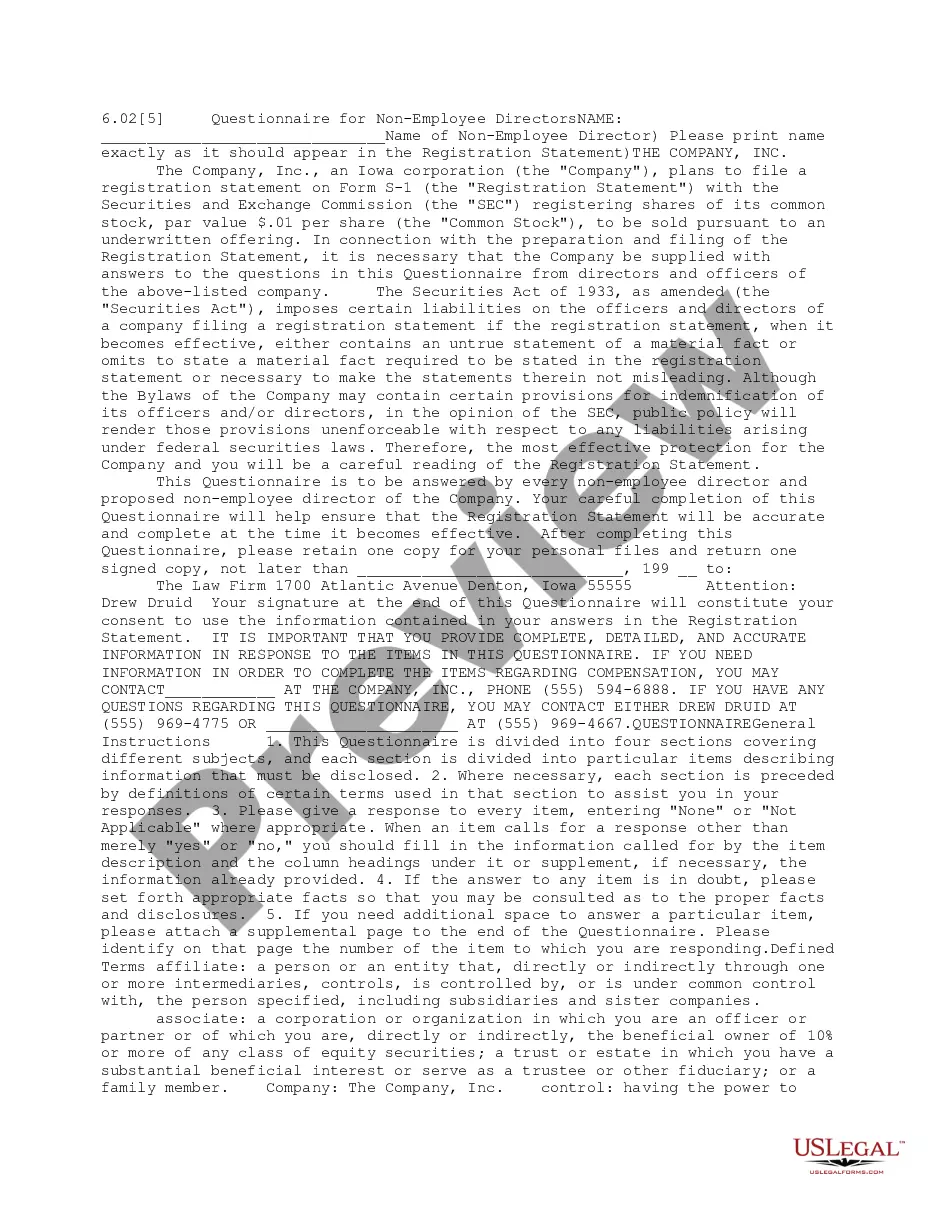

This form is a due diligence checklist that outlines information pertinent to non-employee directors in a business transaction.

South Carolina Nonemployee Director Checklist

Description

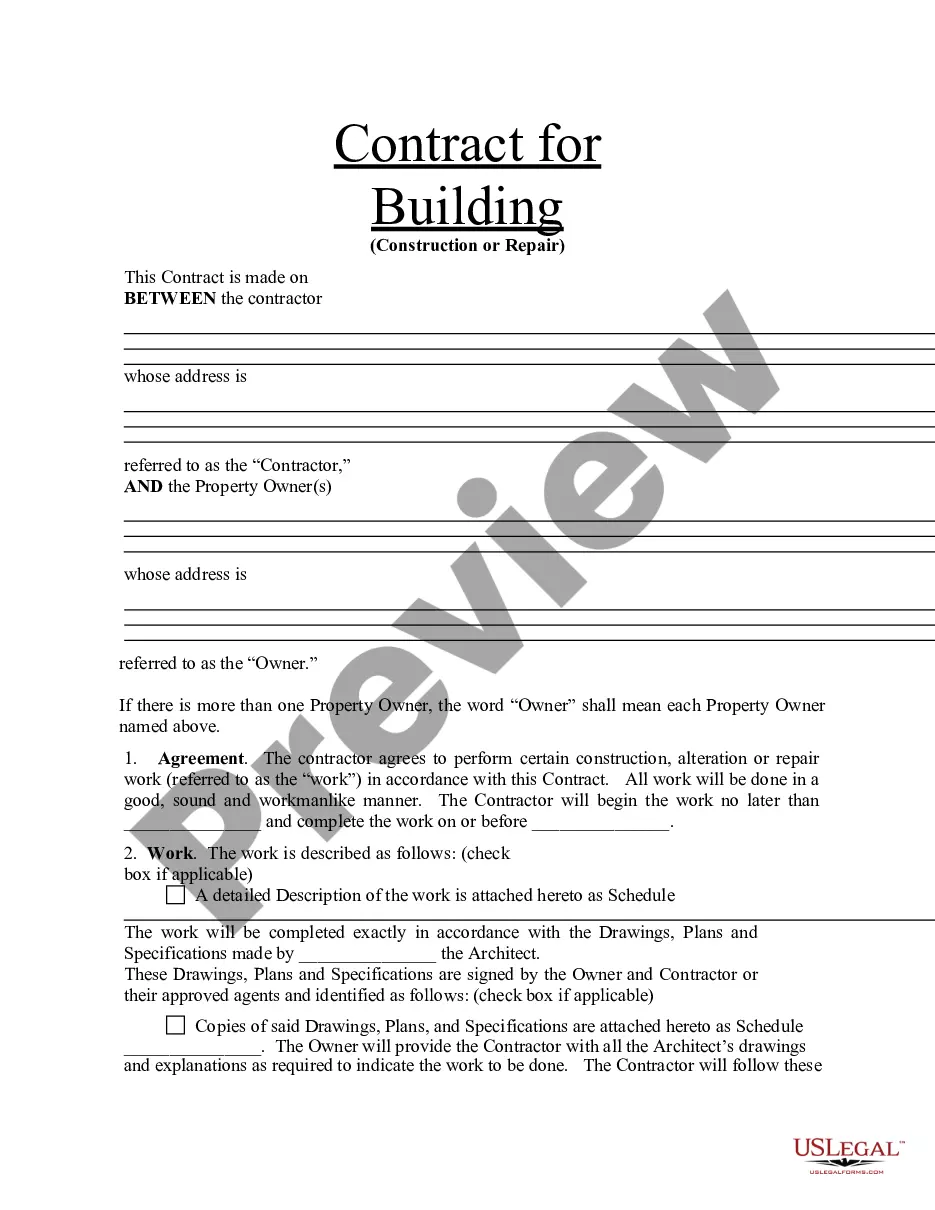

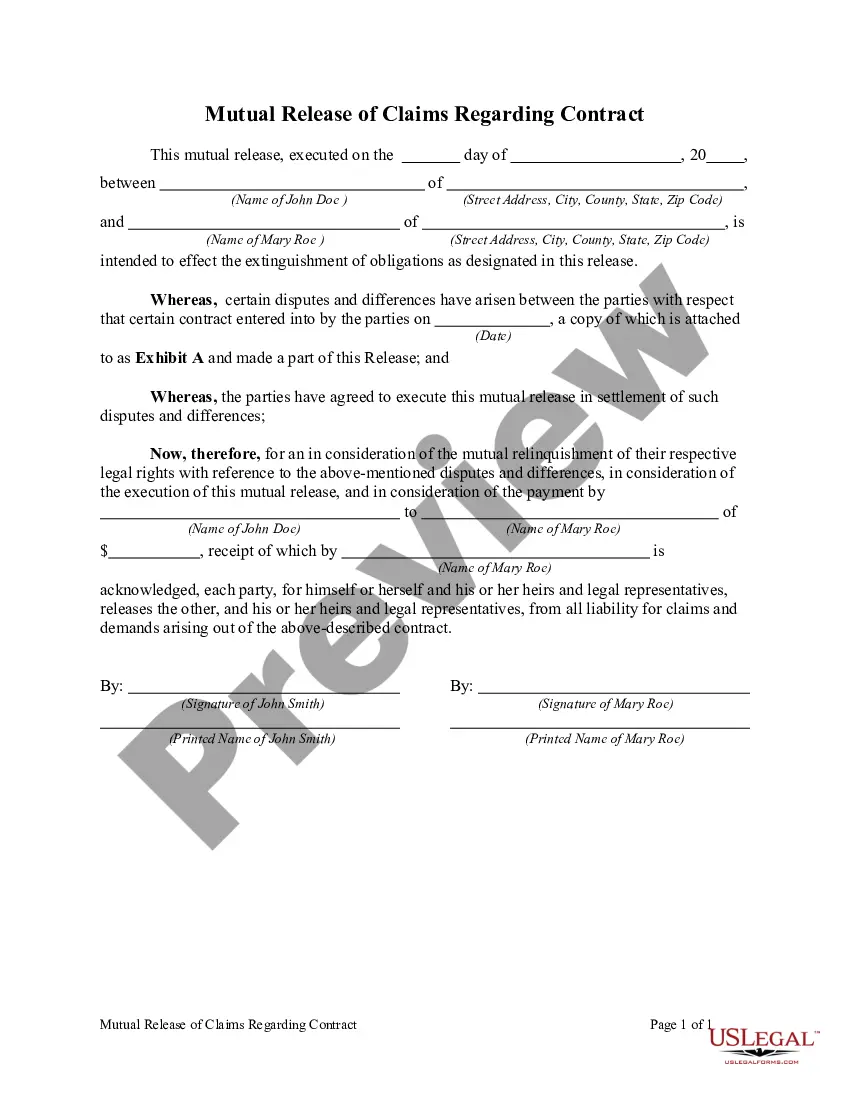

How to fill out Nonemployee Director Checklist?

It is feasible to spend numerous hours online attempting to locate the authorized document template that fulfills the federal and state requirements you desire.

US Legal Forms provides thousands of legal forms that can be reviewed by professionals.

You can actually download or print the South Carolina Nonemployee Director Checklist from our service.

If available, use the Preview button to view the document template as well.

- If you have a US Legal Forms account, you can Log In and then click the Download button.

- Next, you can fill out, modify, print, or sign the South Carolina Nonemployee Director Checklist.

- Every legal document template you purchase is yours indefinitely.

- To obtain an additional copy of the purchased form, go to the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for the state/city of your preference.

- Review the form description to confirm you have selected the right form.

Form popularity

FAQ

Getting articles of organization in South Carolina involves filling out the appropriate forms and submitting them to the Secretary of State's office. You can choose to file online for a quicker process or send your application via mail. Following the South Carolina Nonemployee Director Checklist will help you gather all required information efficiently. US Legal Forms offers an easy-to-use service that ensures you have the correct documents and filing instructions.

To obtain an article of organization in South Carolina, you need to complete the necessary forms provided by the South Carolina Secretary of State. You can file online or submit your application by mail. It is essential to ensure that you meet all the requirements outlined in the South Carolina Nonemployee Director Checklist. Using a platform like US Legal Forms can simplify this process, providing you with the templates and guidance you need.

Form 1099-NEC. Use Form 1099-NEC solely to report nonemployee compensation payments of $600 or more you make in the course of your business to individuals who aren't employees.Form 1099-MISC.Payer's name, address, and phone number.Payer's TIN.Recipient's TIN.Recipient's name.Street address.City, state, and ZIP.More items...?

Yes, you can handwrite a 1099 or W2, but be very cautious when doing so. The handwriting must be completely legible using black ink block letters to avoid processing errors. The IRS says, Although handwritten forms are acceptable, they must be completely legible and accurate to avoid processing errors.

Prior to 2020, you would include nonemployee compensation in Box 7 on Form 1099-MISC. In 2020, Box 7 on Form 1099-MISC turned into Payer made direct sales of $5,000 or more of consumer products to a buyer (recipient) for resale, and nonemployee compensation is reported on Form 1099-NEC instead.

Form 1099-NEC. Use Form 1099-NEC solely to report nonemployee compensation payments of $600 or more you make in the course of your business to individuals who aren't employees.Form 1099-MISC.Payer's name, address, and phone number.Payer's TIN.Recipient's TIN.Recipient's name.Street address.City, state, and ZIP.More items...?

You must report directors' fees and other remuneration, including payments made after retirement, on Form 1099-NEC in the year paid. Report them in box 1.

Nonemployee compensation (also known as self-employment income) is the income you receive from a payer who classifies you as an independent contractor rather than as an employee. This type of income is reported on Form 1099-MISC, and you're required to pay self-employment taxes on it.

Self-employment taxes As a self-employed individual, you must pay Social Security and Medicare taxes. However, since your 1099-NEC income is not subject to employment-tax withholding, you're required to pay these taxes yourself.

Beginning with the 2020 tax year, the IRS will require business taxpayers to report nonemployee compensation on the new Form 1099-NEC instead of on Form 1099-MISC. Businesses will need to use this form if they made payments totaling $600 or more to a nonemployee, such as an independent contractor.