South Carolina Director Option Agreement

Description

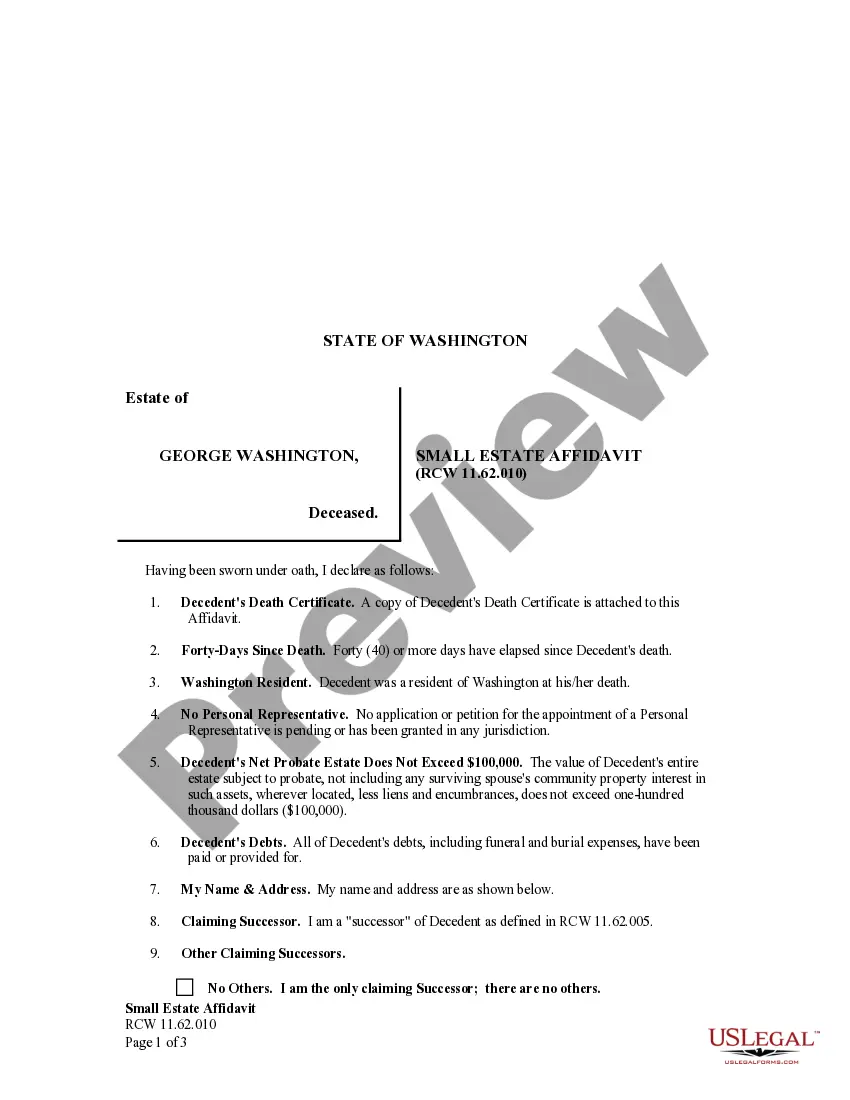

How to fill out Director Option Agreement?

Have you been in the place in which you require documents for possibly company or specific purposes almost every day? There are a variety of legitimate document web templates available on the Internet, but getting ones you can trust isn`t effortless. US Legal Forms offers 1000s of develop web templates, like the South Carolina Director Option Agreement, which can be composed to fulfill state and federal demands.

When you are currently familiar with US Legal Forms website and also have your account, simply log in. Afterward, it is possible to acquire the South Carolina Director Option Agreement web template.

Should you not provide an bank account and wish to begin using US Legal Forms, adopt these measures:

- Get the develop you require and make sure it is for the right metropolis/county.

- Utilize the Review key to check the form.

- Read the explanation to ensure that you have chosen the appropriate develop.

- When the develop isn`t what you`re searching for, utilize the Research area to obtain the develop that meets your needs and demands.

- Whenever you find the right develop, just click Buy now.

- Choose the costs prepare you want, complete the necessary details to generate your money, and buy the transaction using your PayPal or Visa or Mastercard.

- Choose a convenient data file format and acquire your version.

Locate all the document web templates you might have purchased in the My Forms menu. You can obtain a extra version of South Carolina Director Option Agreement whenever, if needed. Just go through the necessary develop to acquire or printing the document web template.

Use US Legal Forms, by far the most extensive assortment of legitimate forms, to conserve time as well as avoid errors. The services offers appropriately manufactured legitimate document web templates which can be used for a selection of purposes. Produce your account on US Legal Forms and initiate producing your lifestyle easier.

Form popularity

FAQ

A share option agreement is an agreement between the holder of shares and a third party giving one party the right (but not the obligation) to purchase or sell shares at a future date, at an agreed price. If the option is exercised, the other party is obliged to purchase or sell those shares.

Shareholders own the company by owning its shares and are often referred to as 'members'. Directors on the other hand, manage the business and its operations. Unless the articles of association state so, a director isn't required to be a shareholder, and a shareholder has no legal right to be a director.

A share option is the right to buy a certain number of shares at a fixed price, some period of time in the future, within a company. Employees can generally exercise their share options - ie buy the shares - after a specified period, known as the vesting period.

A share option gives the holder the right, but not the obligation, to purchase a specific number of shares in the company at a predetermined price, known as the 'exercise price', or the 'strike price'.

ESOs are a form of equity compensation granted by companies to their employees and executives. Like a regular call option, an ESO gives the holder the right to purchase the underlying asset?the company's stock?at a specified price for a finite period of time.

Stock Options? this is valued by the grant date fair value award that is reported by the company; equates to approximately 6% of total compensation. Full Value Stock Awards? includes stock and stock unit awards; equates to approximately 48% of total compensation.