South Carolina Amendment to Articles of Incorporation regarding paying distributions out of any funds legally available therefor

Description

How to fill out Amendment To Articles Of Incorporation Regarding Paying Distributions Out Of Any Funds Legally Available Therefor?

Have you been inside a place where you will need documents for both business or individual purposes nearly every day? There are tons of legal papers web templates available on the net, but discovering ones you can depend on is not straightforward. US Legal Forms gives a huge number of develop web templates, such as the South Carolina Amendment to Articles of Incorporation regarding paying distributions out of any funds legally available therefor, which are created to satisfy federal and state specifications.

When you are already acquainted with US Legal Forms internet site and possess a free account, simply log in. After that, you may down load the South Carolina Amendment to Articles of Incorporation regarding paying distributions out of any funds legally available therefor web template.

If you do not offer an bank account and would like to begin to use US Legal Forms, adopt these measures:

- Get the develop you will need and make sure it is for your proper town/area.

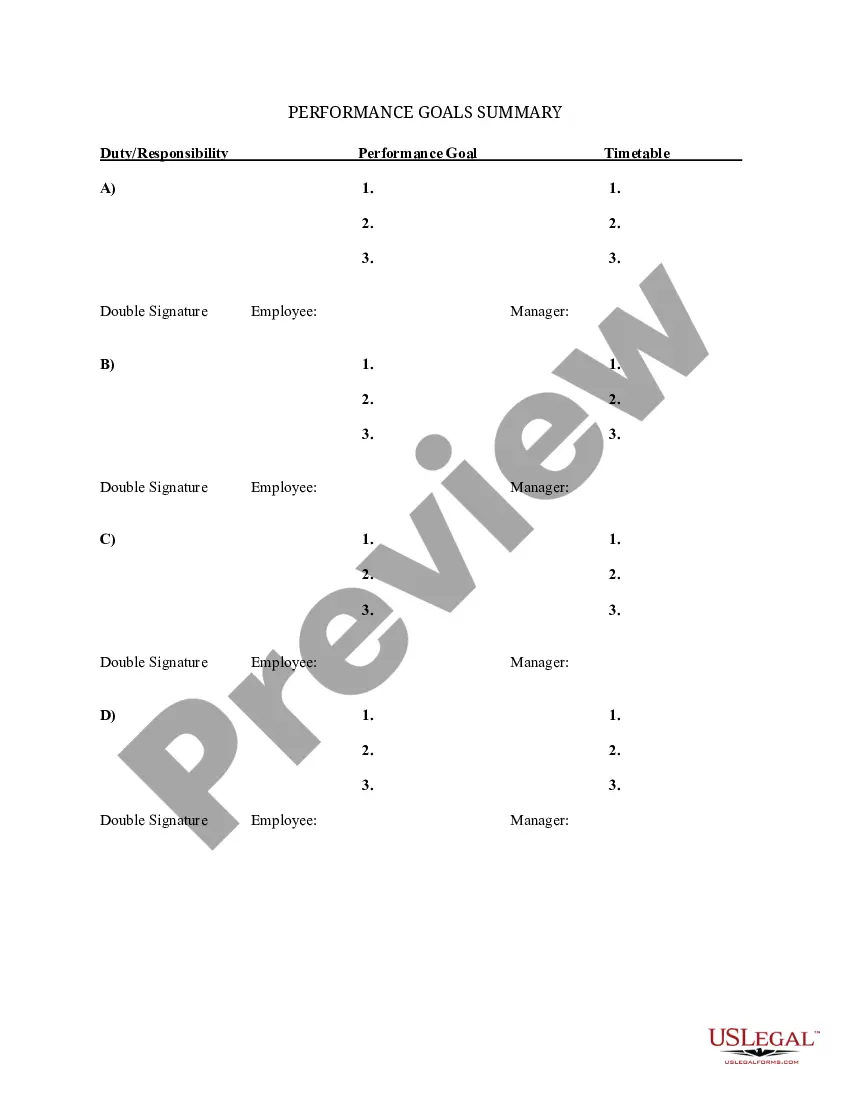

- Take advantage of the Preview switch to check the shape.

- See the description to ensure that you have selected the right develop.

- When the develop is not what you are looking for, use the Research discipline to obtain the develop that meets your needs and specifications.

- When you get the proper develop, simply click Buy now.

- Choose the prices plan you desire, fill out the necessary details to produce your account, and pay for the transaction using your PayPal or credit card.

- Choose a convenient data file structure and down load your version.

Discover all of the papers web templates you have bought in the My Forms menu. You may get a more version of South Carolina Amendment to Articles of Incorporation regarding paying distributions out of any funds legally available therefor any time, if required. Just go through the required develop to down load or produce the papers web template.

Use US Legal Forms, by far the most extensive collection of legal types, to conserve some time and prevent errors. The services gives appropriately manufactured legal papers web templates which you can use for a selection of purposes. Produce a free account on US Legal Forms and initiate making your way of life a little easier.

Form popularity

FAQ

Notices to the Attorney General. (a) A nonprofit organization shall give the Attorney General written notice that it intends to dissolve at or before the time it delivers articles of dissolution to the Secretary of State. The notice shall include a copy or summary of the plan of dissolution.

In South Carolina, you must have a minimum of three directors. Most nonprofits will have more depending on the size and structure of the organization. South Carolina also requires that board members be naturalized persons. There are no residency or membership requirements in the state.

Here's a quick overview of the main steps to dissolve and wind up a 501(c)(3) nonprofit corporation under South Carolina law. Authorizing Dissolution. ... Initial Notice to Attorney General. ... Articles of Dissolution. ... "Winding Up" ... Notice to Creditors and Other Claimants. ... Final Notice to Attorney General. ... Federal Tax Note.

Section 33-31-1402 - Dissolution by directors, members, and third persons. (3) in writing by any person whose approval is required by a provision of the articles authorized by Section 33-31-1030 for an amendment to the articles or bylaws.

(a) Unless prohibited or limited by the articles or bylaws, any action that may be taken at any annual, regular, or special meeting of members may be taken without a meeting if the corporation delivers a written or electronic ballot to every member entitled to vote on the matter.