South Carolina Proposal to amend certificate to reduce par value, increase authorized common stock and reverse stock split with Exhibit

Description

How to fill out Proposal To Amend Certificate To Reduce Par Value, Increase Authorized Common Stock And Reverse Stock Split With Exhibit?

You are able to commit time online searching for the authorized file template that fits the state and federal requirements you will need. US Legal Forms provides a large number of authorized varieties which are reviewed by experts. You can actually down load or print out the South Carolina Proposal to amend certificate to reduce par value, increase authorized common stock and reverse stock split with Exhibit from your service.

If you already have a US Legal Forms profile, it is possible to log in and click on the Obtain switch. Next, it is possible to full, edit, print out, or sign the South Carolina Proposal to amend certificate to reduce par value, increase authorized common stock and reverse stock split with Exhibit. Every single authorized file template you acquire is the one you have for a long time. To get another version of any obtained form, check out the My Forms tab and click on the corresponding switch.

If you are using the US Legal Forms internet site the first time, stick to the straightforward guidelines listed below:

- Initially, be sure that you have chosen the best file template to the region/city of your choice. Look at the form explanation to make sure you have chosen the correct form. If offered, use the Review switch to look from the file template as well.

- If you wish to get another version of your form, use the Search industry to discover the template that fits your needs and requirements.

- When you have discovered the template you need, click Get now to move forward.

- Choose the prices plan you need, enter your references, and sign up for an account on US Legal Forms.

- Complete the financial transaction. You should use your Visa or Mastercard or PayPal profile to pay for the authorized form.

- Choose the format of your file and down load it for your product.

- Make alterations for your file if required. You are able to full, edit and sign and print out South Carolina Proposal to amend certificate to reduce par value, increase authorized common stock and reverse stock split with Exhibit.

Obtain and print out a large number of file layouts using the US Legal Forms web site, that offers the greatest collection of authorized varieties. Use skilled and express-certain layouts to deal with your business or personal requirements.

Form popularity

FAQ

Although these moves were part of AMC's plan to avoid bankruptcy, investors have not responded well. AMC was trading in the $2 range before the split and went to about $16 just after the split. The stock price then dipped below $11 after the APE conversion.

A reverse stock split has no immediate effect on the company's value, as its market capitalization remains the same after it's executed. However, it often leads to a drop in the stock's market price as investors see it as a sign of financial weakness.

As the term implies, the reverse stock split is the conventional stock split in reverse-instead of a company amending its charter so as to have more shares authorized and outstanding, the charter is amended so as to reduce dramatically the authorized and outstanding shares.

One way is to buy shares of the company before the reverse split occurs with the plan to sell them soon afterwards. This can be profitable if the company's stock price increases after the split. Another way to make money from a reverse stock split is to short sell the stock of the company.

A reverse stock split has no immediate effect on the company's value, as its market capitalization remains the same after it's executed. However, it often leads to a drop in the stock's market price as investors see it as a sign of financial weakness.

This would affect only the number of shares and par value per share of the company. When there is a 2-for-1 stock split, that means that 1 share would increase to 2 shares after this stock split. The total amount of the stocks would be still the same, thus, par value per share would be affected.

If you already have par value and you want to raise or lower it, things are a bit more complicated. Typically, you can't just make an amendment saying you now have a new par value. Instead, the most common way that corporations change their par value is with a stock split (or reverse stock split).

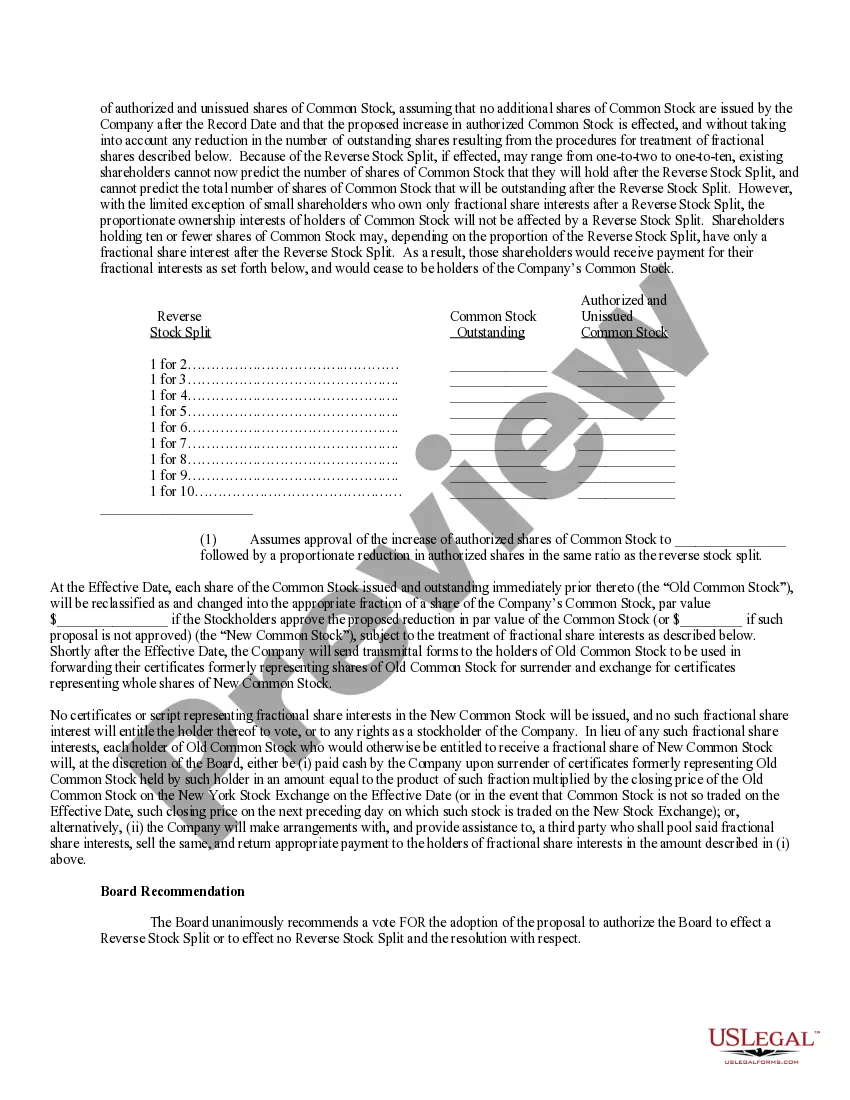

The number of outstanding shares of Common Stock will be decreased as a result of a Reverse Stock Split, but the number of authorized shares of Common Stock will not be so decreased.

When a company completes a reverse stock split, each outstanding share of the company is converted into a fraction of a share. For example, if a company declares a one for ten reverse stock split, every ten shares that you own will be converted into a single share.

Typically, you can't just make an amendment saying you now have a new par value. Instead, the most common way that corporations change their par value is with a stock split (or reverse stock split). A stock split is exactly what it sounds like: a division of shares.