South Carolina Employee Stock Purchase Plan of American Annuity Group, Inc.

Description

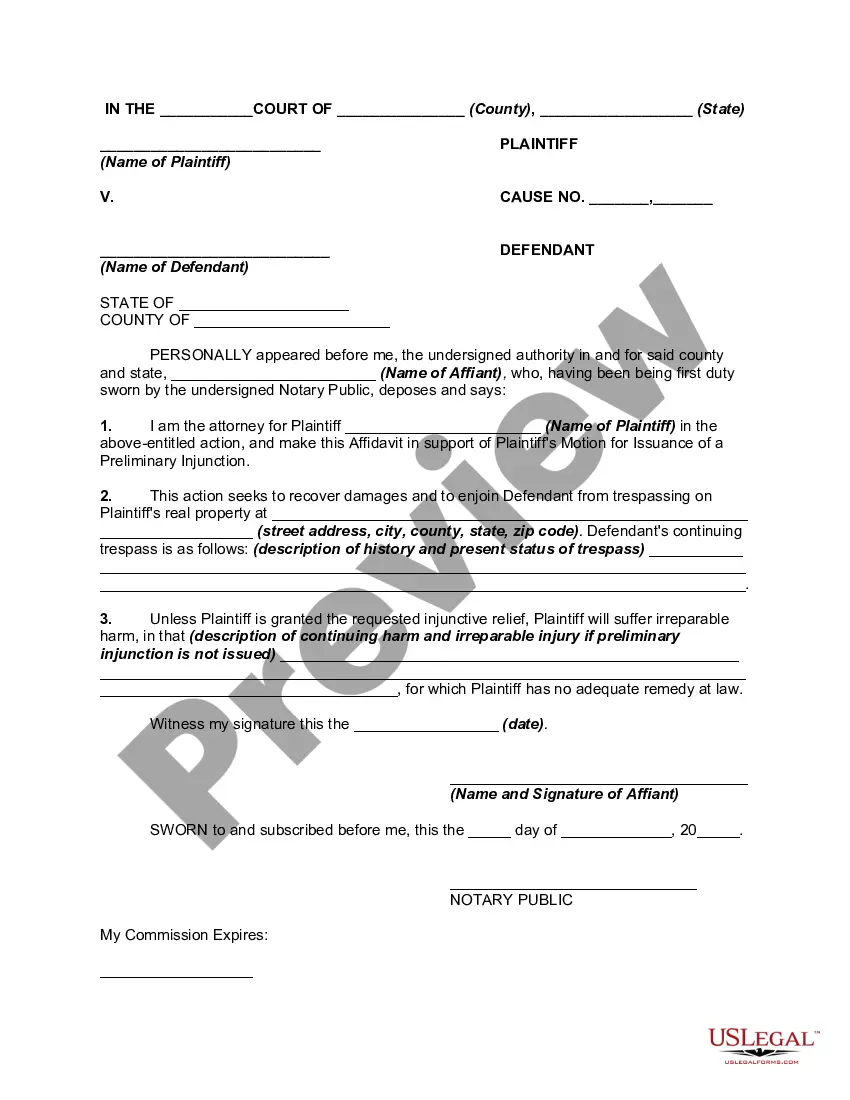

How to fill out Employee Stock Purchase Plan Of American Annuity Group, Inc.?

If you wish to complete, obtain, or print out legitimate record web templates, use US Legal Forms, the most important assortment of legitimate kinds, which can be found online. Utilize the site`s simple and easy handy look for to get the files you require. A variety of web templates for company and personal reasons are sorted by groups and states, or keywords. Use US Legal Forms to get the South Carolina Employee Stock Purchase Plan of American Annuity Group, Inc. in just a couple of clicks.

If you are previously a US Legal Forms client, log in for your bank account and click the Obtain switch to get the South Carolina Employee Stock Purchase Plan of American Annuity Group, Inc.. You may also entry kinds you formerly acquired from the My Forms tab of your respective bank account.

If you use US Legal Forms the first time, follow the instructions under:

- Step 1. Ensure you have selected the shape to the appropriate town/nation.

- Step 2. Use the Preview choice to examine the form`s content material. Don`t overlook to learn the information.

- Step 3. If you are unsatisfied with the type, make use of the Look for industry towards the top of the screen to locate other models of the legitimate type web template.

- Step 4. Upon having discovered the shape you require, go through the Purchase now switch. Select the prices strategy you like and add your credentials to sign up for the bank account.

- Step 5. Method the transaction. You should use your credit card or PayPal bank account to perform the transaction.

- Step 6. Select the structure of the legitimate type and obtain it on your own system.

- Step 7. Complete, edit and print out or indicator the South Carolina Employee Stock Purchase Plan of American Annuity Group, Inc..

Every legitimate record web template you buy is your own forever. You may have acces to each type you acquired inside your acccount. Click the My Forms portion and pick a type to print out or obtain once more.

Compete and obtain, and print out the South Carolina Employee Stock Purchase Plan of American Annuity Group, Inc. with US Legal Forms. There are millions of professional and condition-certain kinds you can use to your company or personal needs.

Form popularity

FAQ

If the principal profits or income of a taxpayer are derived from sources other than those described in Section 12-6-2252 or Section 12-6-2310, the taxpayer shall apportion its remaining net income using a fraction in which the numerator is gross receipts from within this State during the taxable year and the ...

South Carolina Code §12-6-3360(C)(1) provides a tax credit against South Carolina income tax, bank tax, or insurance premium tax for a qualifying business creating new jobs in this State.

The name of AmerUs Life Insurance Company was changed to Aviva Life and Annuity Company November 1, 2007. The operations of the former AmerUs Group are currently being integrated with Aviva's existing operations in the U.S. - Aviva Life Insurance Company and Aviva Life Insurance Company of New York.

South Carolina Code §12-6-2210 provides for the determination of whether taxable income of a business will be apportioned. A taxpayer whose entire business is transacted or conducted in South Carolina is subject to income tax based on the entire taxable income of the business for the taxable year.

INDIVIDUAL INCOME TAX RATES South Carolina Code §12-6-510 imposes an income tax upon the South Carolina taxable income of individuals, estates, and trusts at rates ranging from 3% to a maximum rate of 7%. There are six income brackets adjusted annually for inflation.

Code Sections 12-6-2220 and 12-6-2230 provide that certain classes of income less related expenses are allocated. Items directly allocated include dividends, nonbusiness interest, and nonbusiness gains and losses from sales of intangible property.

IRC section 12 contains cross references related to section 11, which imposes a tax on corporations' income. These cross references point taxpayers to special rules on unrelated business income, accumulated earnings tax, personal holding company tax, and withholding for foreign corporations.