South Dakota Registration of Foreign Corporation

Description

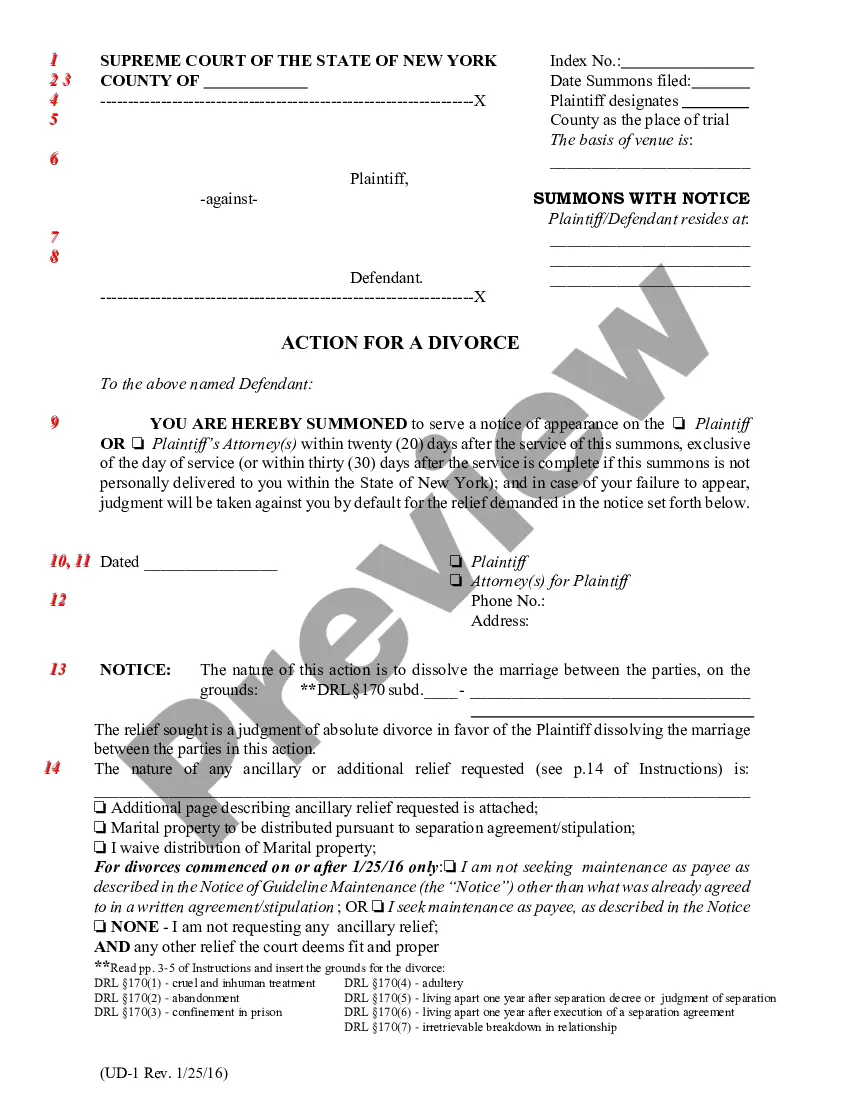

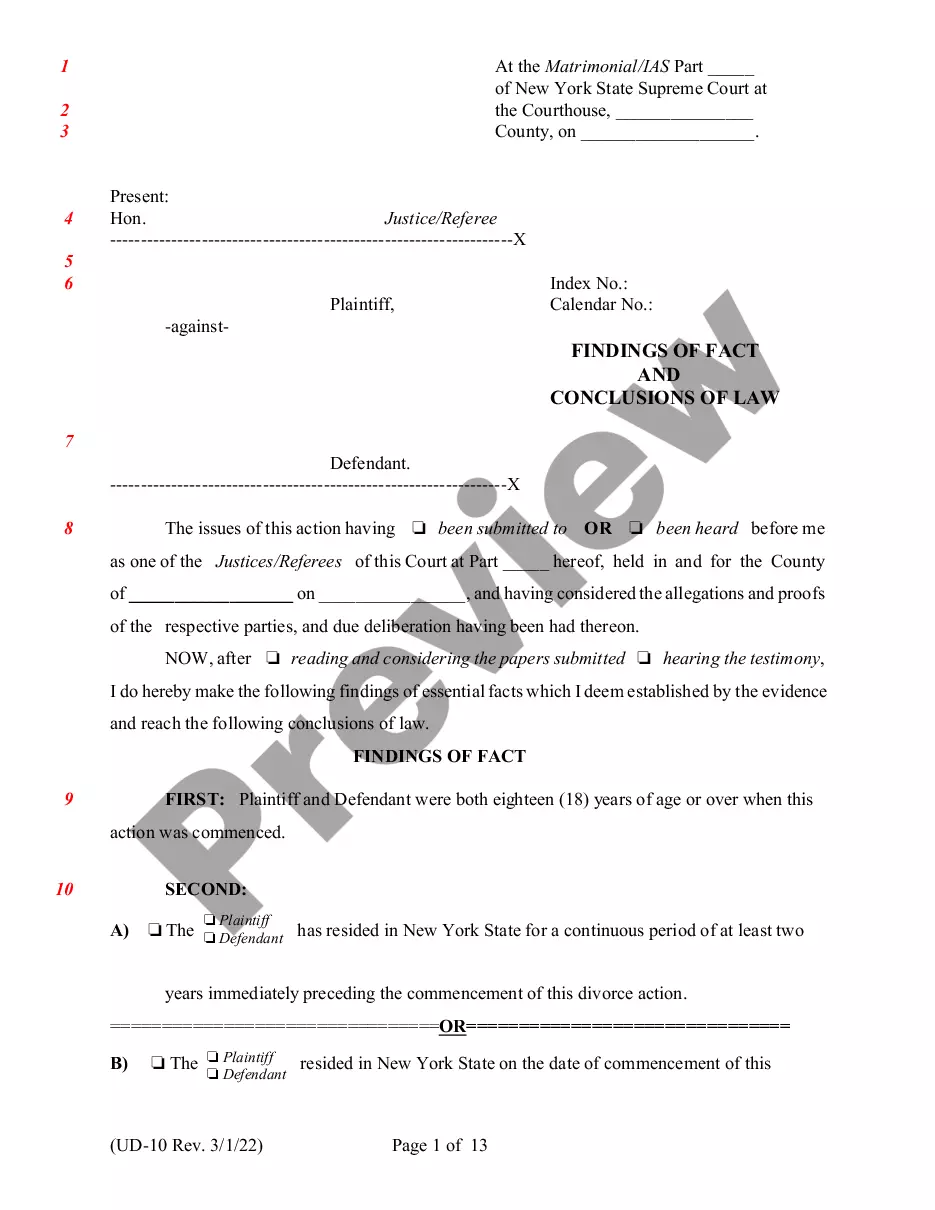

How to fill out South Dakota Registration Of Foreign Corporation?

Creating documents isn't the most uncomplicated task, especially for those who rarely deal with legal papers. That's why we recommend utilizing correct South Dakota Registration of Foreign Corporation templates created by professional attorneys. It gives you the ability to avoid problems when in court or working with formal organizations. Find the files you require on our site for top-quality forms and correct explanations.

If you’re a user having a US Legal Forms subscription, simply log in your account. When you’re in, the Download button will immediately appear on the file webpage. After downloading the sample, it will be stored in the My Forms menu.

Users without an active subscription can easily get an account. Utilize this simple step-by-step guide to get the South Dakota Registration of Foreign Corporation:

- Make certain that the form you found is eligible for use in the state it is required in.

- Verify the document. Make use of the Preview feature or read its description (if offered).

- Click Buy Now if this sample is what you need or use the Search field to get a different one.

- Select a convenient subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your document in a preferred format.

After doing these easy actions, it is possible to complete the form in a preferred editor. Double-check filled in information and consider asking a lawyer to review your South Dakota Registration of Foreign Corporation for correctness. With US Legal Forms, everything becomes much simpler. Try it now!

Form popularity

FAQ

What is a Foreign Legal Entity?Essentially, a foreign legal entity is similar to a foreign corporation. In America, it refers to an established corporation that is legally registered to operate in a state or jurisdiction outside of its original location.

Texas statutes do not specifically define transacting business; however, section 9.251 of the BOC lists 15 activities that do not constitute transacting business. Generally, a foreign entity is transacting business in Texas if it has an office or an employee in Texas or is otherwise pursuing one of its purposes in

When you formed your business, you had to do so in a specific state.Foreign entity registration is the process of registering your business in one state to do business in another state. The only state that your business is not foreign to is the original state you registered your business in.

In Washington, D.C. a business is considered a foreign LLC if it was formed in another state. Foreign refers to a business organized under the laws of another state.

Foreign Entity - Any business organization that transacts business outside of its state of formation is recognized as foreign in the states in which it obtains a certificate of authority. Foreign Qualification - Refers to registering your business or nonprofit outside its state of formation.

A Foreign entity is an entity that is already formed in another jurisdiction, state, or country.

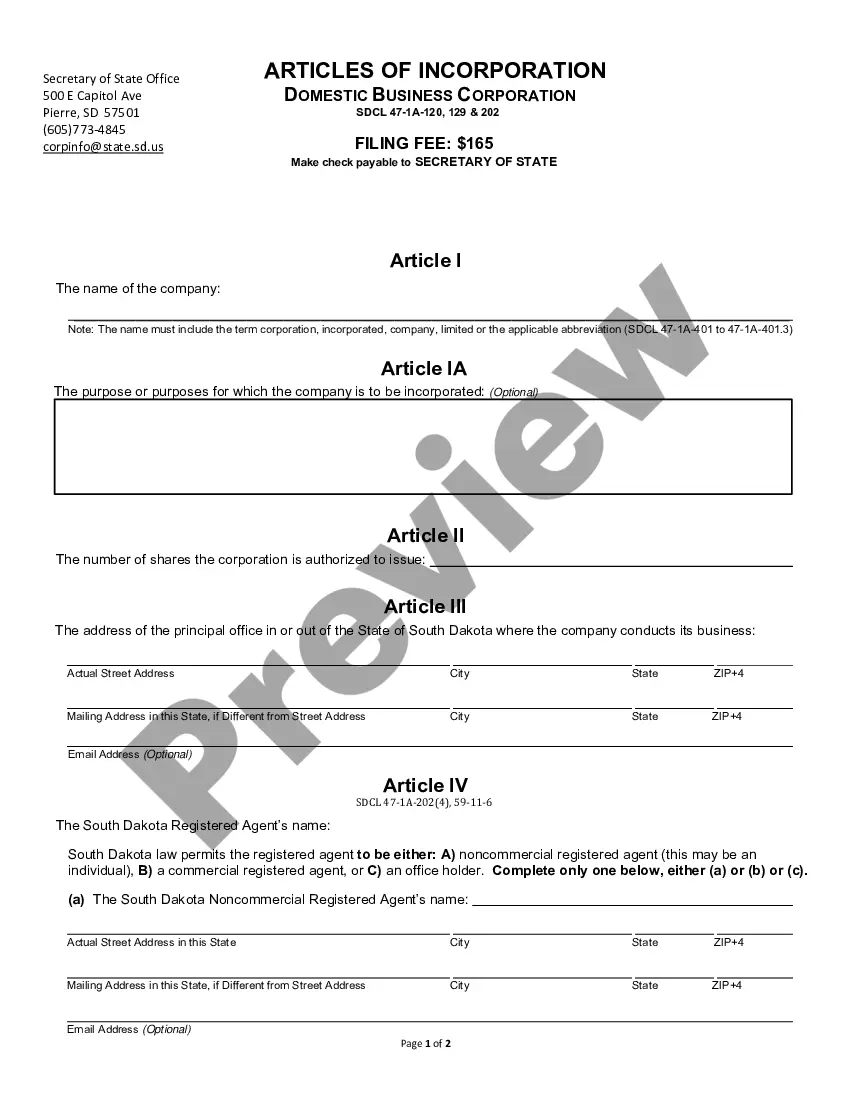

The filing fee is between $150 & $165 depending on how you file.

A Foreign Entity (also called "Out-of-State Entity") is an entity formed in a state other than the state (or another jurisdiction, such as foreign country) in which your company was originally formed.

A Foreign Entity (also called "Out-of-State Entity") is an entity formed in a state other than the state (or another jurisdiction, such as foreign country) in which your company was originally formed.