This office lease provision states that the definitions of terms for taxes on buildings and atriums and the land on which such buildings are located including all sidewalks, plazas, streets and land adjoining to such buildings, and all replacements thereof, and constituting a part of the same tax lot or lots.

South Carolina Provision Defining the Taxable Components Falling into the Escalation Definition of Taxes

Description

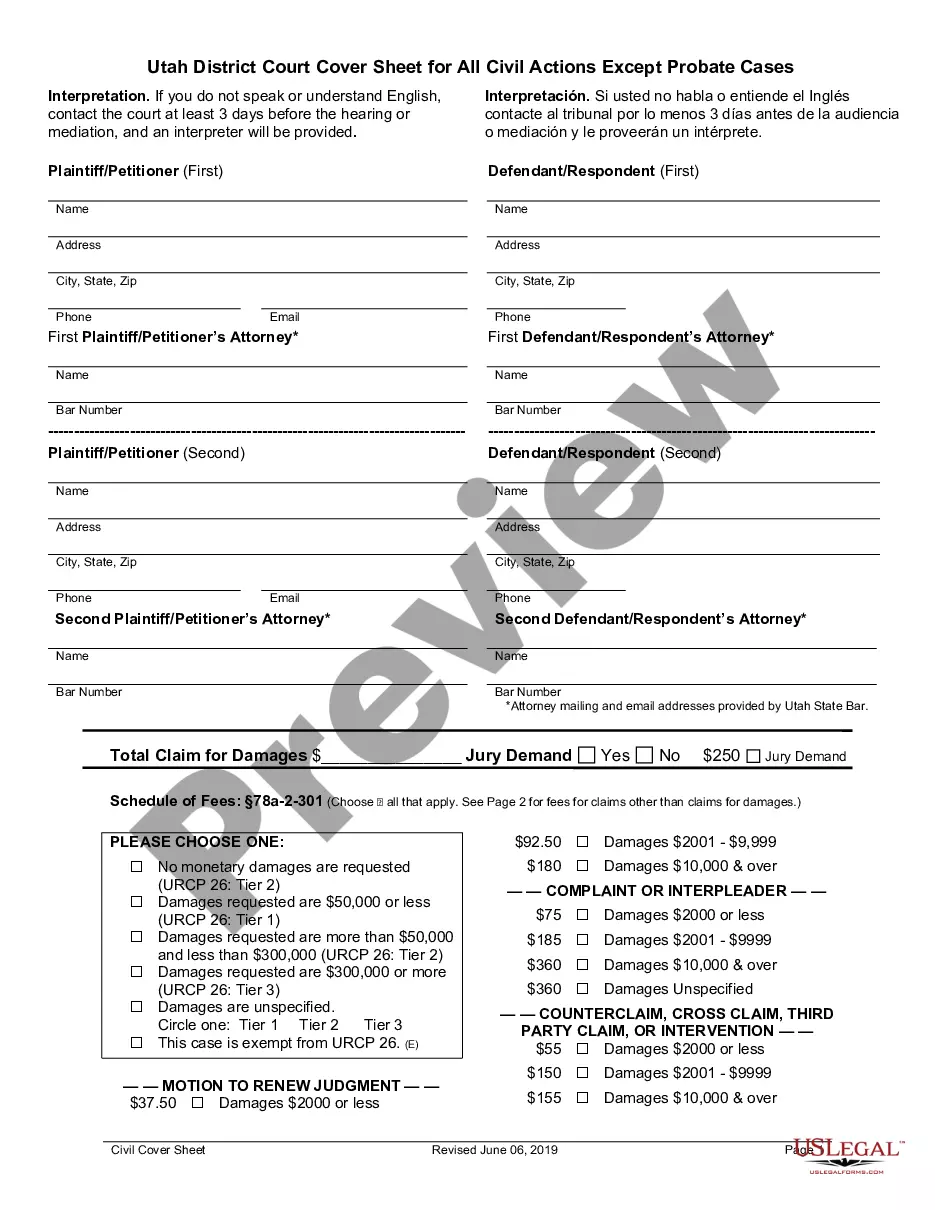

How to fill out Provision Defining The Taxable Components Falling Into The Escalation Definition Of Taxes?

Discovering the right legal file format can be a have difficulties. Needless to say, there are plenty of themes available online, but how will you find the legal develop you require? Make use of the US Legal Forms web site. The assistance gives a large number of themes, including the South Carolina Provision Defining the Taxable Components Falling into the Escalation Definition of Taxes, that can be used for business and personal needs. Every one of the types are checked out by professionals and meet federal and state demands.

In case you are previously listed, log in in your bank account and then click the Acquire option to find the South Carolina Provision Defining the Taxable Components Falling into the Escalation Definition of Taxes. Make use of your bank account to appear through the legal types you possess ordered in the past. Visit the My Forms tab of your respective bank account and have yet another copy of the file you require.

In case you are a brand new end user of US Legal Forms, listed here are simple recommendations that you should stick to:

- Very first, ensure you have chosen the correct develop to your area/county. It is possible to examine the shape making use of the Preview option and look at the shape description to make sure this is the best for you.

- If the develop does not meet your needs, make use of the Seach discipline to find the appropriate develop.

- Once you are certain that the shape is proper, select the Buy now option to find the develop.

- Pick the costs prepare you desire and type in the required information and facts. Design your bank account and buy the transaction with your PayPal bank account or charge card.

- Opt for the data file structure and down load the legal file format in your device.

- Total, change and print and signal the obtained South Carolina Provision Defining the Taxable Components Falling into the Escalation Definition of Taxes.

US Legal Forms may be the most significant local library of legal types in which you will find a variety of file themes. Make use of the company to down load skillfully-produced documents that stick to state demands.

Form popularity

FAQ

South Carolina Code §12-6-2210 provides for the determination of whether taxable income of a business will be apportioned. A taxpayer whose entire business is transacted or conducted in South Carolina is subject to income tax based on the entire taxable income of the business for the taxable year.

South Carolina Code §12-36-2120(75) specifically states that the exemption for unprepared food only applies to the state sales and use tax. Therefore, such sales are subject to local sales and use taxes unless the local sales and use tax specifically exempts sales of unprepared food.

(A) A use tax is imposed on the storage, use, or other consumption in this State of tangible personal property purchased at retail for storage, use, or other consumption in this State, at the rate of five percent of the sales price of the property, regardless of whether the retailer is or is not engaged in business in ...

Chapter 36 - South Carolina Sales And Use Tax Act. Section 12-36-2110. Maximum tax on sale or lease of certain items; calculation of tax on manufactured homes; maximum tax on purchase of certain property by religious organizations; maximum tax on sale or use of machinery for research and development.

South Carolina Code §12-6-3360(C)(1) provides a tax credit against South Carolina income tax, bank tax, or insurance premium tax for a qualifying business creating new jobs in this State.

Title 12 - Taxation. Chapter 36 - THE SOUTH CAROLINA SALES AND USE TAX ACT. Section 12-36-1710 - Excise tax on casual sales of motor vehicles, motorcycles, boats, motors, and airplanes; exclusions; payment of tax as prerequisite to titling, licensing, or registration.

INDIVIDUAL INCOME TAX RATES South Carolina Code §12-6-510 imposes an income tax upon the South Carolina taxable income of individuals, estates, and trusts at rates ranging from 3% to a maximum rate of 7%. There are six income brackets adjusted annually for inflation.

SECTION 12-36-60. "Tangible personal property". "Tangible personal property" means personal property which may be seen, weighed, measured, felt, touched, or which is in any other manner perceptible to the senses.