South Carolina Employee Stock Option Plan of Emulex Corp.

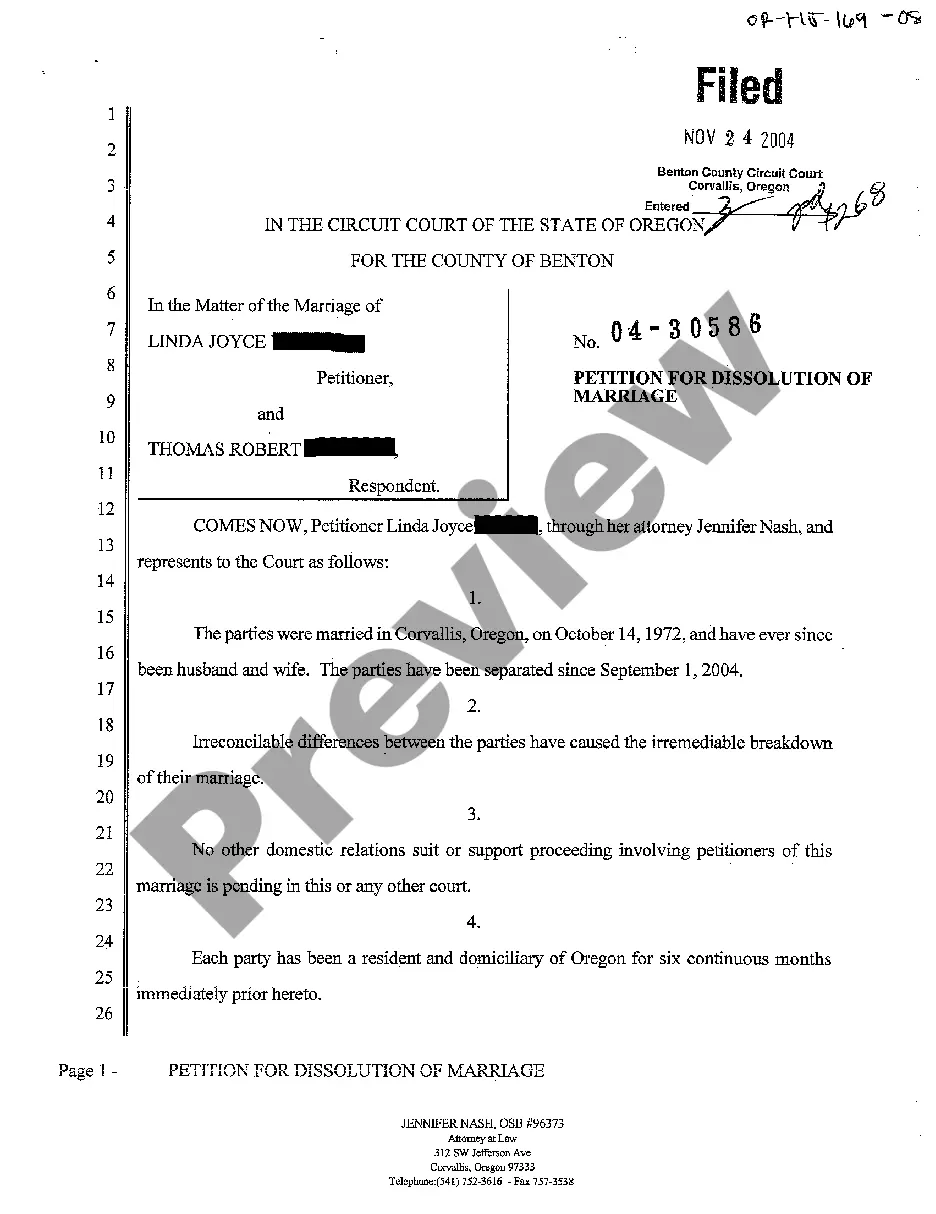

Description

How to fill out Employee Stock Option Plan Of Emulex Corp.?

US Legal Forms - one of several most significant libraries of legitimate types in the United States - gives an array of legitimate papers templates it is possible to obtain or print. Making use of the internet site, you will get a huge number of types for enterprise and specific functions, categorized by classes, suggests, or search phrases.You will discover the most recent variations of types just like the South Carolina Employee Stock Option Plan of Emulex Corp. within minutes.

If you currently have a registration, log in and obtain South Carolina Employee Stock Option Plan of Emulex Corp. through the US Legal Forms collection. The Download switch will appear on each form you look at. You have accessibility to all formerly saved types from the My Forms tab of your own profile.

If you would like use US Legal Forms initially, listed below are basic instructions to obtain started:

- Be sure you have picked the correct form for your personal metropolis/state. Click the Preview switch to analyze the form`s content material. Browse the form explanation to actually have selected the right form.

- When the form doesn`t match your needs, utilize the Search industry near the top of the display to find the the one that does.

- If you are content with the shape, confirm your selection by visiting the Buy now switch. Then, select the prices strategy you favor and offer your references to sign up for an profile.

- Approach the transaction. Utilize your Visa or Mastercard or PayPal profile to accomplish the transaction.

- Choose the structure and obtain the shape on the device.

- Make modifications. Fill out, modify and print and signal the saved South Carolina Employee Stock Option Plan of Emulex Corp..

Every single template you included in your money does not have an expiry day which is your own permanently. So, if you would like obtain or print yet another backup, just go to the My Forms portion and click on in the form you will need.

Gain access to the South Carolina Employee Stock Option Plan of Emulex Corp. with US Legal Forms, probably the most extensive collection of legitimate papers templates. Use a huge number of professional and state-certain templates that meet up with your small business or specific requirements and needs.

Form popularity

FAQ

The most notable difference between an ESOP vs ESPP is in how the employee receives the stock and when they can sell the stock. ESOPs provide the stock or shares at no cost to employees. ESPPs require participants to contribute funds to purchase shares of stock, though at a discounted rate.

Holders of share purchase rights may or may not buy an agreed number of shares of stock at a pre-determined price, but only if they are an existing stockholder. Options, on the other hand, are the right to buy or sell stocks at a pre-set price called the strike price.

Stock options give employees the option to buy a certain number of shares at a predetermined price within a specified period. Equity, on the other hand, gives employees actual shares of the company, either outright or subject to vesting conditions.

Your ESPP will have set offering and purchase periods, while a stock option grant has a set term in which you can exercise the options after they vest. The purchase price of stock under a tax-qualified Section 423 ESPP is typically discounted in some way from the market price at purchase.

Procedure to Issue ESOP A draft needs to be prepared of the ESOP ing to the companies,2013 and Rules. A board meeting notice along with the draft resolution that is to be passed in the board meeting is to be made. The notice of the board meeting is to be sent seven days before the meeting to all the directors.

Disadvantages of Employee Stock Purchase Plans Ensuring the ESPP follows security and tax law guidelines can be challenging. A large amount of HR functions goes into administering the stock purchase plan. There are legal, tax, and administrative issues that go into setting up the plan.

The difference between an ESOP and a stock option is that while ESOP allows owners of tightly held businesses to sell to an ESOP and reinvest the revenues tax-free, as long as the ESOP controls at least 30% of the business, as well as certain requirements, are met.

An ESOP is an employee benefit plan that enables employees to own part or all of the company they work for. ESOPs are most commonly used to facilitate succession planning, allowing a company owner to sell his or her. shares and transition flexibly out of the business.