South Carolina Plan of Conversion from state stock savings bank to federal stock savings bank

Description

How to fill out Plan Of Conversion From State Stock Savings Bank To Federal Stock Savings Bank?

Are you within a placement where you require papers for both company or person purposes just about every day? There are a lot of legitimate file templates available online, but discovering ones you can trust is not simple. US Legal Forms offers a huge number of form templates, just like the South Carolina Plan of Conversion from state stock savings bank to federal stock savings bank, that happen to be published to satisfy federal and state needs.

When you are previously knowledgeable about US Legal Forms site and get a merchant account, basically log in. Following that, you may acquire the South Carolina Plan of Conversion from state stock savings bank to federal stock savings bank design.

Unless you offer an accounts and wish to begin to use US Legal Forms, follow these steps:

- Find the form you want and ensure it is for the appropriate area/county.

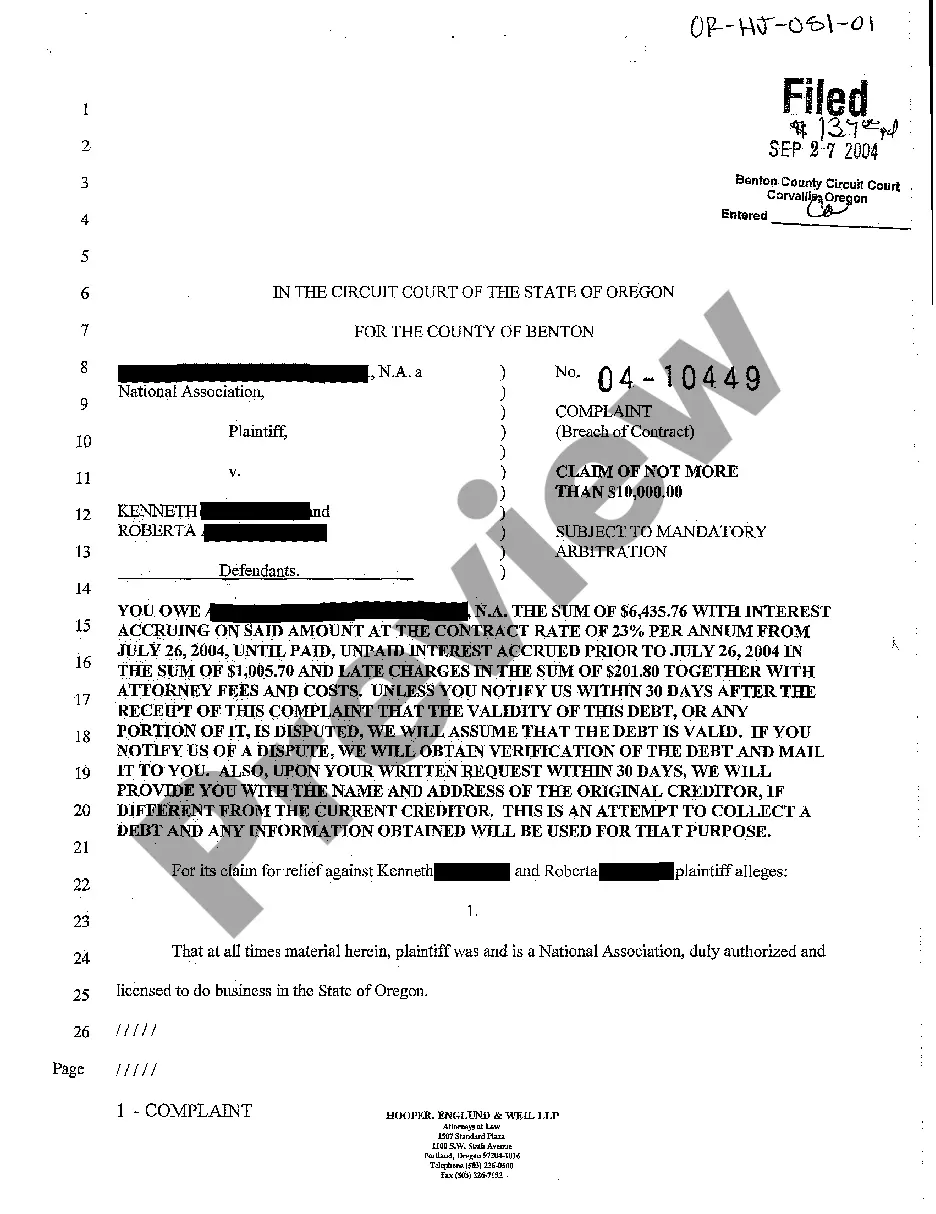

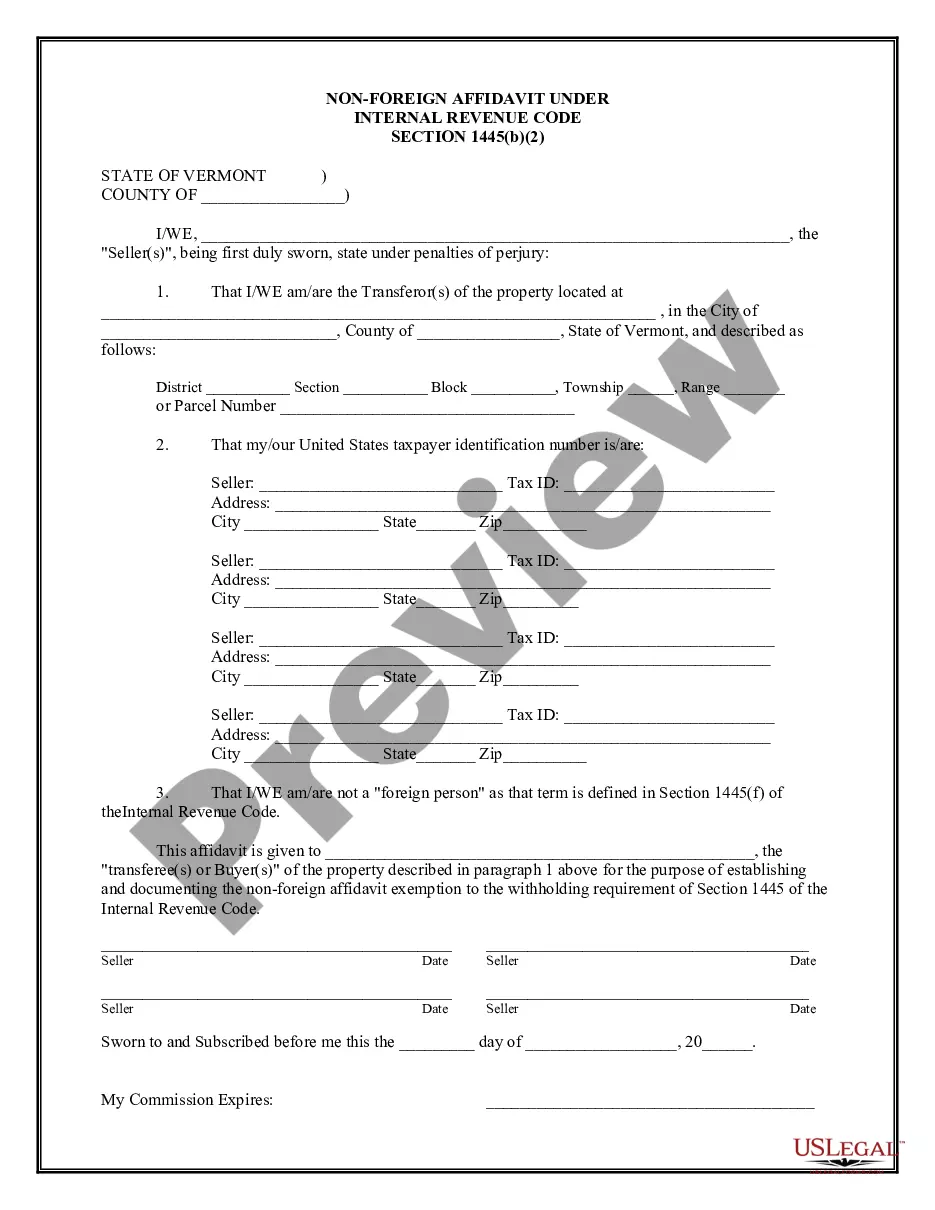

- Utilize the Preview option to analyze the shape.

- Look at the description to ensure that you have chosen the correct form.

- If the form is not what you`re looking for, make use of the Look for field to find the form that meets your needs and needs.

- Whenever you discover the appropriate form, click on Purchase now.

- Choose the pricing prepare you would like, submit the necessary info to generate your money, and pay for an order using your PayPal or bank card.

- Decide on a handy file file format and acquire your backup.

Discover every one of the file templates you might have purchased in the My Forms food selection. You can get a extra backup of South Carolina Plan of Conversion from state stock savings bank to federal stock savings bank at any time, if needed. Just click on the necessary form to acquire or print the file design.

Use US Legal Forms, probably the most comprehensive variety of legitimate types, to save lots of time and avoid mistakes. The support offers expertly created legitimate file templates which can be used for a selection of purposes. Make a merchant account on US Legal Forms and begin creating your way of life easier.

Form popularity

FAQ

Mutual to stock conversions are highly complex corporate reorganizations where a company which is ?owned? by its depositors (if it is a financial institution such as a savings bank) or by its members or policyholders (if it is a mutual insurer) changes its form of organization to one where the mutual members' rights ...

The Demutualization Process In a demutualization, a mutual company elects to change its corporate structure to a public company, where prior members may receive a structured compensation or ownership conversion rights in the transition, in the form of shares in the company.

Both banks will continue to operate independently under their respective brands, with the same team members serving their local communities, under one multi-bank holding company (Mutual Bancorp).

Needham Bank has filed a plan with the U.S. Securities and Exchange Commission to go public. It is seeking to raise $390 million via an initial public offering (IPO), which was filed on June 9.

A conversion merger is when a mutual institution simultaneously acquires a stock institution at the same time it completes a standard stock conversion. A mutual FSA may acquire another insured institution that is already in the stock form of ownership at the time of its stock conversion transaction.