South Carolina Cease and Desist for Debt Collectors

Description

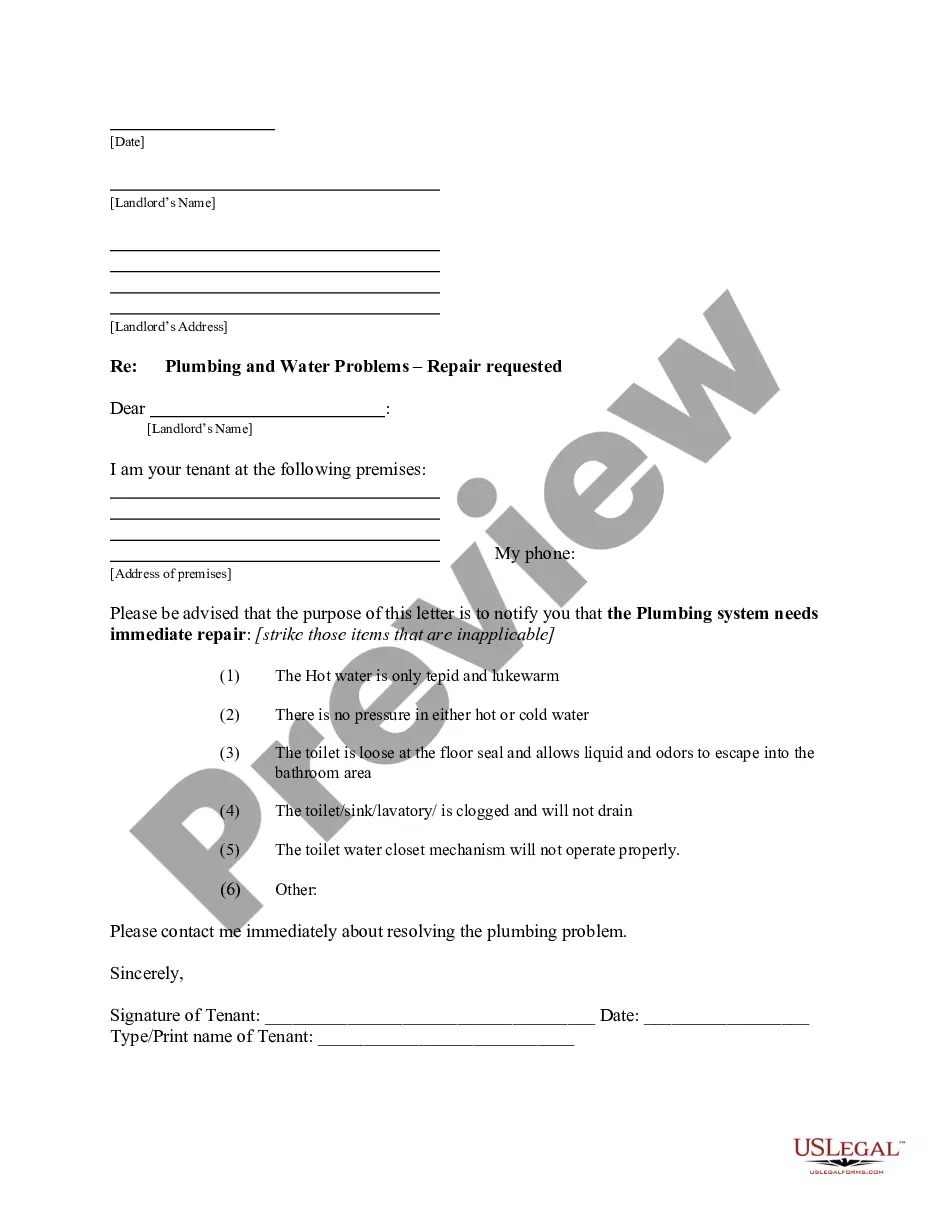

How to fill out Cease And Desist For Debt Collectors?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal document templates that you can download or print. By using the website, you can discover thousands of forms for business and personal purposes, sorted by categories, states, or keywords.

You can obtain the latest versions of forms such as the South Carolina Cease and Desist for Debt Collectors in just seconds. If you already have a monthly subscription, Log In and retrieve the South Carolina Cease and Desist for Debt Collectors from the US Legal Forms library. The Download button will appear on every form you view. You have access to all previously downloaded forms within the My documents tab of your account.

If you are using US Legal Forms for the first time, here are simple instructions to help you get started: Ensure you have selected the correct form for your city/county. Click the Preview button to review the form's content. Read the form description to confirm you have chosen the right form. If the form does not meet your requirements, use the Search field at the top of the screen to find one that does. When you are satisfied with the form, confirm your selection by clicking the Purchase now button. Then, choose the pricing plan you want and provide your information to register for an account.

Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Process the transaction. Use your Visa or Mastercard or PayPal account to complete the transaction.

- Choose the format and download the form to your device.

- Make modifications. Complete, edit, print, and sign the downloaded South Carolina Cease and Desist for Debt Collectors.

- Every template you added to your account has no expiration date and belongs to you permanently.

- Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need.

- Access the South Carolina Cease and Desist for Debt Collectors with US Legal Forms, the most extensive library of legal document templates.

Form popularity

FAQ

Certainly, you can instruct a debt collector to cease communication. By sending a formal cease and desist letter, you notify them that you do not wish to be contacted again. This is an important step if you find their calls intrusive or harassing. Utilizing a South Carolina Cease and Desist for Debt Collectors can be an effective way to manage your situation.

Yes, you can send a cease and desist letter to a debt collector in South Carolina. This letter instructs the collector to stop all communication regarding the debt. It is a powerful tool to assert your rights and can provide you with peace of mind. Using a South Carolina Cease and Desist for Debt Collectors template can simplify the process.

In South Carolina, the statute of limitations for most debts is three years. This means that creditors have three years to file a lawsuit to collect the debt. After this period, the debt becomes uncollectible through legal means. If you believe your debt is nearing this time limit, consider using a South Carolina Cease and Desist for Debt Collectors to protect yourself.

Debt collector laws in South Carolina are designed to protect consumers from abusive practices. These laws regulate how debt collectors can communicate with you and require them to provide certain information about the debt. Understanding these laws is crucial, and using a South Carolina Cease and Desist for Debt Collectors letter can help you assert your rights effectively. For detailed guidance, consider resources like US Legal Forms, which provide insights into these regulations.

You can tell a debt collector to cease and desist, and doing so can protect your rights. Under the Fair Debt Collection Practices Act, you have the right to request that a collector stop contacting you. Sending a South Carolina Cease and Desist for Debt Collectors letter not only puts your request in writing but also provides a record of your communication. This step can help you regain control over your situation.

Yes, you can write a cease and desist letter to a debt collector. This letter formally requests that the collector stop all communication with you regarding the debt. By using a professionally crafted South Carolina Cease and Desist for Debt Collectors template, you can ensure your letter meets legal requirements and effectively communicates your wishes. Platforms like US Legal Forms offer easy-to-use templates that simplify this process.

A 609 letter is a request for verification of a debt under Section 609 of the Fair Credit Reporting Act. This letter requests that the debt collector provide proof that you owe the debt they are trying to collect. It's a way to challenge the validity of the debt and can be an important step in managing your financial situation. For those in South Carolina, sending a 609 letter can complement the efforts made with a cease and desist letter.

Yes, cease and desist letters can be effective in stopping debt collectors from contacting you. When you send a letter asserting your right to cease communication, collectors are legally obligated to comply. This can provide you with the peace of mind and breathing room needed to address your financial situation. Using a professionally crafted South Carolina Cease and Desist for Debt Collectors can enhance its effectiveness.

The 11-word phrase often referenced to stop debt collectors is, 'I do not want to hear from you ever again.' This statement, when communicated effectively, can serve as a powerful way to assert your rights. By using this phrase, you can prompt the collector to cease communication under the Fair Debt Collection Practices Act. When combined with a formal South Carolina Cease and Desist for Debt Collectors, it can be particularly effective.

Writing a cease and desist letter to a debt collector is straightforward. Start by addressing the letter to the debt collector, clearly stating your intention to cease further communication. Include your account information, specify the type of debt, and assert your rights under the law. Using a service like USLegalForms can provide templates and guidance to ensure your letter is effective and compliant with South Carolina laws.