South Carolina Grant Agreement from 501(c)(3) to 501(c)(4)

Description

How to fill out Grant Agreement From 501(c)(3) To 501(c)(4)?

You are able to devote hours on-line searching for the legal document format that suits the state and federal demands you need. US Legal Forms provides thousands of legal types that are evaluated by experts. It is possible to download or print the South Carolina Grant Agreement from 501(c)(3) to 501(c)(4) from my support.

If you have a US Legal Forms account, you can log in and click on the Download key. Next, you can full, revise, print, or indication the South Carolina Grant Agreement from 501(c)(3) to 501(c)(4). Every legal document format you get is the one you have eternally. To get one more version for any obtained type, visit the My Forms tab and click on the corresponding key.

Should you use the US Legal Forms web site the very first time, keep to the simple guidelines listed below:

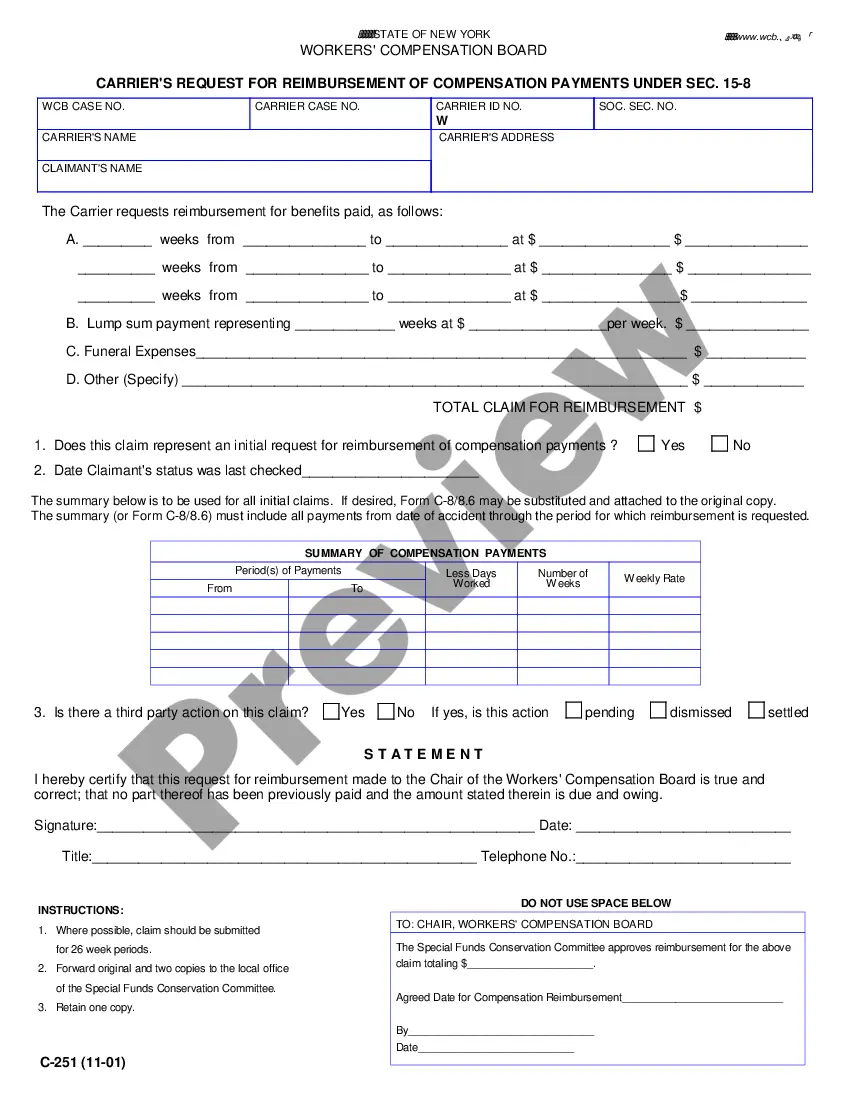

- First, be sure that you have chosen the right document format for the region/area of your choice. Read the type information to make sure you have picked out the correct type. If available, utilize the Review key to check with the document format as well.

- If you want to locate one more edition from the type, utilize the Look for field to find the format that meets your needs and demands.

- When you have discovered the format you desire, just click Get now to move forward.

- Pick the prices prepare you desire, type your credentials, and sign up for a merchant account on US Legal Forms.

- Total the purchase. You can utilize your bank card or PayPal account to fund the legal type.

- Pick the structure from the document and download it to your device.

- Make modifications to your document if possible. You are able to full, revise and indication and print South Carolina Grant Agreement from 501(c)(3) to 501(c)(4).

Download and print thousands of document templates while using US Legal Forms Internet site, which offers the greatest variety of legal types. Use specialist and state-specific templates to tackle your small business or specific needs.

Form popularity

FAQ

South Carolina Sales Tax Exemption for a Nonprofit In some states, your organization is not automatically exempt from state sales tax, even after obtaining 501(c)(3) recognition from the IRS. You must file a separate application in order to receive state sales tax exemption.

Starting a nonprofit can be a lengthy process. Some of it depends on how quickly you can get organized, assemble a board of directors, incorporate your nonprofit, and prepare everything you need to apply for tax-exempt status. For most new nonprofits, this stage can take a few months.

To start a nonprofit corporation in South Carolina, you must file nonprofit Articles of Incorporation with the South Carolina Secretary of State. You can submit your articles in person, by mail, or online. The articles of incorporation cost $25 to file.

In South Carolina, you must have a minimum of three directors. Most nonprofits will have more depending on the size and structure of the organization. South Carolina also requires that board members be naturalized persons. There are no residency or membership requirements in the state.

In South Carolina, you must have a minimum of three directors. Most nonprofits will have more depending on the size and structure of the organization. South Carolina also requires that board members be naturalized persons. There are no residency or membership requirements in the state.

A 501(c)(3) organization is a nonprofit organization established exclusively for one of the following purposes: charitable, religious, educational, scientific, literary, testing for public safety, fostering national or international amateur sports competition, or preventing cruelty to children or animals.

How to Start a Nonprofit in South Carolina Name Your Organization. ... Recruit Incorporators and Initial Directors. ... Appoint a Registered Agent. ... Prepare and File Articles of Incorporation. ... File Initial Report. ... Obtain an Employer Identification Number (EIN) ... Store Nonprofit Records. ... Establish Initial Governing Documents and Policies.

Costs of starting a new nonprofit in South Carolina These are the filing fees for South Carolina nonprofits: Filing Articles of Incorporation: $25. Applying for federal income tax exemption or 501(c): $275 or $600 IRS fee. South Carolina charitable registration: $50 (or $0 if filing exemption)