South Carolina Annual Incentive Compensation Plan

Description

How to fill out Annual Incentive Compensation Plan?

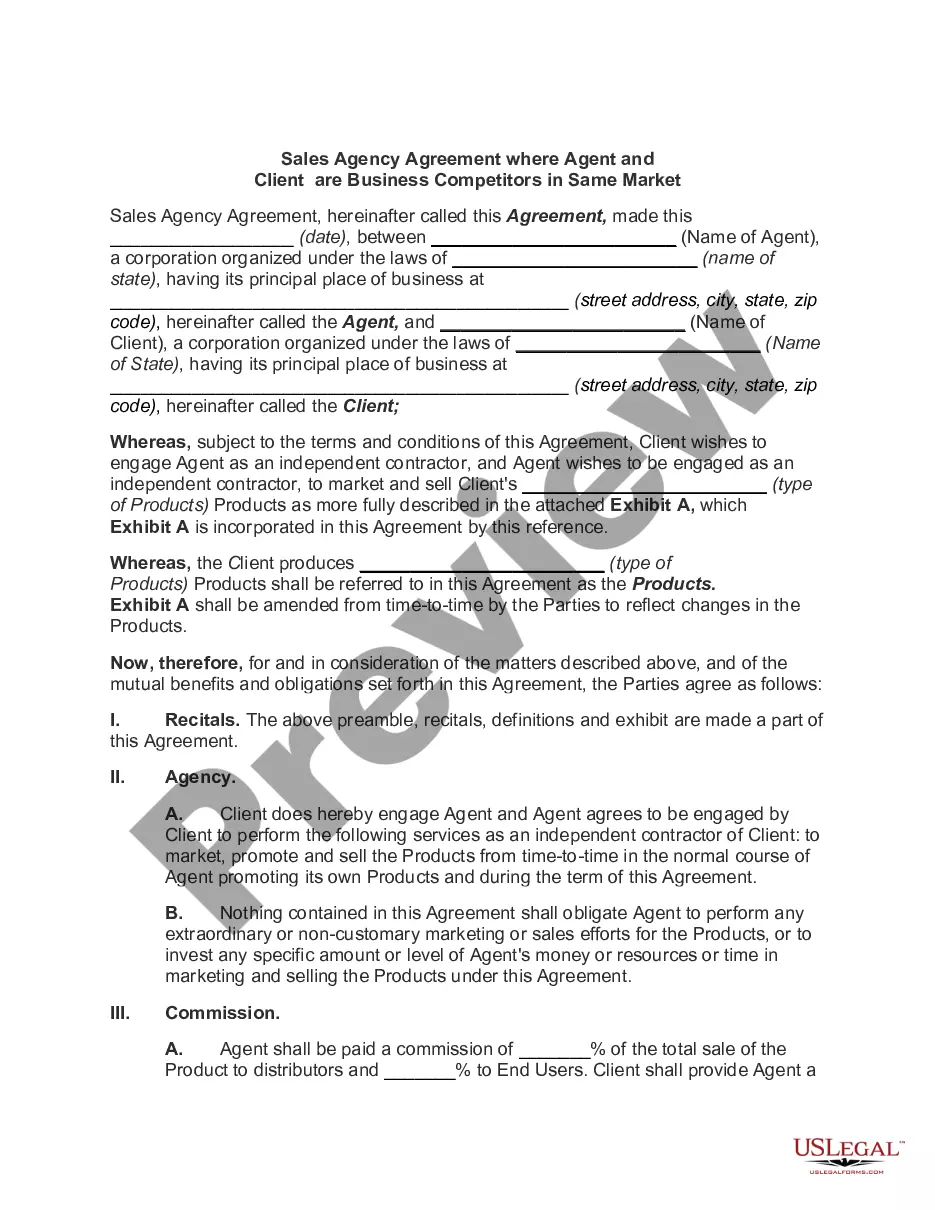

You can devote hours on the Internet looking for the legal record design that suits the state and federal needs you will need. US Legal Forms provides a large number of legal kinds that are examined by experts. You can easily download or produce the South Carolina Annual Incentive Compensation Plan from your support.

If you currently have a US Legal Forms profile, it is possible to log in and then click the Obtain option. After that, it is possible to total, modify, produce, or sign the South Carolina Annual Incentive Compensation Plan. Every legal record design you purchase is your own property for a long time. To get yet another copy of the obtained kind, check out the My Forms tab and then click the related option.

Should you use the US Legal Forms website the first time, follow the straightforward guidelines beneath:

- First, ensure that you have chosen the right record design for the county/metropolis that you pick. Read the kind explanation to make sure you have chosen the appropriate kind. If available, make use of the Preview option to look from the record design at the same time.

- If you would like locate yet another version in the kind, make use of the Search discipline to find the design that fits your needs and needs.

- Upon having identified the design you need, just click Acquire now to carry on.

- Select the prices program you need, type in your accreditations, and sign up for a free account on US Legal Forms.

- Complete the financial transaction. You should use your bank card or PayPal profile to cover the legal kind.

- Select the structure in the record and download it in your system.

- Make changes in your record if required. You can total, modify and sign and produce South Carolina Annual Incentive Compensation Plan.

Obtain and produce a large number of record templates making use of the US Legal Forms site, that offers the greatest selection of legal kinds. Use professional and state-distinct templates to take on your organization or individual requires.

Form popularity

FAQ

Under SCRS, you are eligible to retire with an unreduced benefit if you have at least eight years of earned service credit and: Met the Rule of 90 requirement; or ? Reached age 65. The Rule of 90 means your age and your years of service total 90.

SCRS provides a fixed monthly benefit based on a formula that includes your average final compensation, years of service credit and a benefit multiplier, not on your account balance at retirement. The plan assumes life expectancy and investment risk.

The South Carolina Deferred Compensation Program (Program) is a voluntary program that gives you a tool to save and invest extra money for retirement through before-tax and after-tax contributions.

The budget includes: A 4% pay raise in 2023 and a 3% raise in 2024 for most state employees, including non-certified school personnel, community college, and UNC employees. A 4% one-time supplement for retirees in 2023. A 5.5% pay raise in 2023 for employees on a step-pay plan and an additional 3% in 2024.

The South Carolina Deferred Compensation Program (Deferred Comp) is a voluntary retirement savings program that provides participants an opportunity to supplement their retirement savings through its 401(k) and 457 plans.

An employee is vested in the System after eight (8) years of full-time service and may draw an annuity upon eligibility.

The South Carolina Deferred Compensation Program (Deferred Comp) is a voluntary retirement savings program that provides participants an opportunity to supplement their retirement savings through its 401(k) and 457 plans.

South Carolina wage law does not explicitly address bonuses. Generally, discretionary bonuses are not considered wages, while nondiscretionary bonuses paid under an agreement are considered wages and protected under wage law. Employers should follow any written policy they have about paying bonuses as a best practice.