparing a South Dakota Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand. Utilizing services like uslegalforms can streamline this process.

In California, the statute of limitations for filing a bad faith insurance claim generally falls under the two-year rule. This time frame begins when you become aware of the bad faith actions of the insurance company. It is crucial to act promptly, as delays can affect your ability to pursue a South Dakota Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand. Consulting with a legal expert can help you navigate this process effectively.

The collateral source rule in South Dakota allows a plaintiff to recover damages even if they have received compensation from other sources, such as insurance. This means that if you face wrongful termination of insurance benefits under ERISA, you can pursue a South Dakota Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand without worrying about offsets from other compensations. Essentially, the rule protects your right to full recovery for your losses, creating a fairer legal landscape.

In the realm of insurance, the company with the most complaints can vary by year and region. Generally, large national insurers often face more complaints simply due to their extensive customer base. However, if you are considering filing a South Dakota Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand, it's beneficial to research specific companies and their complaint histories. This understanding can help you choose an insurer or seek legal action if necessary.

7 Tips for Writing a Demand Letter To the Insurance Company Organize your expenses. ... Establish the facts. ... Share your perspective. ... Detail your road to recovery. ... Acknowledge and emphasize your pain and suffering. ... Request a reasonable settlement amount. ... Review your letter and send it!

How to write this complaint letter: Give all the relevant facts concerning the claim. Refer to any documents that will help substantiate your position. Include a specific request for action you feel will correct the situation. ... Close the letter with an expression of hope or confidence.

Insurance companies in South Dakota do not have a specific time frame in which a claim must be settled. State law requires insurers to acknowledge the claim within 30 days of receiving it, then send the necessary paperwork, but there is no official guidance on how long the rest of the process should take.

Consumer complaints against insurance companies must be received in writing. You may file a complaint using our Online Consumer Complaint Portal. You may print off our Insurance Complaint Form and mail or fax the completed form to the Consumer Services Division.

How to write an appeal letter to insurance company appeals departments Step 1: Gather Relevant Information. ... Step 2: Organize Your Information. ... Step 3: Write a Polite and Professional Letter. ... Step 4: Include Supporting Documentation. ... Step 5: Explain the Error or Omission. ... Step 6: Request a Review. ... Step 7: Conclude the Letter.