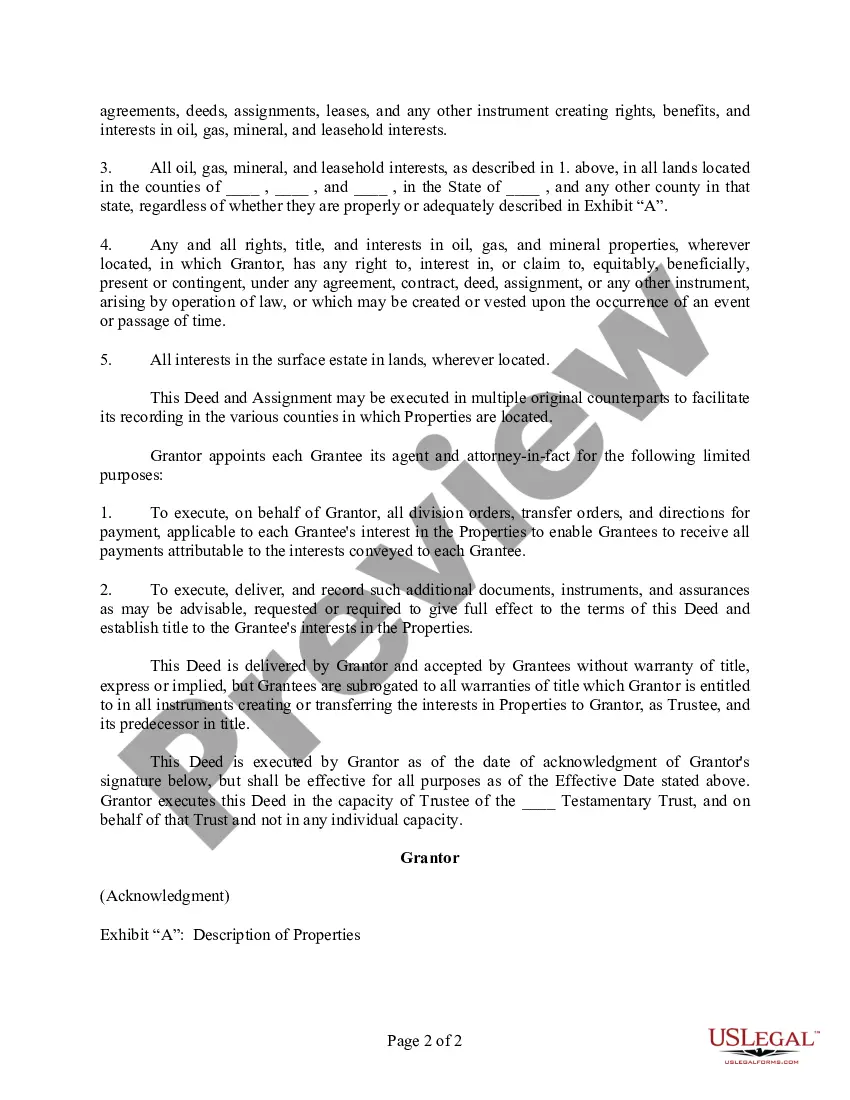

South Carolina Trustee's Deed and Assignment for Distribution by Trustee to Testamentary Trust Beneficiaries

Description

How to fill out Trustee's Deed And Assignment For Distribution By Trustee To Testamentary Trust Beneficiaries?

You may invest time on-line looking for the legal papers web template that suits the federal and state requirements you will need. US Legal Forms supplies a large number of legal forms that are examined by specialists. It is simple to obtain or print the South Carolina Trustee's Deed and Assignment for Distribution by Trustee to Testamentary Trust Beneficiaries from the assistance.

If you already have a US Legal Forms accounts, you may log in and click on the Acquire option. Following that, you may full, revise, print, or indicator the South Carolina Trustee's Deed and Assignment for Distribution by Trustee to Testamentary Trust Beneficiaries. Every single legal papers web template you acquire is the one you have eternally. To have one more duplicate associated with a acquired form, check out the My Forms tab and click on the related option.

If you use the US Legal Forms site the very first time, adhere to the simple recommendations listed below:

- First, ensure that you have chosen the correct papers web template for that region/metropolis that you pick. Browse the form information to ensure you have picked out the right form. If available, make use of the Review option to appear with the papers web template also.

- If you wish to locate one more version of the form, make use of the Research field to obtain the web template that meets your requirements and requirements.

- After you have discovered the web template you would like, click on Acquire now to move forward.

- Pick the costs plan you would like, key in your credentials, and sign up for a merchant account on US Legal Forms.

- Full the purchase. You may use your bank card or PayPal accounts to purchase the legal form.

- Pick the file format of the papers and obtain it to your gadget.

- Make changes to your papers if necessary. You may full, revise and indicator and print South Carolina Trustee's Deed and Assignment for Distribution by Trustee to Testamentary Trust Beneficiaries.

Acquire and print a large number of papers layouts using the US Legal Forms web site, that offers the most important selection of legal forms. Use specialist and express-certain layouts to handle your company or specific needs.

Form popularity

FAQ

Outright distributions, in which the beneficiaries receive the assets outright, generally in a lump sum, and without restrictions. Staggered distributions, in which assets remain in a trust and are distributed over time, or based on the beneficiaries' ages or specific dates or events.

Whether or not the trustee can withhold funds from you depends on the terms of the trust itself. If the trust requires withholding distributions under certain circumstances, such as the beneficiary reaching a specific age, the trustee must follow those stipulations.

Bank accounts, retirement accounts, and life insurance will automatically transfer an inheritance if beneficiaries are designated. Listing beneficiaries on these accounts can be the easiest and quickest way to transfer those assets outside probate court.

The deed of distribution is signed by the acting PR in the presence of a notary public and two witnesses before recording in the Register of Deeds' office of the county where the subject property is situated. A certified copy should be delivered to the probate court.

Any income/losses and capital gains/ losses earned in the in-trust account will be taxed in the trust unless the income or capital gains are paid or made payable to the beneficiaries. Income taxed in the trust is taxable at the highest marginal tax rate.

The transferee must have been a beneficiary of the trust when the property was acquired and became an asset of the trust (i.e. the relevant time). There must be no consideration for the transfer and the transfer of property from trustee to beneficiary must not be part of a sale or other arrangement.

In South Carolina, the personal representative must execute a deed of distribution with respect to real estate owned by a deceased person in order to transfer or release the estate's ownership or control over the property.

The grantor can opt to have the beneficiaries receive trust property directly without any restrictions. The trustee can write the beneficiary a check, give them cash, and transfer real estate by drawing up a new deed or selling the house and giving them the proceeds.