The articles of amendment shall be executed by the corporation by an officer of the corporation.

South Carolina Articles of Amendment to the Articles of Incorporation of Church Non-Profit Corporation

Description

How to fill out Articles Of Amendment To The Articles Of Incorporation Of Church Non-Profit Corporation?

Selecting the ideal legal document template can be a challenge. Of course, there are numerous templates available online, but how do you find the legal form you require.

Utilize the US Legal Forms website. This service provides a wide array of templates, such as the South Carolina Articles of Amendment to the Articles of Incorporation of Church Non-Profit Corporation, which you can use for both business and personal purposes. All of the forms are validated by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Download button to access the South Carolina Articles of Amendment to the Articles of Incorporation of Church Non-Profit Corporation. Use your account to browse through the legal forms you have previously purchased. Visit the My documents section in your account and download another copy of the documents you require.

Choose the file format and download the legal document template to your device. Complete, modify, and print, then sign the downloaded South Carolina Articles of Amendment to the Articles of Incorporation of Church Non-Profit Corporation. US Legal Forms is the premier repository of legal forms where you can find countless document templates. Utilize the service to obtain professionally crafted documents that adhere to state requirements.

- First, ensure that you have chosen the correct form for your region/state.

- You can explore the form using the Preview button and read the form description to confirm it is suitable for you.

- If the form does not meet your expectations, utilize the Search feature to find the appropriate form.

- Once you are confident that the form is right, click the Get now button to obtain the form.

- Select the pricing plan that you prefer and provide the required information.

- Create your account and complete the transaction using your PayPal account or credit card.

Form popularity

FAQ

State laws determine the minimum number of board directors, which is usually two or three. Depending on the state, there could be a board of one, but it might be difficult to attain 501(c)(3) status with just one board member. Nonprofit organizational budgets are sometimes a factor in the number of board members.

The IRS generally requires a minimum of three board members for every nonprofit, but does not dictate board term length.

Nonprofit organizations can't legally operate without a designated board of directors that takes responsibility for ensuring legal compliance and accountability. A nonprofit board of directors is responsible for hiring capable staff, making big decisions and overseeing all operations.

You must have at least three directors on your board in South Carolina. Your initial directors are named in your articles and need not be residents of South Carolina.

Visit the Secretary of State's website at to access the Business Entities Online filing application. You can also download the Articles of Incorporation form and submit it by mail. The fee to incorporate as a nonprofit corporation is $25.

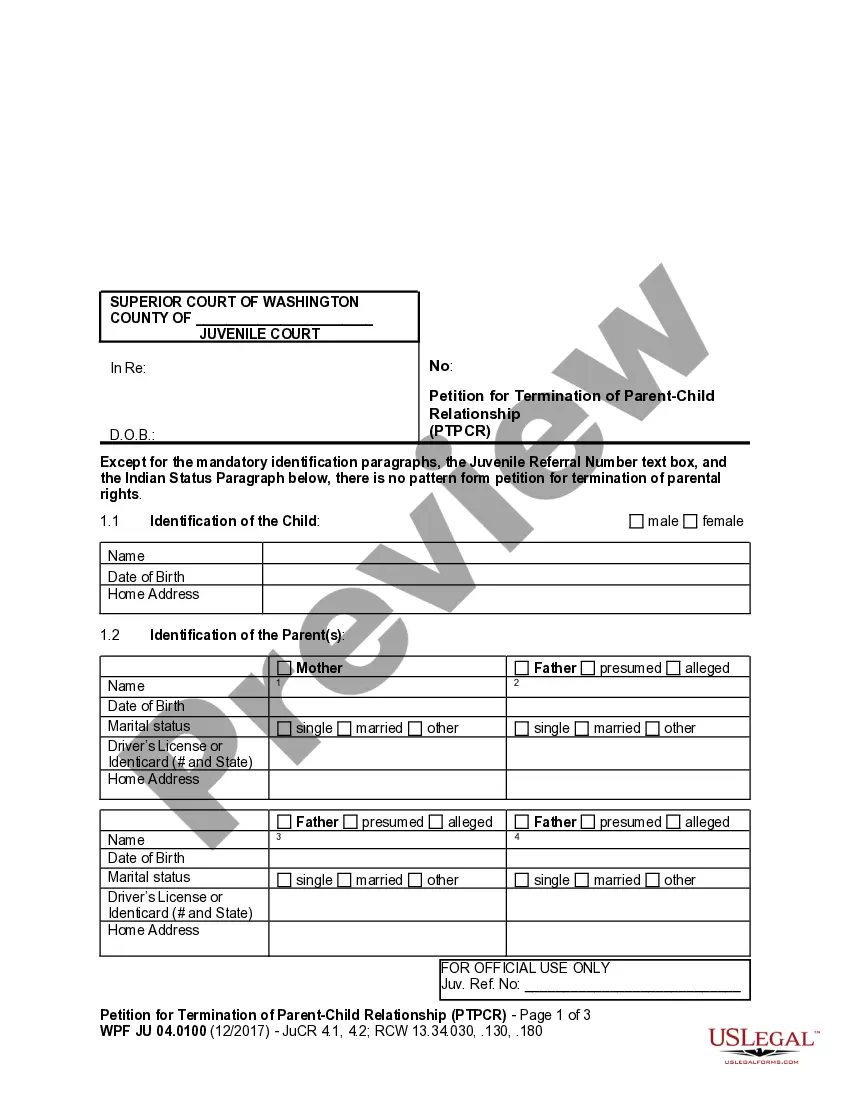

To amend your South Carolina articles of incorporation, file two copies of the Articles of Amendment with the South Carolina Secretary of State, Division of Business Filings (SOS).

Visit the Secretary of State's website at to access the Business Entities Online filing application. You can also download the Articles of Incorporation form and submit it by mail. The fee to incorporate as a nonprofit corporation is $25.

South Carolina articles of incorporation are filed to create a corporation. Preparing and filing your articles of incorporation is the first step in starting your business corporation. Approval of this document secures your corporate name and creates the legal entity of the corporation.

Actually, no! These terms are often used interchangeably, but they all mean different things. Nonprofit means the entity, usually a corporation, is organized for a nonprofit purpose. 501(c)(3) means a nonprofit organization that has been recognized by the IRS as being tax-exempt by virtue of its charitable programs.