South Carolina Disclaimer of All Rights Under Operating Agreement by Successor to Party to Agreement

Description

How to fill out Disclaimer Of All Rights Under Operating Agreement By Successor To Party To Agreement?

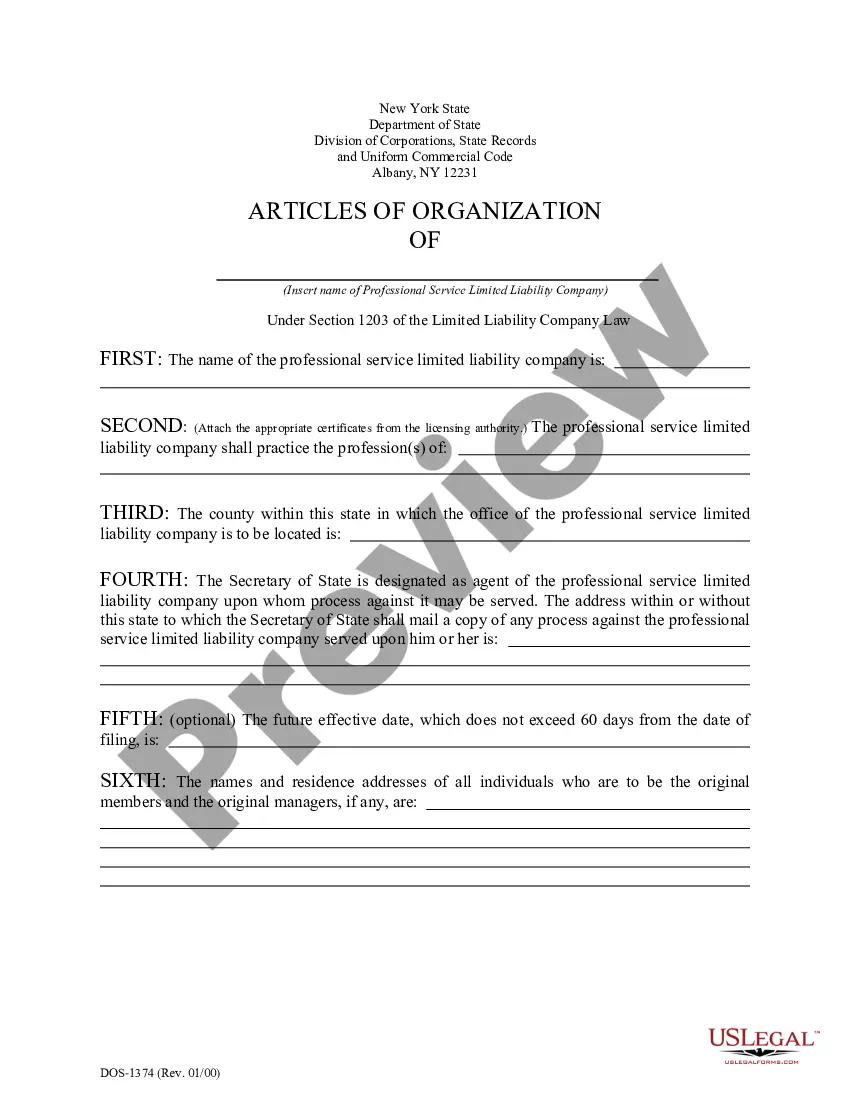

Choosing the best legal papers template can be quite a have a problem. Of course, there are plenty of templates accessible on the Internet, but how do you get the legal form you want? Make use of the US Legal Forms site. The assistance gives a large number of templates, such as the South Carolina Disclaimer of All Rights Under Operating Agreement by Successor to Party to Agreement, that can be used for organization and private requirements. All the varieties are examined by pros and fulfill state and federal specifications.

Should you be previously listed, log in for your bank account and click on the Down load button to have the South Carolina Disclaimer of All Rights Under Operating Agreement by Successor to Party to Agreement. Make use of your bank account to search with the legal varieties you may have ordered formerly. Visit the My Forms tab of your respective bank account and obtain one more version from the papers you want.

Should you be a brand new consumer of US Legal Forms, listed below are basic instructions that you can comply with:

- First, ensure you have chosen the appropriate form for the area/state. You are able to examine the shape making use of the Review button and study the shape explanation to ensure this is the right one for you.

- When the form fails to fulfill your expectations, utilize the Seach industry to obtain the appropriate form.

- When you are certain that the shape is proper, select the Purchase now button to have the form.

- Select the pricing strategy you want and enter the needed info. Create your bank account and pay for the order making use of your PayPal bank account or charge card.

- Pick the file structure and download the legal papers template for your gadget.

- Total, modify and print out and signal the acquired South Carolina Disclaimer of All Rights Under Operating Agreement by Successor to Party to Agreement.

US Legal Forms is the largest library of legal varieties where you can find a variety of papers templates. Make use of the company to download expertly-produced papers that comply with condition specifications.

Form popularity

FAQ

SECTION 33-44-202. Organization. (a) One or more persons may organize a limited liability company, consisting of one or more members, by delivering articles of organization to the office of the Secretary of State for filing.

South Carolina Code of Laws Sections 33-44-108 through 33-44-111 contain the state law governing registered agents for limited liability companies. This includes the need to have an agent and office for service of process, the procedures for changing the agent or office, and what an agent must do to resign.

S.C. Code Ann. § 33-44-504(e) provides that Section is the exclusive remedy by which a judgment creditor may satisfy a judgment out of the distributional interests in an LLC.

SECTION 33-44-303. Liability of members and managers. (a) Except as otherwise provided in subsection (c), the debts, obligations, and liabilities of a limited liability company, whether arising in contract, tort, or otherwise, are solely the debts, obligations, and liabilities of the company.

Title 33 - Corporations, Partnerships and Associations. Chapter 44 - UNIFORM LIMITED LIABILITY COMPANY ACT OF 1996. Section 33-44-1002 - Application for certificate of authority. (8) whether the members of the company are to be liable for its debts and obligations under a provision similar to Section 33-44-303(c).

The Secretary of State may commence a proceeding to dissolve a limited liability company administratively if the company does not pay a fee, tax, or penalty imposed by this chapter or other law within sixty days after it is due.