South Carolina Self-Employed Precast Concrete Contract

Description

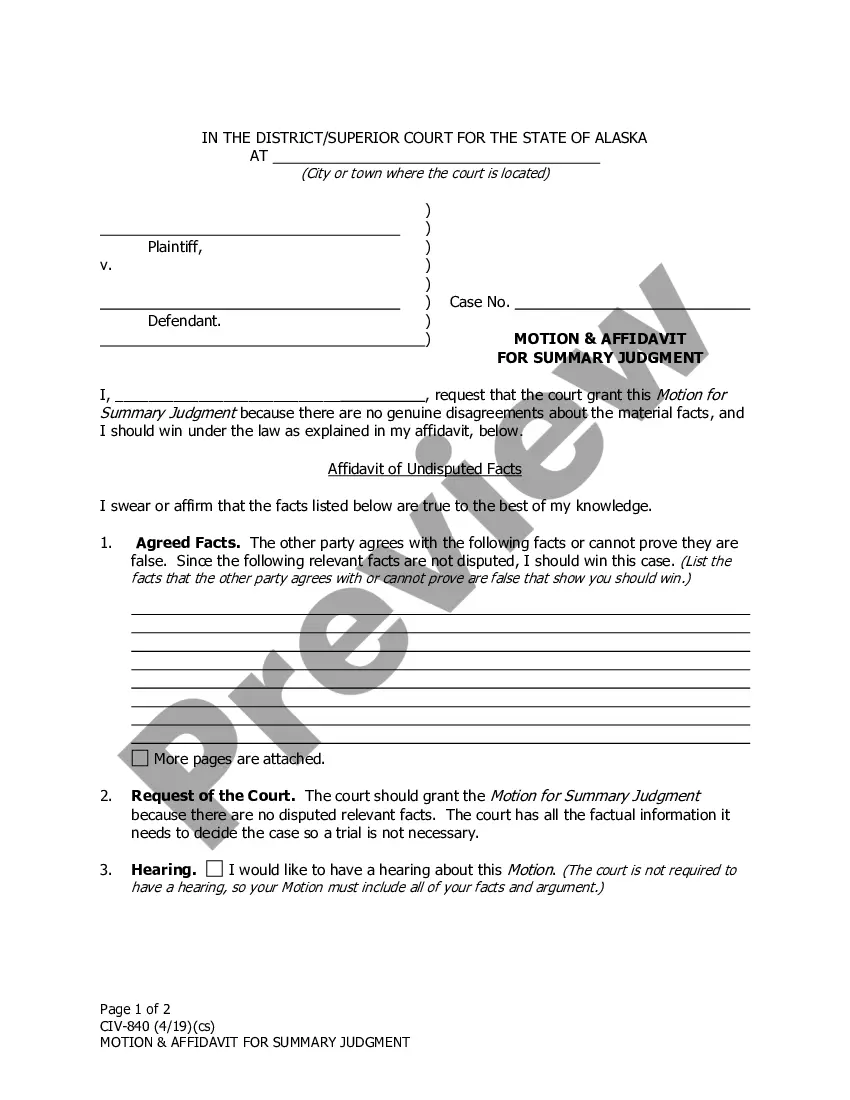

How to fill out Self-Employed Precast Concrete Contract?

If you need to acquire comprehensive, download, or print legal document templates, utilize US Legal Forms, the largest selection of legal forms available online. Use the site's simple and user-friendly search to find the documents you require. Various templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to locate the South Carolina Self-Employed Precast Concrete Contract within a few clicks.

If you are already a US Legal Forms member, Log Into your account and click the Download button to obtain the South Carolina Self-Employed Precast Concrete Contract. You can also access forms you previously acquired from the My documents section of your account.

If you are using US Legal Forms for the first time, follow the instructions below: Step 1. Ensure you have selected the form for the correct city/state. Step 2. Use the Review option to browse through the form’s details. Don’t forget to read the information. Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other variations of the legal form template. Step 4. Once you have found the form you need, click on the Purchase now button. Choose the pricing plan you prefer and enter your details to register for the account. Step 5. Complete the payment. You can use your Visa or MasterCard or PayPal account to process the payment. Step 6. Select the format of your legal document and download it to your device. Step 7. Complete, modify, and print or sign the South Carolina Self-Employed Precast Concrete Contract.

- Every legal document template you purchase is yours for a long time.

- You will have access to every form you obtained with your account.

- Click on the My documents section and select a form to print or download again.

- Be proactive and download, and print the South Carolina Self-Employed Precast Concrete Contract with US Legal Forms.

- There are numerous professional and state-specific forms you can utilize for your business or personal needs.

Form popularity

FAQ

In South Carolina, a handyman can perform minor repairs and maintenance tasks without a license. This includes small jobs like painting, fixing leaky faucets, or assembling furniture. However, for larger projects that involve the South Carolina Self-Employed Precast Concrete Contract, a licensed contractor is necessary to ensure compliance with state regulations. Always know the limits of what unlicensed individuals can legally do to avoid issues.

Yes, hiring an unlicensed contractor in South Carolina can lead to legal complications. If you hire someone without the proper license, you may not have protections under the law, which can impact your project. This is especially important when dealing with specialized work, like the South Carolina Self-Employed Precast Concrete Contract. Always verify the licensing status of any contractor you consider hiring.

If you are caught working without a contractor's license in South Carolina, you may face significant penalties. Fines can accumulate, and you may be required to stop all work immediately. Additionally, you could lose potential contracts, including those related to the South Carolina Self-Employed Precast Concrete Contract. It is essential to ensure you meet all licensing requirements to avoid these issues.

Yes, you can write your own legally binding contract as long as it includes essential elements like the agreement between the parties, consideration, and lawful purpose. It is important to ensure clarity in the terms to avoid potential disputes. For a comprehensive South Carolina Self-Employed Precast Concrete Contract, consider using resources like uslegalforms to ensure all legal requirements are met.

The independent contractor agreement in South Carolina is a legal document that outlines the relationship between a contractor and a client. This agreement specifies the nature of the work, payment terms, and other obligations. For those involved in concrete work, a South Carolina Self-Employed Precast Concrete Contract can help clarify these terms and ensure legal compliance.

To make a contract for concrete work, begin by outlining the project scope, including types of concrete, project timelines, and payment schedules. It’s important to clarify roles and expectations to avoid misunderstandings. Utilizing a South Carolina Self-Employed Precast Concrete Contract template from uslegalforms can provide you with a solid foundation for your agreement.

Writing a contract for a concrete job starts with detailing the work to be performed, including specifications for materials and techniques. Include payment terms and deadlines to ensure both parties are on the same page. A well-crafted South Carolina Self-Employed Precast Concrete Contract from uslegalforms can guide you through the necessary elements for a successful agreement.

To write an independent contractor contract, begin with the contractor's and client’s details, along with the contract date. Clearly define the scope of work, payment terms, and duration of the contract. Using a structured format, such as those available on uslegalforms, can help you create a South Carolina Self-Employed Precast Concrete Contract that protects both parties.

Writing a simple construction contract involves defining the project details, including materials, timelines, and payment terms. You should specify the responsibilities of each party, ensuring clarity on what is expected. For a South Carolina Self-Employed Precast Concrete Contract, consider using templates from platforms like uslegalforms to simplify the process and ensure compliance with state laws.

To write a simple contract agreement, start with the names of the parties involved and the date of the agreement. Clearly outline the terms and conditions of the agreement, including the scope of work, payment details, and deadlines. Make sure to include a section for signatures to make the South Carolina Self-Employed Precast Concrete Contract legally binding.