South Carolina Self-Employed Independent Contractor Consideration For Hire Form

Description

How to fill out Self-Employed Independent Contractor Consideration For Hire Form?

Have you found yourself in a circumstance where you require documentation for both organizational or personal purposes almost every day.

There are numerous legal document templates accessible online, but locating reliable versions can be challenging.

US Legal Forms provides thousands of form templates, including the South Carolina Self-Employed Independent Contractor Consideration For Hire Form, designed to meet state and federal requirements.

Once you find the appropriate form, click Acquire now.

Select the pricing plan you prefer, complete the required information to create your account, and pay for the order using your PayPal or credit card. Choose a convenient document format and download your copy. Access all the document templates you have purchased in the My documents menu. You can obtain an additional copy of the South Carolina Self-Employed Independent Contractor Consideration For Hire Form whenever needed. Just select the desired form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors. The service offers properly crafted legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and start making your life simpler.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Then, you will be able to download the South Carolina Self-Employed Independent Contractor Consideration For Hire Form template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/region.

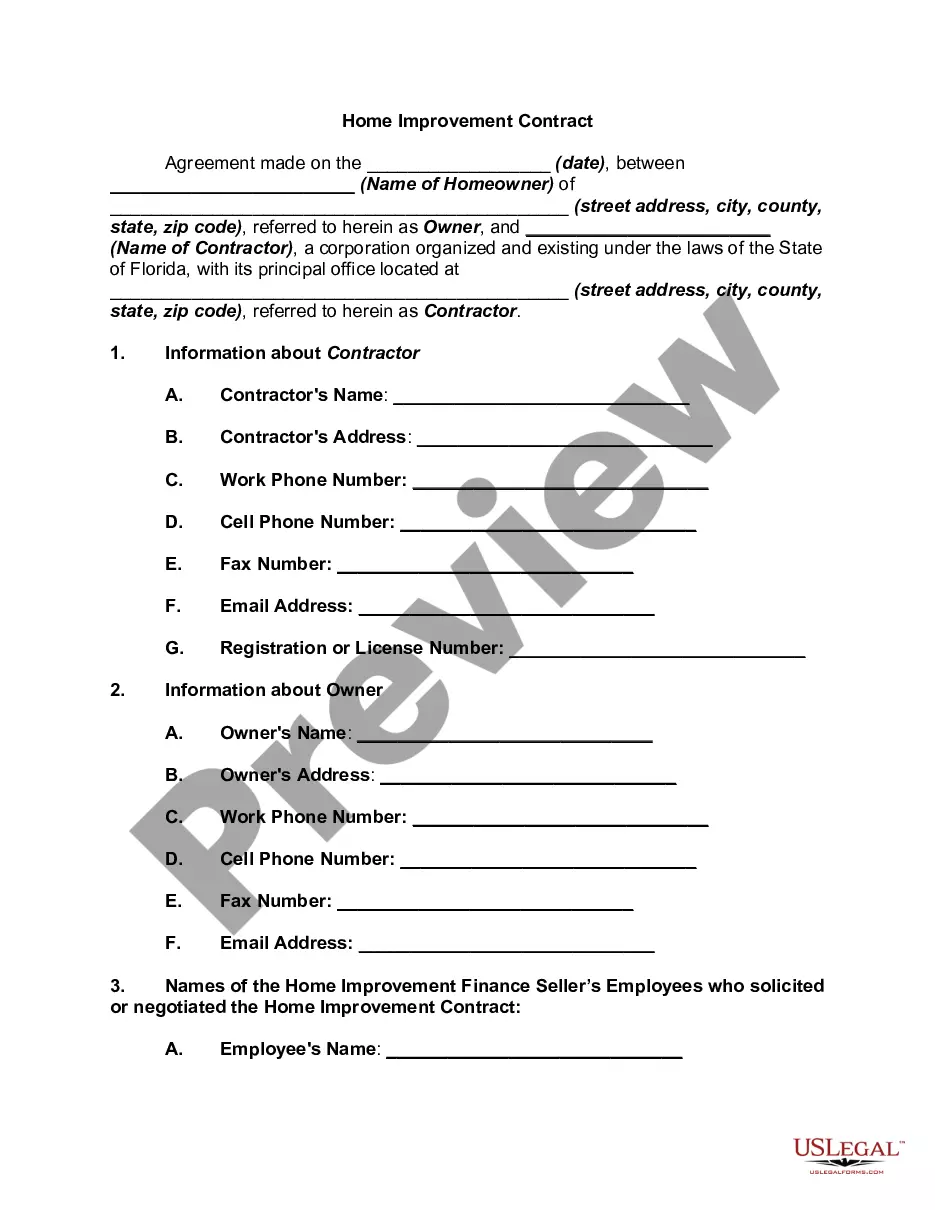

- Utilize the Review button to examine the form.

- Read the description to confirm that you have selected the right form.

- If the form is not what you are looking for, use the Search field to find the form that suits your requirements.

Form popularity

FAQ

Legal requirements for independent contractors include having a well-defined contract, such as the South Carolina Self-Employed Independent Contractor Consideration For Hire Form, which outlines the working terms and compensation. It is also necessary to ensure proper tax documentation, including a W-9 form. Understanding these legalities protects both the contractor and the hiring entity, promoting a healthy working relationship. Compliance with all legal requirements is vital for successful contract work.

Yes, an independent contractor is considered self-employed as they operate their own business and provide services under a contract. This classification allows them to enjoy greater flexibility in work arrangements and tax management. Nevertheless, it is important to complete the South Carolina Self-Employed Independent Contractor Consideration For Hire Form to formalize the self-employment status. This form is crucial for both legal protection and clarity in responsibilities.

Independent contractors typically need to fill out the South Carolina Self-Employed Independent Contractor Consideration For Hire Form and a W-9 form. The first form outlines the hiring specifics, while the W-9 form collects tax information. These forms help maintain clarity in the working relationship, ensuring both parties are on the same page for tax obligations. Completing these documents helps facilitate a legally sound arrangement.

An independent contractor should fill out a South Carolina Self-Employed Independent Contractor Consideration For Hire Form to clarify the terms of the working relationship. They should also complete a W-9 form to provide their taxpayer information. It is essential for independent contractors to maintain accurate records for tax filing and compliance. Ensuring these forms are filled out correctly mitigates misunderstandings.

To hire an independent contractor in South Carolina, you will need a South Carolina Self-Employed Independent Contractor Consideration For Hire Form. This form ensures that both parties understand their responsibilities and the terms of the engagement. Additionally, you may want to gather a W-9 form for tax purposes. Having the right paperwork promotes a smooth hiring process.

To complete an independent contractor form, begin with your personal information and details about your services. If using the South Carolina Self-Employed Independent Contractor Consideration For Hire Form, ensure you accurately describe the nature of your work and your business structure. Double-check for any required signatures and submission instructions to avoid any delays.

Filling out an independent contractor agreement involves clearly stating the roles, responsibilities, and compensation involved in the project. Use the South Carolina Self-Employed Independent Contractor Consideration For Hire Form as a reference point to include necessary terms, such as deadlines, work expectations, and payment structures. Be sure both parties review and sign the agreement to finalize the arrangement.

An independent contractor typically needs to complete several forms, including the South Carolina Self-Employed Independent Contractor Consideration For Hire Form. They should also fill out a W-9 form for tax purposes and consider signing a detailed independent contractor agreement that defines the scope of work. Proper paperwork aids in establishing a clear professional relationship and ensures tax compliance.

When hiring an independent contractor, you need to prepare several key documents, including the South Carolina Self-Employed Independent Contractor Consideration For Hire Form. Additionally, it’s essential to create a written independent contractor agreement outlining the terms and conditions of the job. Keeping all paperwork organized ensures compliance with state regulations and protects both parties involved.

To fill out the South Carolina Self-Employed Independent Contractor Consideration For Hire Form, start by gathering your basic information, including your name, address, and the services you provide. Clearly state your intention to operate as an independent contractor rather than an employee. Follow the prompts carefully, and ensure you sign and date the document to validate it, which helps establish your status appropriately.